W-2 sample is one of the most widespread forms, used by the taxpayers. It is also known like Wage and Tax Statement, that means, that this sample is used to report payments, issued by the company to every employee during one tax year. This small sample is very important, as the information it contains is used to report other tax return forms. IRS has stated the deadline for providing those forms. It’s the end of January. To file all W-2 samples in time employer should better complete them in the digital format. In fact, the IRS requirementsays, that the employers, who have more than two hundred and fifty employees have to obligatory provide tax report documents in the electronic format.

How to File the Form Electronically?

There are several guidelines for those who desire to complete multiple W-2 samples faster than ever before:

1. Go digital. It is better to store all payment information as well as documents in the digital format. You can store documents in the cloud storage or use the personal computer. Also, you can complete samples with the special PDF editing software like PDFfiller, SmallPDF, PDFescape etc.

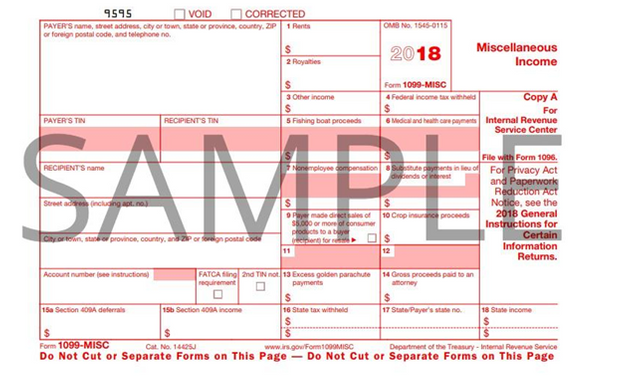

2. File the sample only for officially hired individuals, as it is acceptable only in this case. Those who work with independent contractors are obliged to require the W-9 form from them and then file one of the 1099 form variants, acceptable in the concrete case.

3. Prepare all needed supporting documents and make all countings before you start filling out the form. Check everything twice, because once you realize that you have made mistake in the template, you will need to file the correct variant as soon as possible. If you fail to do it in time, then you will have to pay IRS penalties.

4. Make a rule in your organization for every individual to inform you, as an employer, about all changes, connected with tax payment purposes. It may be the change of the place you are living at or the name or marital status change. Your tax payment or healthcare plan may change because of it.

5. Remember about the due date. The official IRS website says that penalties are very high in a case you are late. Still, they depend on the number of documents you are late with and the company status. Smaller companies get fewer penalties, but the bigger ones higher. Also, the sum depends on how much you are late. Basically the whole sum is varies from $187,500 to $1,072,500 for small companies and from $ 536,000 to $3,218,500 for larger businesses.

6. If you have too much taxes to count and pay it is better to hire an accountant who knows how to count and complete everything faster. Also, you may subdivide payments into smaller sums and pay them quarterly. This way you will not be overloaded in the tax period.

7. Not all items in the second part of the sample are obligatory for filling out, as some of them are needed in individual cases only.

8. Do not miss the bottom of the W-2 tax form, as this part contains taxes, paid to the local budget. Every employer is required to report them.

9. To know the sample status, register at official IRS website and provide the document via e-file system.