Index - https://steemit.com/tax/@alhofmeister/4rnkcy-tax-blog-index

Introduction

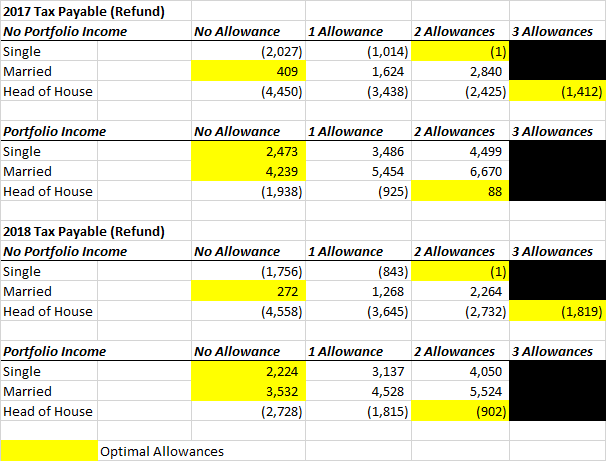

The purpose of this entry is to summarize the withholding case studies and provide a conclusion. The case studies examined the effect of the change in the withholding calculation and it's effect on a taxpayer's liability at the end of the year.

Calculation

Discussion

The following are the key takeaways from the series:

The facts and circumstances surrounding a taxpayer's financial situation will drive the optimal amount of withholding allowances that the taxpayer should claim. It can vary widely and there is no one-size-fits-all.

The ability of a taxpayer to claim credits (such as the child tax credit claimed by the head of household taxpayer - other examples include the earned income tax credit, child care credit, energy savings credit, etc.) has the potential to have a significant impact on the calculation. More allowances can be safely claimed when income tax credits are available to the taxpayer.

Outside income (portfolio income, multiple jobs, etc.) can drive down the effectiveness of the withholding allowances. Generally, less allowances should be claimed when these types of situations exist. Additionally, taxpayers with too large of a tax liability will need to make estimated income tax payments throughout the year to avoid paying penalties and interest.

The goal should be to have a tax liability close to $0 at the end of the year. A large refund equates to an interest free loan to the government while a large payment might result in interest and penalties being assessed to the taxpayer.

References

- https://steemit.com/tax/@alhofmeister/case-study-12-single-taxpayer-withholding-no-exemptions

- https://steemit.com/tax/@alhofmeister/case-study-13-single-taxpayer-withholding-one-allowance

- https://steemit.com/tax/@alhofmeister/case-study-14-single-taxpayer-withholding-two-allowances

- https://steemit.com/tax/@alhofmeister/case-study-15-married-taxpayers-withholding-no-allowances

- https://steemit.com/tax/@alhofmeister/case-study-16-married-taxpayers-withholding-one-allowance

- https://steemit.com/tax/@alhofmeister/case-study-16-married-taxpayers-withholding-two-allowances

- https://steemit.com/tax/@alhofmeister/case-study-18-head-of-household-taxpayers-withholding-no-allowances

- https://steemit.com/tax/@alhofmeister/case-study-19-head-of-household-taxpayers-withholding-one-allowance

- https://steemit.com/tax/@alhofmeister/case-study-20-head-of-household-taxpayers-withholding-two-allowances

- https://steemit.com/tax/@alhofmeister/case-study-21-head-of-household-taxpayers-withholding-three-allowances

- https://steemit.com/tax/@alhofmeister/case-study-22-single-taxpayers-with-investment-income-withholding-no-allowances

- https://steemit.com/tax/@alhofmeister/case-study-23-single-taxpayers-with-investment-income-withholding-one-allowance

- https://steemit.com/tax/@alhofmeister/case-study-24-single-taxpayers-with-investment-income-withholding-two-allowances

- https://steemit.com/tax/@alhofmeister/case-study-25-married-taxpayers-with-investment-income-withholding-no-allowances

- https://steemit.com/tax/@alhofmeister/case-study-26-married-taxpayers-with-investment-income-withholding-one-allowance

- https://steemit.com/tax/@alhofmeister/case-study-27-married-taxpayers-with-investment-income-withholding-two-allowances

- https://steemit.com/tax/@alhofmeister/case-study-28-head-of-household-taxpayers-with-investment-income-withholding-no-allowances

- https://steemit.com/tax/@alhofmeister/case-study-29-head-of-household-taxpayers-with-investment-income-withholding-one-allowance

- https://steemit.com/tax/@alhofmeister/case-study-30-head-of-household-taxpayers-with-investment-income-withholding-two-allowances

Disclosure

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

@OriginalWorks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit