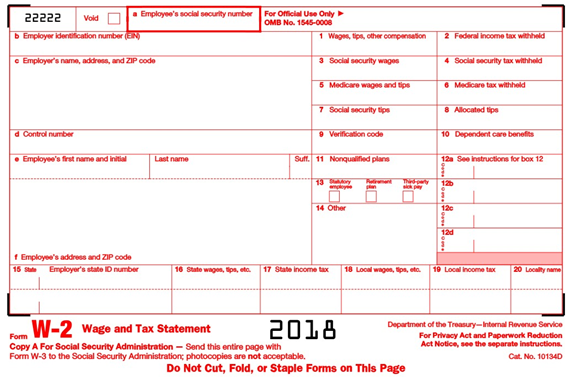

W-2 form is very important for every taxpayer, as it is one of the most widespread documents we complete during the tax year. It contains the general information about the amount of income you receive. It includes itemized salary, wages, tips, and earnings every particular employee receives. The employer completes it and sends the copy to every employee, as well as to the IRS.

The minimal amount of salary the company pays to workers per year is six hundred dollars. This is the numeral where the W-2 obliged report begins to work.

This document is also called the Wage and Tax Statement. It is necessary for withholding purposes for IRS to count the withdrawals correctly.

This document is obligatory for every individual the company officially hires, but not needed for independent contractors or self-employed individuals. The sample has the same fields no matter what the employer is. This template subdivided into smaller parts, containing detailed data about every particular type of income you get. The employer should send this sample to every person to attach it to his or her report. It is extremely important, as this information is necessary for infilling your tax return.

Being quite small in size, this form is very informative and is completed in several variants to avoid the loss of data. We highly recommend you to file it in the PDF format, as it is officially accepted by all governmental institutions. The data typed inside the template, you can print it on the separate blank or file digitally. The example of printable blank, that is easily infilled right from your computer, is available at PDF filler website.

Additionally, filing the form digitally you will help IRS to faster process it, as it will deliver earlier than the paper variant. Especially, it is good for those who send their documents at the time, close to the deadline.

What Information W-2 Form Contains?

The one-page W-2 form is quite informative. To fill it out in the right way, follow instructions, given below:

- First of all, provide the personal details of the taxpayer like the full name, for the Internal Revenue Service to know if you owe taxes or not.

- Be careful about providing the Employer Identification Number, as if it is wrong, the IRS will not be able to differentiate you as the taxpayer.

- The W-2 tax form 2018 also contains employer's contact details and contact details.

- The right part of the sample covers the full information, in particular, detailed earnings report, further subdivided into separate types, depending on the case. It is not obligatory to complete every cell, as it may be not applicable to you.

- It is very important to itemize withdrawals, made by the employer for the employee, like insurance or health care tips, federal income tax withheld, allocated tips etc.

- Finally, provide the information about tax withheld to your state.

- This short informational W-2 tax form is impossible to complete without a collaboration between the company and an employee.

- The employee should include the correct and up-to-date information.

- The employer, according to the official IRS website, has to correctly complete the sample and send it to the Social Security Administration, as well as employees, before the thirty-first of January.