Backed by the biggest Silicon Valley insiders, this crypto will roll out to 2.1

billion computer owners this year. This hack-proof technology will secure

the Internet, disrupt the biggest growth driver of Amazon and Microsoft, and

generate potential returns of 22,620%.

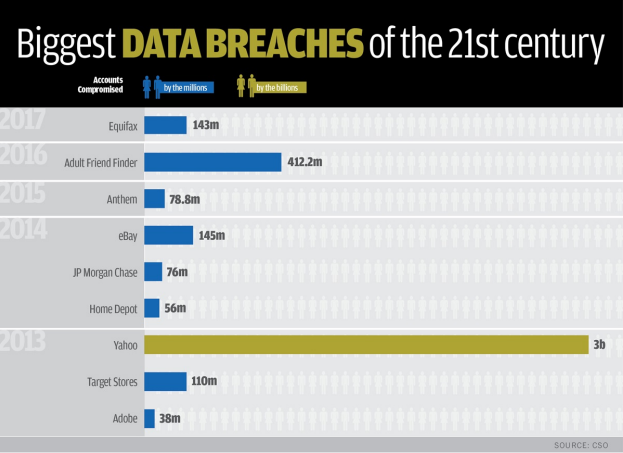

You’ve seen the news. Hackers are getting bolder and they’re cracking into giant pools of

personal data – yours included.

The Equifax breach alone exposed the names, birthdates, Social Security Numbers, and

driver’s license numbers of more than half the US adult population.

Kick in the Target, Yahoo, and eBay hacks, and there is a better than 75% chance that your

personal records are in the hands of hackers.

According to a 2015 report by Javelin Research, if your personal data is compromised in

a data security breach, you have a 1 in 3 chance that it will be used.

And, if that data included your debit card information, the odds are nearly 1 in 2 that

your data will be used, and you will be the victim of financial fraud or theft.

The good news is that there’s a way to virtually eliminate data breaches. Even better,

ordinary people will be paid to shut the hackers out using the crypto technology we call

the “Airbnb of data storage.”

This technology leverages the power of decentralization inherent to both blockchain and

to the sharing economy…

The Sharing Economy

From 2009 to today, Uber has become a household name and its valuation has exploded

from $4M to $68B.

Over the same period, Airbnb has grown from a tiny $1.5M startup into a $31B juggernaut.

Both companies have rewarded early investors with gains of better than 5000x – turning

every $200 invested into over $1M.

While most people have heard of Uber and Airbnb, few understand the business model

that allowed them to grow at such incredible speed and to disrupt large entrenched

industries in under a decade.

These companies and their users are part of the sharing economy.

The sharing economy is simply peer-to-peer business. Someone needs a place to stay for

a week and someone else has an empty condo they’d like to rent. Someone needs a ride

to the airport and someone else is happy to drive them for a fee.

Uber and Airbnb built software platforms and mobile apps that match buyers and sellers

of transportation and lodging services. The apps are incredibly easy to use and

dramatically increase the efficiency of bringing buyers and sellers together. They also

self-regulate to a large degree by allowing app users, on both sides of the transaction, to

rate each other.

These are beautiful business models because they require very little overhead and no

inventory. The vehicles and the homes are provided by users of the platforms.

For example, over 1 million people drive for Uber, but it owns no taxis (apart from the

self-driving autos it is currently testing).

Similarly, Airbnb controls 4 million home and room listings - more listings than the top

5 hotel chains (Marriot, Hilton, Intercontinental, Wyndham, and AccorHotels) combined

have rooms!

As a result of competition from Uber, New York City taxi medallions have plummeted in

value from $1 million to around $200,000 today. Meanwhile, Airbnb is steadily eroding

the margins of the major hotels.

The sharing economy model is expanding to include more and more services and PwC

projects that the sharing economy will grow to $335 billion in annual revenue by 2025.

The key for any sharing economy startup is building an easy-to-use platform that matches

service users with service providers.

The sharing economy play that interests us today is about to disrupt the data storage

market. Presently, the data storage business generates $40 billion in annual revenue and

is growing by about 30% per year.

Bank Heists and Data Hacks

When asked why he robbed banks, Willie Sutton is famously, though erroneously,

attributed with saying “that’s where the money is.” Simply put, the concentration of

money within banks make them attractive targets.

In most bank heist movies, the robbers typically go after the primary vault and don’t

bother with the safety deposit boxes. Clearly, the treasure trove is the central vault; that’s

what makes it such an attractive target.

It’s far more of a gamble to go after the safety deposit boxes because that takes too much

time, increasing the risk of getting caught by the authorities, and the payoffs are smaller.

Of course, the analogy is that, like banks, big centralized pools of data are attractive

targets for hackers.

In recent years, we’ve heard of more and more large centrally-stored data pools being

compromised. High-profile victims abound including Yahoo, Linked-In, and most

recently, Equifax.

But if those breaches weren’t bad enough, significantly more concerning is that even the

CIA and NSA use centralized servers to store their data. And, each agency has an arsenal

of their own cyber weapons (i.e. malware, viruses, trojan horses, etc.)

In 2016, the central server containing the NSA’s cyber weapons was itself hacked and the

hackers proceeded to auction off those cyber weapons to the highest bidders. It’s no

wonder malicious hackers have become so bold – and successful. They now have the same

tools as the most powerful government agencies.

According to a study funded by IBM, the average data breach, across the 419 global

businesses surveyed, costs $3.6 million. In total, the cost of these breaches runs well into

the hundreds of billions annually. In fact, according to a report by Juniper Research, the

cumulative annual cost of these data breaches will rise to $2.1 trillion by next year.

So, what’s the solution?

Creating Millions of Decentralized Mini-Vaults

Imagine taking all the money stored in a bank vault and distributing a few dollars across

millions of mini-vaults spread across the globe. How attractive would those targets

appear to thieves? Not very, right?

How much would it cost to break into all of them? Clearly, the cost would be vastly higher

than the potential reward.

Likewise, one should not store large amounts of data in a single place if given a choice.

You break the data into pieces, encrypt it, and distribute it. Decentralized data storage is

the solution to the hacking problem.

Of course, creating all these mini data vaults from scratch would be prohibitively

expensive. The good news is: they already exist.

An “Airbnb for Data”

Like millions of computer owners across the world, chances are, you have unused space

on your computer’s hard drive. If you’d like to rent out some of that space, just like

homeowners rent out extra rooms using Airbnb, then Filecoin (FIL) is for you.

The Filecoin platform matches people and businesses who need to safely store data with

computer owners who have unused hard drive space.

Of course, this idea could be a little confusing and questionable at first. If you are a user

of the service, do you really want your data stored on someone else’s hard drive?

Well, it’s actually quite simple and ingenious.

As a user, the platform takes your data, breaks it up into small pieces, encrypts it, and

then stores it on thousands of other computers. No one else can read or retrieve your data

but you.

As a storage provider, you simply join the network and dedicate a certain amount of your

hard drive capacity to the platform. You earn Filecoin tokens, as payment, from that point

forward. You can then either hold the tokens, sell them for Bitcoin, or convert them to

Dollars or Euros through cryptocurrency exchanges.

Why would one hold onto their Filecoin tokens?

Filecoin tokens are used to pay for storage on the network, and there is a fixed supply that

will not increase. Thus, if the Filecoin storage network grows, demand for Filecoin tokens

should also grow, causing upward pressure on the token’s price.

Merging the Sharing Economy with Blockchain Decentralization

Filecoin’s platform combines the power of the sharing economy with blockchain

decentralization. One of the key reasons blockchain is so powerful is because it’s virtually

impossible to hack.

In order to successfully hack a blockchain-based network, a hacker needs to hack 51% of

the computers on the network simultaneously. When you are talking about thousands of

computers, the level of difficulty skyrockets. More importantly, the cost of hacking

thousands of computers simultaneously is astronomical – both in computing power and

in electricity.

The incredible security of blockchain-based systems is why every major financial

institution in the world is looking to integrate blockchains into their technology

platforms.

Competing with the Big Guys

Filecoin’s developers hope that their platform will become the preferred way to use and

sell the world’s unused data storage. Their decentralized model should be significantly

more cost effective than the offerings of cloud computing juggernauts like Amazon Web

Services (AWS) and Microsoft Azure. At present, similar decentralized platforms are

charging are about half the price of AWS and those are the kinds of economics we expect

out of Filecoin.

Filecoin leverages a decentralized sharing economy model, similar to Airbnb, while its

primary competitors like AWS use less efficient centralized models, similar to the major

hotel chains.

Presently, just a handful of big cloud storage providers, like AWS, account for more than

70% of data storage worldwide. Filecoin’s distributed model should vastly expand the

number of participants in that market, thus decreasing the world’s data concentration. In

turn, decentralized storage should enable a more decentralized internet, one that is more

robust and resistant to even state-sponsored hacking attacks.

Filecoin Breakdown

Summary

A decentralized data storage network, powered by a blockhain and the Filecoin token.

Use Case: A+

Filecoin’s model is a perfect use case for blockchain and decentralization.

Development Team: AFilecoin

is the product of Protocol Labs, a US-based company building internet

infrastructure technology. The Protocol Labs core team has deep expertise in distributed

systems, cryptography, and open-source community management. Over 1,700

individuals and institutions across the globe have contributed to open-source projects led

by Protocol Labs.

Juan Benet is the Founder and CEO of Protocol Labs. He has a Bachelor’s and Master’s

degree in Computer Science from Stanford University. He has experience in advising and

working with Silicon Valley start-ups.

Nicola Greco is a key programmer at Protocol Labs who developed the Filecoin protocol

and wrote the 2017 Filecoin whitepaper in collaboration with Juan Benet. He is also a

Ph.D. student in Computer Science at the Decentralized Information Group at MIT.

Key Investors: A

Marquee investors include Union Square Ventures, Y Combinator, Digital Currency

Group, Winklevoss Capital, Sequoia Capital, Andreessen Horowitz, and Naval Ravikant

(AngelList founder). The list is a virtual “who’s who” of prominent crypto investors.

Additional Info:

Filecoin’s initial coin offering (ICO) took place in August 2017, however, FIL is not yet

trading on any crypto exchange. The founders have said that the coin will list once the

platform launches. As for launch, the founders have yet to provide a concrete date but it

is anticipated sometime this year.

The concept, the developers, and the investors behind Filecoin are each impressive and

the market opportunity is huge. In fact, it is more than big enough to support multiple

competitors. As of this writing, another crypto project called Storj (STORJ) is the

dominant player in the decentralized data storage market and we consider it a buy in our

CryptoInvestor portfolio.