The deduction available is the least of the following amounts:

a. Actual HRA received;

b. 50% of [basic salary + DA] for those living in metro cities (40% for non-metros); or

c. Actual rent paid less 10% of basic salary + DA

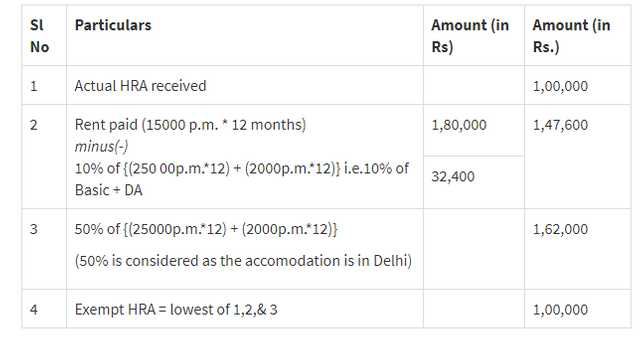

We can understand the HRA calculation better with the following example:

Mr. Ram, employed in Mumbai, has taken up an accommodation on rent for which he pays a monthly rent of Rs 15,000 during the Financial Year (FY) 2017-18 i.e. Assessment Year(AY) 2018-19. He receives a Basic Salary of Rs 25,000 monthly along with DA of Rs. 2000, which forms a part of the salary. He also receives a HRA of Rs 1,00,000 from his employer during the year. Let us understand the HRA component that would be exempt from income tax during the FY 2017-18.

Therefore, in the above example, the entire HRA received from the employer is exempt from income tax.

Refer our Blog for other recommended Articles

ISPEAKSFORUM

Congratulations @ispeaksforum! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit