Introduction

Synthetix is an Ethereum based convention for the issuance of synthetic assets. This permits individuals to exchange synthetic, not the real asset. Basically, as synthetic token can bring a genuine USD on-chain. Be that as it may, brokers don't possess the hidden asset yet get a similar openness as exchanging the first resource. Assuming you've known about computerized resources like USDT, USDC, or TUSD, these are synthetic assets that are completely or incompletely sponsored by genuine USD. Presently numerous individuals have utilized synthetic assets to exchange products or cryptocurrency market like Synthetix's sXAU (gold) or other synthetic assets.

Discussing synthetic assets, perhaps you will be keen on Token Exchange Synthetic. Token Exchange Synthetic or TES for short is an ecosystem that permits clients to exchange with influence without the danger of liquidation. This is an all inclusive arrangement of monetary instruments that plans to expand the benefit of clients' venture without requiring KYC techniques or other convoluted things.

Synthetic Exchange Token

An ecosystem that allows you to trade with leverage without the risk of liquidation. Trading using leverage is actively used and known to every trader. The risk of getting a "margin call" is completely eliminated and it gives you the opportunity to increase your own profit. Unlike traditional traders, crypto traders have not previously been able to use ETF with leverage. The mission of «TES» in the cryptocurrency world is to provide zero liquidation risk using leveraged trading.

There are several ways to achieve the set goals, excluding the continuous calculation of the price. The current price is generated from the synchronization of the Chainlink price update. As a result of non-static leverage, balancing asset pairs will provide a 3X asset with a difference of 1.5 to 4.5X.

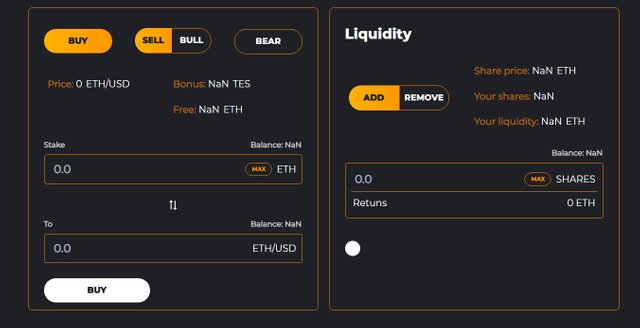

Buying and selling

All "TES" assets are derived from ETH at the current token price and guarantee 100% liquidity with no initial offer. From this — tokens are burned when sold. A 0.4% commission will carry all purchased and sold tokens from the smart storage, and those who place their tokens will receive a distribution from all following charges.

Token «TES»

By generating a commission for the purchase and sale of assets, as well as receiving a profit for storage to ensure all operations, token «TES» acts as a share of the «TESECO» ecosystem. It is worth remembering that project administration is centralized, which means «TES» is not a management token. According to the work plan, immediately after the launch of «TESECO», TES-staking will be enabled. The calculated percentage of tokens will be transferred to LINK holders after the manual request for distribution.

Further actions

The next step will be the distribution of TES to Chаinlink token holders along with a lightweight document, launch a test network, and roadmap. At the same time, we confidently forecast the first asset «TESECO» a pair of 3X ETH/USD Long&Short.

Tokens “Long” “Short”. How does it work?

The main difference from traditional leverage is that “Long” “Short” tokens are backed by ETH.The more ETH on deposit — the more tokens with leverage. As a result, the assets always have 100% liquidity. Using this decentralized model, the actual leverage of a given token “Long” or “Short” is rarely 3x — but it will never be above 4.5x or usually below 1.5x. You can see the actual leverage in the “Statistics” section of the app. TesECO platform, by visiting our website tes-token.com, you can learn about it (currently under development) by joining the Ethereum network using MetaMask. After connecting, you can familiarize yourself in more detail with its interface, it is simple and intuitive.

Liquidity pool

In the right corner of the application, you will see a “Liquidity” section. This is where users can provide liquidity and receive commissions on the platform. In the case of adding ETH liquidity, liquidity is provided by ETHLONG and ETHSHORT tokens through the TesECO storage contract. They also burn when the same liquidity is removed. In the future, besides Ethereum, there will be more Long and Short tokens for cryptocurrencies. It should be noted that adding liquidity to the pool only brings you profit for this particular pair of assets. Staking Tes brings you income for the entire ecosystem — for all pairs of assets. By adding liquidity, you get shares. You can see the share price and quantity with liquidity that you own in the “Pool” section of the app. If you are familiar with Uniswap pools, they work in much the same way. When adding liquidity, you will see some changes of the information in the “Statistics’’ section below. Adding liquidity will not have a major impact on TesECO’s statistics in the future, especially if liquidity reaches levels similar to those of Uniswap pairs.

Token Distribution

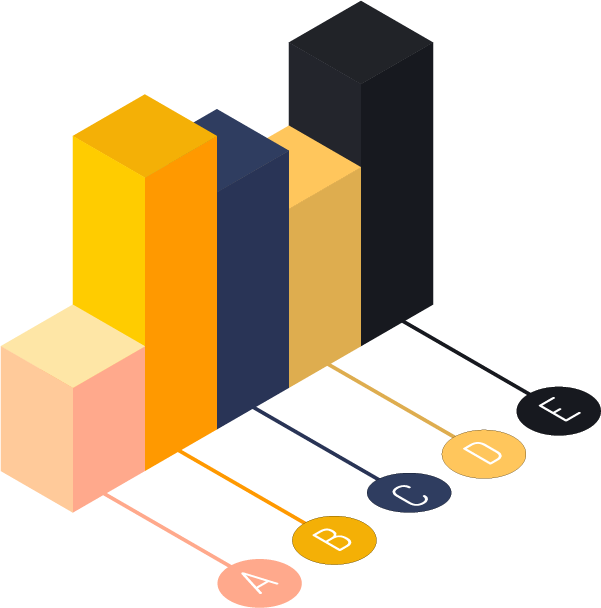

.png)

The mission of TesECO is to provide investors with access to leveraged decentralized assets that operate on the ETF principle. Check out the token distribution table. The basis of this percentage distribution is that the main task for our team is the development of the project.

Public sale - 30% - 30.000 000 TES

dApp development - 25% - 25.000 000 TES

Bounty campaign - 20% - 20.000 000 TES

Dev team - 15% - 15.000 000 TES

Airdrop - 10% - 10.0

00 000 TES

Bounty Token

You can join the bounty campaigns that will be run by our team. Follow us on social media for important updates (Twitter, Telegram).

TesECO Platform

Coming soon: A highly liquid economic model is integrated into the TesECO app. Familiarize with it. You can use all the tools on our platform by clicking on the link. Increase your assets with TesECO.

THIS PLATFORM IS UNDER DEVELOPMENT AND PROVIDED FOR REVIEW

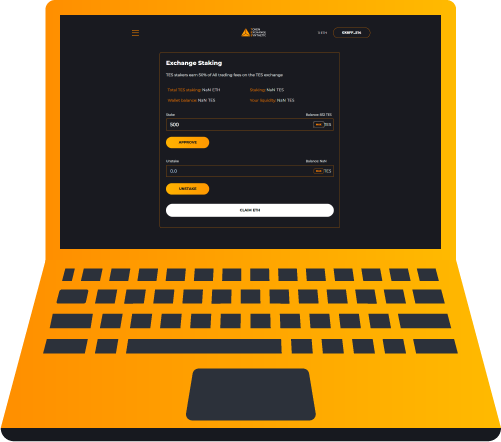

Exchange Staking

TES stakers earn 50% of All trading fees on the TES exchange

Total TES staking: 0ETH

Staking: NaNTES

Wallet balance: NaNTES

Your liquidity: NaNTES

Public Sale

30,000,000 TES tokens will be sold for the project development.

Conclusion

TesECO's mission is to create a unique product for the cryptocurrency market, integrating the financial instrument foundations of the traditional investment market. Unlike traditional traders, previous crypto traders were unable to use leveraged ETFS. TES's mission in the cryptocurrency world is to ensure there is no risk of liquidation in leveraged trading

Official Social Links:

Official website: https://tes-token.com/

Medium: https://teseco.medium.com/

Twitter: https://twitter.com/TESyntetic

Telegram Chat: https://t.me/TesEC0

Telegram Cannel: https://t.me/TESyntetic

AUTHOR

Bitcointalk Username: martin688

Bitcointalk Profile link: https://bitcointalk.org/index.php?action=profile;u=1723324

Telegram Username: @martin160388

TES wallet address: 0x95f19489661EcAEdB3C1c8CeB6d004520E80973f