While speculating on cryptocurrency is exciting and certainly profitable, I have an uneasiness that it can’t be this easy to make gains. Recent months have been crazy with the only mistake you could make was to board a slow rocket to the moon. I’ve made some good choices and missed others but I’m certain that the real achievement will be to navigate the wild speculation and pick the best companies for the longer term. Hopefully, that will be profitable but also satisfying to support those companies that deliver on the promise of decentralisation. I really believe that the blockchain can be a powerful agent of change and address wealth inequality with self forming economies that are not reliant on traditional banking and corporations. In my opinion, TenX might be one such company

What are TenX trying to create?

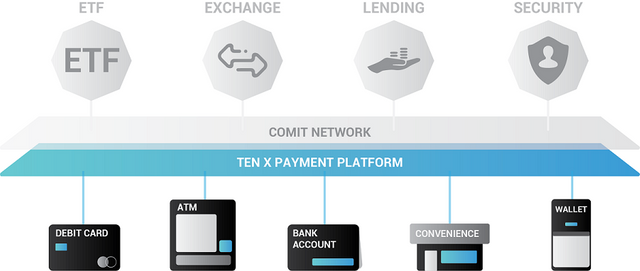

“At TenX it is our mission to make virtual currencies spendable anytime anywhere.” - White paper. Basically, you can store your cryptocurrency in the TenX wallet and spend in fiat currency using a normal payment card. They have a good website that explains how it works in more detail but I want to focus on why I think this company might be a winner

Why TenX will succeed?

Solve an actual problem

Firstly, I believe TenX are building a solution to a real problem. As crypto becomes more mainstream, users will have to be able to transact easily across a range of cryptocurrencies. Imagine a reality where all the world’s fiat currencies were usable in one country. Exchange between currencies would make it unworkable. Cryptos can co-exist in one ecosystem once there are solutions, like TenX, to handle the storage and exchange of various cryptocurrenciesLeadership and culture

The TenX leadership team is impressive in their focus on delivering value rather than hyping their $PAY token. @julianhosp (co-founder and president) repeatedly avoids pumping the token (to the dismay of some token holders). Instead he diverts the message to building the foundations of a strong company with culture, security, regulatory compliance, real product and customer growth. I have no insider evidence of this other than my fundamental analysis of the white papers and following the frequent social media output @julianhosp generates especially on the YouTube channel in the form of Q&A and general musings on crypto. In fact, I think he contributes very positively and sensibly to the crypto/blockchain domain beyond what is just TenX related e.g. Julian Hosp on BBC’s World Business Report - 1st Jan, 2018. I’d rather this open communication than the covert operations happening in other ICO funded “companies”. Maybe an elaborate scam but you can see the new offices and real employees (~50 total employees as of Dec 2017) in these videos which gives me comfort that something is being built...but maybe you’ll accuse me of just being naiveThe COMIT network

A less user facing element of TenX’s roadmap is their COMIT network. According to the white paper...”COMIT is a super blockchain network that allows for instant transactions which are enforced using off-chain smart contracts. It leverages Payment Channels and Hashed Timelock Contracts (HTLC) across chains to solve the problem of double spending attacks without requiring a settlement onto the underlying blockchains. COMIT’s connectivity is provided by Liquidity Providers (LP), who operate on one or more blockchains, acting as payment hubs and nodes on a single chain and market makers in a decentralized network for cross-chain asset conversions.” Basically, they are trying to be to blockchains what TCP/IP is to the Internet in creating a protocol for interoperability between many networks. COMIT is to enable the “Internet of Transactions”. The theory is that if there is enough liquidity in the network, then transactions can be executed via intermediate nodes without either party knowing much about the route taken with a kind of deferred trust. Nodes on the network, called Liquidity Providers, ensure the liquidity in the system. This is a role they have proposed for the traditional banking sector which could be an inclusive approach that could help COMIT’s adoption. For the blockchain ideologists, is this an acceptable compromise to give the banks a seat at the table without giving them any central control (analogous to ISPs)? This is a brief interpretation to get across the concept; full reading of the white paper is advised for more detail

This is all very nice, but from an investor point of view, there is no tangible evidence of their progress in building the COMIT network. Though open-source, no code has been published yet. Secondly, there is no link between $PAY tokens and utility on the network. I would love if there was utility there and I’ll discuss this more later. Lastly, I’m not well informed on the competition for COMIT so I need to do more homework on that. I’m aware of Bancor Protocol but haven’t analysed the differences and similarities

The competition

Generally, the main competition to TenX is probably Monaco. They launched a successful token sale in May 2017 raising US$26m. They are building a similar product to TenX although they seem to be a little behind them in progress in terms of issuing cards. This is on their roadmap for Sept 2017 but there has been no updates since then. I should mention that TenX are having their own problems with shipping cards but this has been with keeping up with demand rather than launching their card (and the recent problems with their card issuer WaveCrest). Interestingly, Monaco have images of their cards that show the VISA brand. This implies some agreement with VISA to be allowed do this. Other than this, I haven’t done any fundamental analysis of Monaco yet but I plan to and will post what I think about it in more detail later As stated by @julianhosp in their Christmas Q&A video, he says that their biggest competition is Revolut. I would tend to agree. Revolut is a great, free service that offers currency exchange at great rates. They have a very user friendly app that really nails the use case. Recently they added support for crypto (Bitcoin, Litecoin and Ethereum) at a flat 1.5% markup on average exchange price. So with their free base level service you can buy into crypto with over 25 fiat currencies easily in the app. The drawback is that you can still only spend in fiat and cannot transfer crypto to external wallets (i.e. the crypto is locked in their ecosystem). So you have to do a transfer from crypto to fiat before you can spend using the physical card. These drawbacks could be solved over time and Revolut stand a good chance of succeeding with their incumbent 1m+ user base who can transition to crypto easily in this platform with a trusted, established financial service provider. In true crypto fashion, they tweeted that the demand was overwhelming. They are also further down the tracks in acquiring a banking license which they are planning for first half of 2018 in LithuaniaWhy TenX will not succeed

Your thoughts?

Great review, thank you for sharing!

Make sure you follow me and check out my blog for cool stuff on cryptos!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit