Sula Iron & Gold, a London-listed mining firm focused on Sierra Leone, said on Tuesday it had found gold of almost "bonanza grade" and shows a gold grade of 19.3 grams, or 0.7 of an ounce, per tonne. More damn cheap gold to flood the market while goldbugs believe in rocketing prices. I won't budge, all gold over USD 700,-- is too expensive for my feel. Quoting from mining.com (and who knows if it's true, I have seen a lot of mining and oil scams in my life):

"These high-grade results once more provide strong evidence that in Ferensola we have a serious gold province," said Sula CEO Roger Murphy, adding that the find was "on the verge of bonanza grade".

The gold price on world markets is about $1,300 per ounce .

Along with the rest of the mining sector, Sula was hard hit by the commodity price crash of 2015-16 and, in common with other companies with small market values in areas perceived as high risk, it is struggling to attract finance.

Murphy said the plan was to enter a low-cost phase of analysing data and suspending board pay for the foreseeable future to maximise shareholder returns. He is the company's eighth largest shareholder, according to Reuters data.

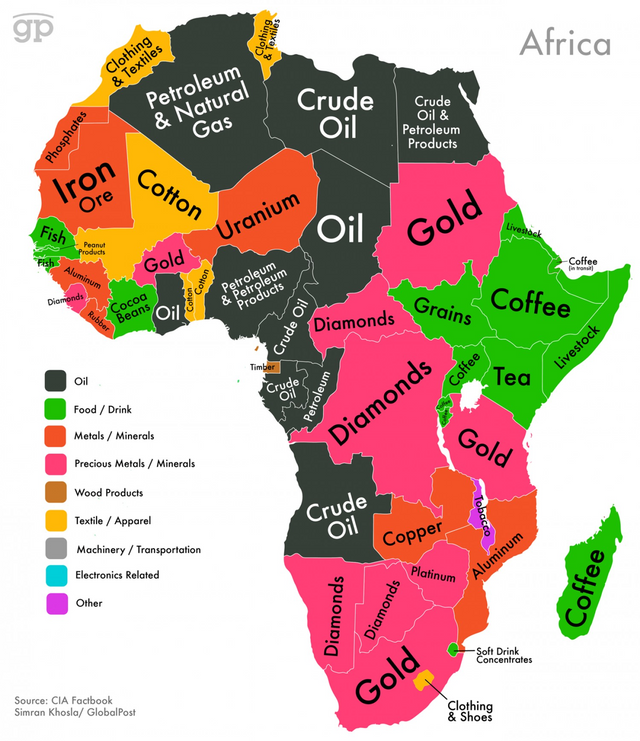

Murphy also said Sula, which has iron ore deposits as well as gold, would be happy to "do a deal" with China's Shandong Iron and Steel Group, which operates the neighbouring Tonkolili iron ore mine.

The advantage of gold for a small mining company is that it requires little infrastucture compared with a bulk commodity such as iron ore.

There is no official definition of bonanza grade for gold but analysts say most gold mines around the world only produce about 5 to 6 grams per tonne. One of the highest grade mines in the world is Klondex's Fire Creek in Nevada where reserves are 42 grams per tonne, the company website says.

Analysts remain cautious and WH Ireland on Tuesday maintained its "speculative buy" recommendation on Sula stock.

Here the complete movie "GOLD" with Roger Moore:

Maybe someone is trying to talk down the price, is Goldman sux involved in this anywhere?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No Silverbug, I am firmly holding on to a justified price of only USD 700,--/Oz. This is the mining cost of expensive mines. Regarding silver, my latest reports show that we are probably going to head way down South. It has to do with that fat fucken railway line that China is building. They have a huge demand for copper and iron etc., that will automatically put more silver on the market. I am just going to keep on buying, but sloooowwwwlllyyy and with less nervousness. It'll take years for the projects to be completed, and while that may happen, maybe rocketman will be put in the sandbox and a new steel and copper boom could push silver prices down. My hopes silver would replace lithium is also not materialising. Cobalt is on the march into the market. So... market signs, from a demand point of view, don't really support rising gold and silver prices (yet).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://af.reuters.com/article/metalsNews/idAFL8N1M633U

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit