This sample is one of the documents, that are used for giving an account of income to the Internal Revenue Service. A 1099-MISC form is intended for independent, private contractors and freelancers, those, who get non-employee type of income. This category also includes outsourcing organizations and maintenance services. Such reports are also useful for the clients as they help to complete their annual tax returns. So 1099-MISC should be submitted once a year up to January 31. A company or an organization prepare fillable templates for their employees and they report the information for the calendar year. This means, there should be included data, that shows the amount paid to the worker during the previous tax year. Usually, the tax withholdings are not taken from the salary, but in case they are, the total amount of all the withholdings should be included.

Where I get a 1099-MISC form?

The easiest way to submit a 1099-MISC form is to find a fillable sample and send it to the IRS online. Try PDFfiller. With this service, you may not only find an appropriate template but to fill it and edit using powerful editing tools.

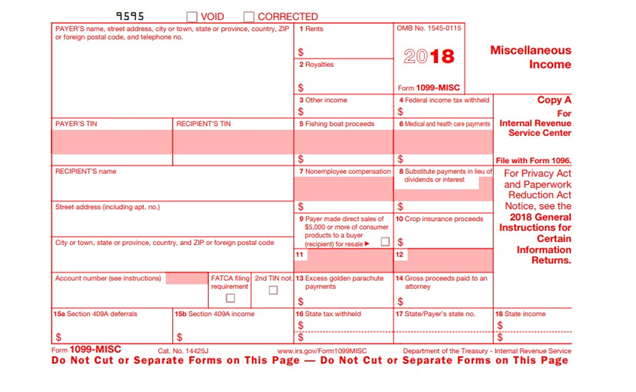

The sample consists of eight pages, two pages of instructions and six pages of the template itself. The document includes Copy A, that appears in red. It should be only used only as an informational resource. Copy B appears in black, it should be completed and submitted according to the requirements. Enter the following:

- payer’s and recipient's data, including name, address, telephone number, and postal code;

- payer’s and recipient's TIN number;

- account number (see instructions);

- rents, royalties, and other types of income;

- fishing boat proceeds;

- non-employee reimbursement ;

- excess golden parachute payments or other bonuses;

- state and federal tax withheld;

- medical and health insurance payments’

- replacing payments instead of dividends or interest.

- crop insurance earnings;

- gross proceeds paid to an attorney.

Note, that in case you report payment in box 8 or 14 you are able to extend the due date of filing to February 15. If the due date falls on a holiday or a weekend, then the deadline is considered to be the next business day. Anyway, it is useful to check the state law before filing, because different states have different requirements. Once, the document is completed, send it to the IRS straight from the website, You are also provided with an ability to print the template. Then you are able to fill it out manually and mail it.

What to do if I don’t get a 1099-MISC form on time?

In case you don’t receive a sample to fill even by January 15, it is strongly recommended to contact the Internal Revenue Service at 1-800-829-1040. You may be able to use a replacing form to submit your return, and you will still be able to send it via email. Remember, that it is also necessary to file a 1096, which summarizes all of your 1099-MISC forms. For more details see the instructions on the website.