Index - https://steemit.com/tax/@alhofmeister/4rnkcy-tax-blog-index

Introduction

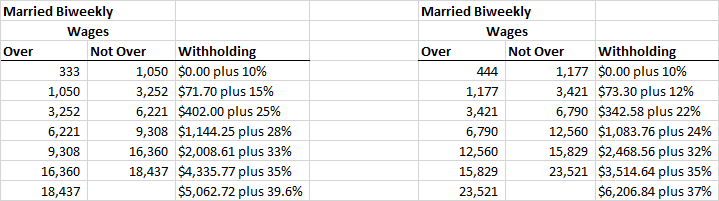

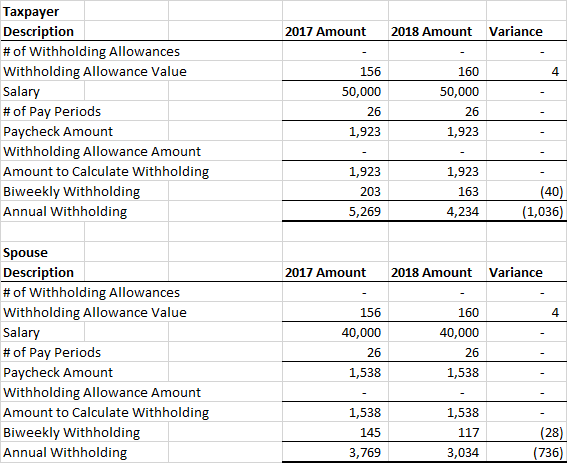

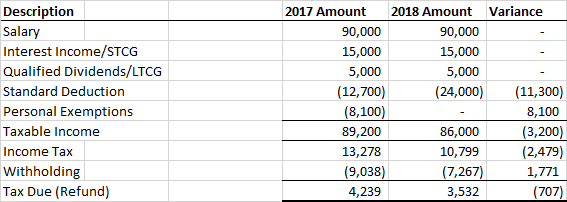

The purpose of this next series of articles is to explore the changes in the withholding rates with the new 2018 tax bill as well as the incremental benefit of taking an additional withholding allowance. In this example, married individuals with qualifying dividends of $5,000 and short term capital gains of $15,000 earning $50,000 and $40,000 a year paid on a biweekly basis electing no withholding allowances.

Calculation

Applicable Withholding

Withholding Calculation

Income Tax Calculation

Discussion

As shown above, the withholding rates for 2018 result in a smaller amount being withheld from each paycheck. The taxpayer will receive an increase on each individual paycheck of $40 and $28, respectively ($1,036 and $736 annually). Additionally, they will end up paying $707 less on their combined income tax return.

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

@OriginalWorks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit