Profits accrue to people on top. That’s the way most markets work, especially those with strong network effects (for more on 5 types of network effects and how to hack them, see this post).

As an angel investor, my job is to spot startups and trends looking to disrupt incumbents and create massive new markets and help them.

But disruption isn’t only a technological leap. Instead, often the very ideas and framework that holds businesses together are the easiest and most lucrative to disrupt. This is the basis of Clayton Christensen’s Disruption Theory.

Disruptive innovation

The reason incumbents always die and even Rome fell, is entropy — the lack of order or predictability in the natural world that ultimately leads to disorder.

It is one of the governing forces of our world, and it certainly applies to business.

The world is full of randomness. Red hair, blue eyes, lactose intolerant — these are all mutations. Something random and unexpected happened and we “evolved” because of it. Traits that promote survival prevail, others eventually die out.

Survival of the fittest

As in nature, business is a life or death battle. While the world is not a zero sum game, most businesses compete pretty directly to survive.

In nowhere is this more true than the scrappy startup. Small startup teams with little money fight tooth and nail to take their seat at the table. And the very best like Uber and Airbnb create entirely new markets.

But even in market creation, incumbents suffer. Uber is killing car ownerships and taxi companies. Airbnb took a chunk out of hotel and hostel revenue. Both have irreversably damaged old, storied industries. But, there’s a bigger reason.

Happier customers

Both Airbnb and Uber took previously crappy customer experiences and made them magical, using technology.

Ever called a cab, waited 10–20 minutes and they didn’t even show? Or paid $30 for a 5 minute ride? The experience is horrible. And the backs of cabbies cars were never pretty. “Wonder what happened back here…?”

The mobile app revolutionized this. Suddenly two clicks and your ride was scheduled, allowing you to monitor and review the driver every step of the way. Forget calling or needing to hail a cab.

And the economics are better too. Because ride sharing apps like Uber and Lyft better optimize driver time, drivers are able to make more money and spend more time driving (and chatting with passengers), as opposed to taxis who just sit and expect business to show up. (That said Uber has a massive business model problem, here’s why)

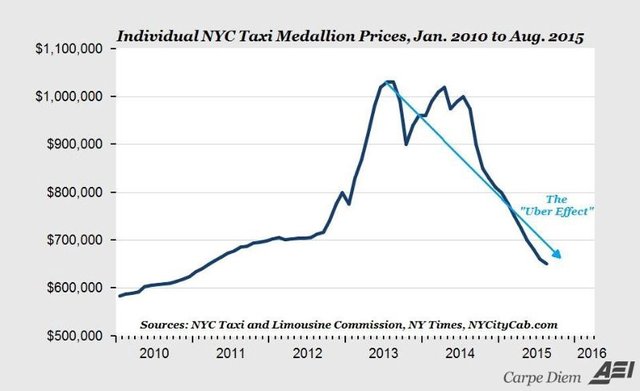

Don’t forget the driver either. In NYC (and many cities around the world), the medaillon system is archaic. Taxi drivers, or companies must purchase “the right” to be taxis in the city.

In 2011 a medallion for a NYC cab fleet cost upwards of $1M. And even in 2016, individual taxis wishing to operate under their own license need $500,000.

…to drive a taxi… are you kidding me?

Source: Carpe Diem

Source: Carpe Diem

This is why Uber and Lyft took off. The system was so broken that any innovation, specifically saving time and money for everyone but the government was the way to go.

The same is more or less true for Airbnb. Owning a hotel (or even a rental property) is expensive. Airbnb empowered anyone to be a landlord, unlocking an enormous, previously untapped portion of the market for short term rentals.

With drastically increased supply and marginally increased demand, pricing power fell to consumers, liberating travelers from hotels price gauging tactics.

The incumbent dilemma

Increased competition and smaller margins suck. At the same time, this alone doesn’t doom incumbents. The real problem is the cost structure.

Look at Airbnb and Uber, neither own tangible assets. The most valuable real estate and transportation companies own almost nothing.

How can legacy players with automobiles and taxi medallions or tons of hotels and staff compete? They can’t.

When startups truly disrupt the incumbents, they win because of these effects. Their business models are not predicated on a previous era and thus remain nimble enough to maneuver the changing landscape and position their startup for success.

To compete, incumbents would literally need to burn the boats (and everything and everyone else) to reduce overhead enough to compete on pricing. This rarely happens.

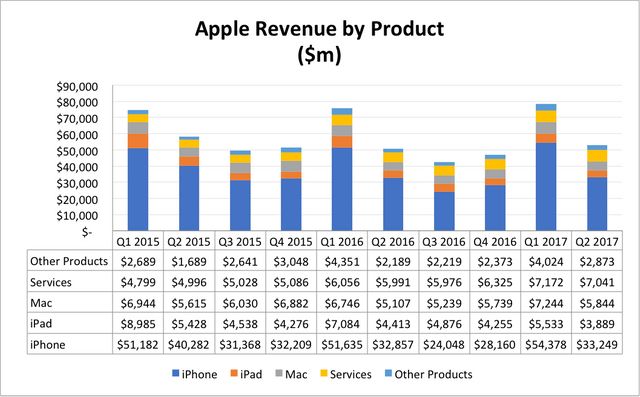

Look at Apple. They are happy getting fat off the iPhone. Creating true innovation could disrupt these core businesses and ultimately shorten their span at the top.

Source: Seeking Alpha

Source: Seeking Alpha

This may sound shortsighted, and it is, but when every company comes and goes, it is critical to ride the wave as long as you can (for more on Apple and why the company is in trouble see this post).

Stick your head in the sand

Market leaders facing disruptive innovation usually die. Other than greed, explained above in the Apple situation, the commonly agreed upon mantra is that:

“The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation”

This is true, but only to an extent. The bigger battle lies not in the innovation, but the ability to think outside the box and the willingness to act.

Think about Kodak. Kodak employee Steve Sasson invented the digital camera in 1975. When Sasson brought the product to execs,

“they were convinced that no one would ever want to look at their pictures on a television set. Print had been with us for over 100 years, no one was complaining about prints, they were very inexpensive, and so” — Sasson in a NY Times interview

The company couldn’t see the future. They could not get out of their own way (as leaders of the film industry) and see a change coming. Instead execs saw a problem that could cannabalize their film business and tabled it.

Kodak has been reeling ever since (pun intended).

[LIKE THIS ARTICLE SO FAR? THEN YOU’LL REALLY WANT TO SIGN UP FOR MY NEWSLETTER OVER HERE — AND GET SOME FREE BONUSES!]

Trying to be cool, and failing

The other contraction to the rule is Microsoft. Microsoft’s dominant monopoly of the 90s was one of history’s most powerful and profitable. The software company that defined over a generation of computing was arguably in the perfect position to continue rolling.

Then the iPhone changed everything.

After Jobs revealed Apple’s smartphone to the world, Microsoft saw the light. They realized mobile would be a thing and had to make their play.

So they reverse engineered the PC and plopped it into a palm sized device — the Windows Phone. The software was easy and compatible with Windows PCs and seemed the perfect competitor to Apple, right?

Wrong. The problem is the paradigm shift. Mobile is inherently different than a PC. People use smartphones in completely new ways. It wasn’t all about the word doc, spreadsheet and search browser anymore. Suddenly apps started to dominate mobile usage, simplifying the experience for users.

Apple adapted and thrived, Microsoft failed to see the future.

Because Microsoft meant well, the failure was bigger. It took until 2017 for Microsoft to officially shut down Windows phone for good and admit defeat.

When paradigm shifts happen, you need new people

We are the average of the 5 people we spend the most time with.

When disruptive change is on the rise, corporations NEED help. The businesses, ideas and leadership that got you here won’t take you to the next level.

The best leaders build an innovation hit squat, combining top notch players from different areas of the company to create the strategy for the new paradigm. NOTE: Innovators should work offsite. It creates less pressure to conform.

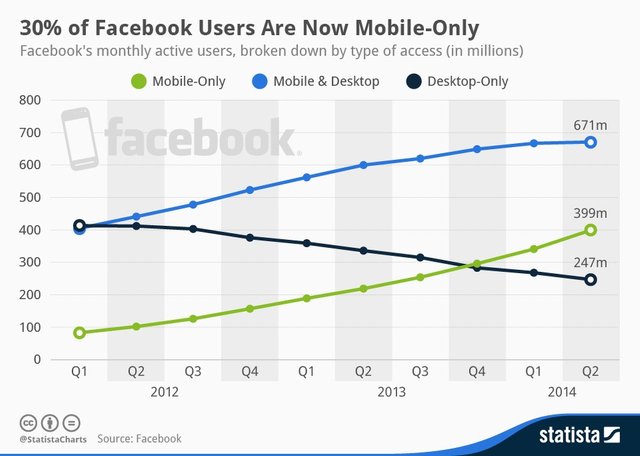

And when strong CEOs see a change happening, they commit. Zuckerberg is a great example.

When Facebook mobile was just a webapp, Mark paused 100% of the work on Facebook.com to focus on mobile. The team cranked for over a year and finally emerged with a solid, high performance mobile product. And as of 2016, 90% of Facebook’s users access it daily via mobile…

Companies NEED to focus on the future. Leaning on the past is a surefire way to miss the mark going forward.

Acqui-hiring awesomeness

The acqui-hire has become more common with our recent crop of tech leaders, buying small innovative teams and bringing them onboard.

Facebook is arguably the best and most prolific at this. Their acquisitions of Instagram, Oculus, TBH, PushPopPress and many more turned potentially dangerous teams and technologies into Facebook’s core strength.

This helps tech companies keep up with trends and innovation to prevent disruption.

I wrote in an article recently that this practice of early acquisition alone could make today’s monopolies: Amazon, Google and Facebook unstoppable. (For more on this theory, see this post)

NOTE: Most acquisitions fail. The ones that succeed typically stay standalone business units. Leaders like Bezos and Zuckerberg recognize the importance of unencumbered innovation and allow teams to stay together and operate with near full autonomy. Keeping creative, innovative cultures together is key to driving disruption and future growth.

NOTE: Most investors (VCs especially) are not fans of the acqui-hire. If Facebook or Amazon offers to buy you early, it likely means they feel threatened by your startup. Pushing just a bit further could be the difference between a 4x and a 40x multiple. As founder that’s the difference between a well paid job and life changing money. Remember that VCs need to shoot for the moon to make the economics work. If you’re acqui-hired early for under $25–50M, many VCs may oppose the sale.

Playing catch up

It seems most market leaders miss the next wave. The structures of their businesses, team, sales staff, incentives… everything causes companies to miss out. Luckily for them, this isn’t always a make or break scenario. While most miss what is coming, the best recover and ride the next wave.

Again look at Microsoft. From PC monopoly to Windows phone flop, it would be easy to see how the company could struggle towards oblivion. Instead they are pushing forward and defining new paradigms.

Between doubling down on the cloud with Azure and Windows 365 and the Surface notebook which is everything the iPad isn’t, Microsoft is starting to outdo Apple. Their performance, aesthetics and reliability from 2016 and 2017 are arguably better than the almighty Apple and the price points are all significantly more manageable.

Thus as the world moves to web apps and cloud experiences, Microsoft is miles ahead of Apple in both of these areas.

“…it ain’t about how hard you hit. It’s about how hard you can get hit and keep moving forward; how much you can take and keep moving forward. That’s how winning is done!” — Rocky Balboa

Wrapping things up

Innovation from the top is hard. Market leaders rarely create new, disruptive changes and trends, especially those that threaten their core business.

Instead the best approach incumbents can take to defeat disruption is strategic, early acquisitions. And while most acquisitions fail, the trend of early acquisitions and relative autonomy is creating a class of entrepreneur and tech giant that rarely stumbles and continually grows and innovates at alarmingly successful rates.

Working in corporate America? Is this pretty much spot on? What are your thoughts on the matter?

What about with startups? How do you see your role in the world of innovation?

And before you go, who are your favorite and most innovative companies of today? If you had to put your money on someone other than Facebook, Amazon, Netflix, Google or Apple, who would it be? And why?

Before you go…

If you got something actionable or valuable from this post, share the article on Facebook and Twitter so your friends can benefit from it too.

BONUS: My money is on Amazon. Here is why:

Congratulations @mattward! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit