Content adapted from this Zerohedge.com article : Source

Elon Musk is walking on a wire without a net.

The sharks are starting to circle around Tesla. Is the magic wand that Musk wielded for the past decade still potent?

We could be very close to the fate of Tesla hinging upon the delivery schedule of the Model 3. Tesla is running short on cash according to analysts meaning another round of outside funding is going to be necessary. If Elon wants the debt to be bought, he is going to have to show the Steet that he is able to deliver a lot more cars.

The 1,000-1,500 cars per week level that he is hitting is not going to cut it.

Tesla has one more quarter to move production near the 5,000 per week level or else things could get very sticky for the company that, just a year ago, many thought was the future.

Authored by Tom Lewis via GoldTelegraph.com,

Tesla is having a disastrous month. Following the fatal accident which involved a Tesla vehicle on autopilot, numerous companies have come out and suspended autonomous driving programs. Shares of Tesla have plummeted 22% in March as the company also experienced a credit rating downgrade.

Morgan Stanley on Wednesday came out and warned Tesla shareholders that this freefall could only be the beginning…

Analyst Adam Jones warned:

A lower share price begets a lower share price… For a company widely expected to continue to fund its strategy through external capital raises, a fall in the share price can take on a self-fulfilling nature that further exacerbates the volatility of the share price.

Jones went on to say that the company must increase production for its model three if the company wants to raise capital at an attractive valuation, as he continued:

The precise timing of when Tesla can achieve a 2,500/week and then a 5,000/week production run-rate for its mass market sedan can make the difference between whether Tesla is potentially raising capital from a position of weakness at a price near our $175 bear case or whether it can access capital from a position of strength with a stock price near our $561 bull case.

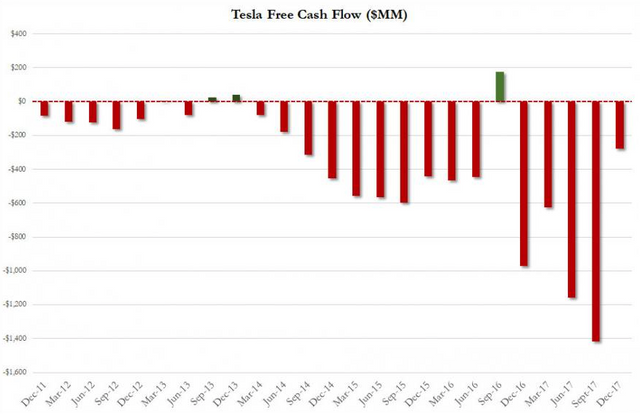

The company has burned cash at an alarming rate, as it lost $2 billion last year and burned $3.4 billion in cash after capital investments in 2017. At the end of the year, it had 3.4 billion left in cash or cash equivalents.

With $230 million of debt due in the latter portion of 2018 and an additional $920 million in 2019, many analysts believe that the company will need to raise capital soon.

On top of the backlash from the fatal accident, Tesla just issued a recall of more than 120,000 model S vehicles due to the risks of power steering failure. Tesla announced this news after the close on Thursday, forcing institutional investors to report holdings without giving them the chance to modify their positions on this news as it was the last day of the quarter. (Well played, Elon)

However, what is even more alarming is the numerous reports that Tesla's senior VP of engineering Doug Field is encouraging the acceleration of production of Model 3s in a short timeframe. Field who has criticized short-sellers, for having production concerns should probably just stay out of the limelight before people realize that he has backed up the truck by unloading Tesla shares himself. (Latest March 5th):

Source: Zach Marx on Twitter

The big question is, will Elon be able to tweet his way out of this mess?

Non-adapted content found at zerohedge.com: Source

Elon Musk on Twitter - "Tesla Goes Bankrupt Palo Alto, California, April 1, 2018 -- Despite intense efforts to raise money, including a last-ditch mass sale of Easter Eggs, we are sad to report that Tesla has gone completely and totally bankrupt. So bankrupt, you can't believe it."

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Elon Musk is a crazy man and that's why he is so successful, I believe this news will have some impact on the company but nothing that it will stop them from "being the future".

All new projects have their ups and downs, losing 22% value is not good, but it is all because of bad speculation, next quarter I believe this value will be recovered.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have always felt like he was a welfare queen, take away all the government grants and loans and lets see how many rockets or cars he can build.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 10.01% upvote from @postpromoter courtesy of @zer0hedge!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit