Index - https://steemit.com/tax/@alhofmeister/47caku-tax-blog-index

Introduction

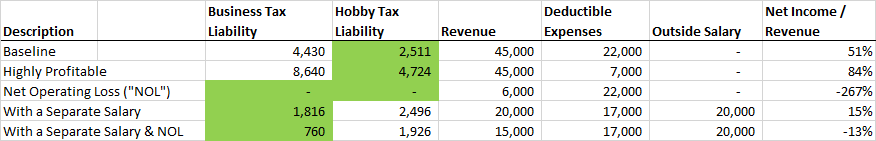

The purpose of this post is to analyze the difference between the business and hobby classifications designated by the IRS.

Calculations

Conclusions

Our set of examples examined the tax liability resultant from the different classifications over a variety of different situations. The one determining factor affecting which classification was preferred was the existence of income outside the taxpayer's business/hobby. If a taxpayer earns a salary outside their other activity, the business classification would be preferred over the hobby classification.

References

https://steemit.com/tax/@alhofmeister/hobby-vs-business-classification

https://steemit.com/tax/@alhofmeister/case-study-75-hobby-vs-business-classification

https://steemit.com/tax/@alhofmeister/case-study-76-hobby-vs-business-classification-reduced-expenses

https://steemit.com/tax/@alhofmeister/case-study-77-hobby-vs-business-classification-reduced-revenues

https://steemit.com/tax/@alhofmeister/case-study-78-hobby-vs-business-classification-with-a-salary

https://steemit.com/tax/@alhofmeister/case-study-79-hobby-vs-business-classification-with-a-salary-and-lowered-revenues

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

@contentvoter

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@OriginalWorks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very nice work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Tanks to share

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit