The nanotechnology industry is poised to touch $76 billion by 2020, enabling early investors to benefit immensely.

Nanotechnology created a stir in the markets since its emergence in 2005. However, as the nanotech companies failed to generate any significant returns for their investors, the sector got sidelined and overshadowed by new-age digital tech companies, autonomous vehicle talks, drones, and cyber warfare.

This downturn is poised to change in 2017!

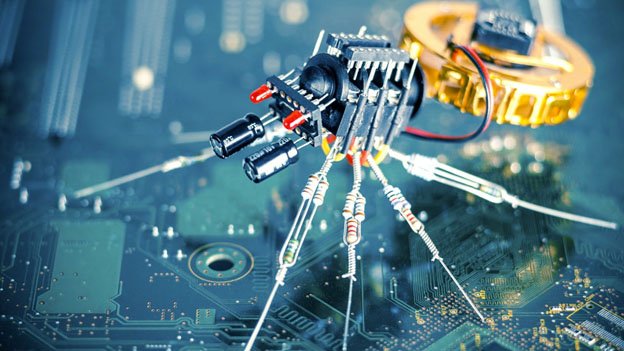

Nanotechnology is an amalgamation of different technologies that may be totally unrelated, thus it would be wrong to consider the nanotechnology industry as a standalone sector – it would be akin to grouping steel, copper, gold, silver, and aluminum under one umbrella.

Nanotechnology-based products will play a revolutionary role in healthcare and medicine, food and agriculture, environmental protection, energy, and industrial applicants. True contrarians should focus on companies that are using nanotechnology in their products.

The 21st Century Cures Act brings into focus biotech drug companies. This legislation will expedite the introduction of drugs into the market. This is a tremendous opportunity for nanobiotechnology companies that make drug delivery instruments based on nanotechnology.

As an investor, you need to view the nanotechnology sector with a hawk’s eye to spot the winning stocks, and they do exist.

The market may not be enthused by this industry’s past performance, but the time is ripe again to bet big on nanotechnology.

You want to be ahead of the game – not behind the trend. Instead, Portfolio Wealth Global will allow you to be out in front of it.

With Trump coming into office and taking over the economy, business could explode all over the place.

The nanotechnology market was pegged at $39.2 billion in 2016. That is poised to change with developments in allied sectors. The companies engaged in production of nanomaterials will grow at a rate of 18.2%, which will touch $76 billion by 2020.

Developed economies, like the U.S., Canada, the U.K., Italy, Germany, and emerging economies, like Russia, China, and India will be key markets. After a tepid start, the sector is showing signs of revival.

Venture capital infusion has picked up again in companies that are developing nanotech materials and products.

What we will focus on are companies that specialize in the following nanotech-based products:

- Nanomedicine: Companies that develop medical applications of nanomaterials and other drugs. This includes biological devices, molecular nanotechnology, and non-electronic biosensors.In 2016, nanomedicine sales have already crossed the $16 billion mark, and more than $3.8 billion was invested in R&D alone.

- Green Nanotechnology: Companies that develop products using nanotechnology that not only produce minimal pollutants, but also help clean up the environmental hazards in an effective way.Various applications are being developed that remove toxins from various sources of water.

Nanotechnology is already being deployed to make batteries more efficient, use in nuclear waste cleanups, and create greener lighting systems. Display technologies are also utilizing nanotech for better performance.

- Food and Agriculture: One of the biggest beneficiaries of the nanotech revolution could be the food and agriculture sector. Efficient and judicious procedures are being developed that make food processing cheaper, with resultant products having a longer shelf life. Antibacterial nanomaterials will further enhance the shelf life of these processed foods. Even food products containing nanoparticles are being developed that can deliver specific nutrients.

Portfolio Wealth Global is currently heading to a number of nanotechnology conferences and is researching the immense potential of this space. This will be one of 2017’s wild cards, and preparing in advance will provide us with an advantage over the pack.

Do you have favorite stocks in the nano industry?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit