Preface

Tether has been ramping up their USD₮ market issuance to the tune of 3 Million USD in the Month of June alone!!

Year to Date tether has increased the amount of USD₮ issued, more than 5 fold; from 951,600 to 5,951,591 USD₮.

This maybe due to the downfall of NuBits at the start of June 2016 leaving a good market opportunity for the team at Tether; Learn more about the Nubit downturn at HERE - posted on the 1st of June; Also a follow up 2 weeks later HERE

After some digging around i have come to the conclusion that Tether is gearing up to launch their Euro pegged crypto currency 'EUR₮'; this is purely speculation and their is no concrete evidence or official word from Tether as yet but i am putting my money on it.

About Tether

Before we jump into the detail here is a bit of an overview of tether the company

Tether.to

Tether is a centralised entity providing price stable crypto currencies. Their Flagship product is USD₮ sometimes known as Tether.USD; but they also have other product such as EUR₮ and JPY₮; These FIAT currencies pairs and known as 'tethers'; these 'tethers' are pegged 1:1 with their associated FIAT currency.

EUR₮ and JPY₮ are not actively traded as yet.

'tethers'(USD₮, EUR₮ and JPY₮) are tokens issued on the OMNI platform (previously known as Mastercoin); OMNI is a meta-protocol running on top of the Bitcoin blockchain. Some other notable OMNI issued assets are MAID, Agoras Tokens and Synereo AMP.

Tether the company is incorporated in Hong Kong with offices in Santa Monica, CA and East Coast USA; and have partnership's with many exchanges including the leading US Exchange BitFinex.

How does Tether work?

Tethers exist on the Bitcoin blockchain through the Omni Protocol. The Omni Protocol is open source software that interfaces with the Bitcoin blockchain to allow for the issuance and redemption of cryptocurrency tokens.

Tether Platform currencies are 100% backed by actual fiat currency assets in our reserve account. Tethers are redeemable and exchangeable pursuant to Tether Limited’s terms of service. The conversion rate is 1 tether USD₮ equals 1 USD.

The Tether Platform is fully reserved when the sum of all tethers in circulation is greater than or equal to the balance of fiat currency held in our reserve. Through our Transparency page, anyone can view both of these numbers in near real-time.

For a more detailed technical explanation of how the Tether Platform works you can check out their Whitepaper HERE

Tethers flagship asset USD₮ adds 3 Million to supply in the last 30 days

At the time of writing 5,951,591 USD₮ have been issued with a market cap of $5,951,591; interestingly the reserve fund is showing 325,100 USD less than the amount of USD₮ issued (you can see the total amount issued via Omniwallet as well) the issuance pool is also showing $325,100 which i think is incorrect and maybe better stated as -$325,100.

My understanding (which may be incorrect) is as follows:

- Reserve Pool = amount of FIAT collateral stored in the bank

- Issuance Pool = amount of surplus funds (Total Authorised - Reserve pool)

- Total Authorised = amount of tokens issued via the OMNI protocol

You can view the current issuance statistic on the Tether transparency page

To me this shows that USD₮ tether is under collateralised by $325,100 USD. it maybe an accounting mistake or maybe the banks audit has not been updated. One thing is for sure there has been a lot of activity in issuing USD₮ in the last month.

Looking at the asset itself shows Tether in the month of June has tripled their issuance from 1.9Million USD₮ to 5.9 Million USD₮

Also looking at the 24h trade volumes it show that USD₮ is beginning to be quite a popular stable currency with 24h trade volumes in the last week averaging $2,000,000 USD when looking at all trading pairs combined.

Where Does USDt Trade?

- BitFinex

- PoloniEX

- Bittrex

- OpenLedger

- C-CEX

- Shapeshift

- Go Coin

- and more

Conclusion

There is a large market for price stable crypto currencies and it looks like Tether is attempting to stamp their position in the market and looking at the latest market volumes they seems to be attracting a lot of attention. Tether is generally seen as a centralised entity operating within the legal framework of the real world and providing liquidity via a reserves of FIAT currencies in bank accounts; this leaves it vulnerable to government, financial and political intervention; looking at their whitepaper they are looking to comply with legislation enforced on them and only operating in countries and states where there are clear regulation in regards to their operations. This centralisation also mean they have a much easier job at maintaining the pegged currency as it is literally pegged to some FIAT currency held in a back account and therefore the can offer spreads much closer to 1:1 and do not need an advanced free market mechanisms with incentive's to users to maintain the peg.

This is of-course only valid while they remain in operation; if they were to be forced to close or have their asset ceased the peg would crumble faster than the news would hit the internet.

Some decentralised players in the stable crypto currency game which do not have to conform to such regulations and therefore can serve users from all corners of the globe are Bitshares offering BitUSD, BitEUR, BitCNY, BitGold and many more and the soon to be release Steem Dollars via the Steem Network.

Comparatively the decentralised solutions have a harder task at bootstrapping their networks due to the need to incentive's in place for the free market to maintain the peg no so much in the case of Steem Dollars as the currency is a loan from the network; but if successful will be superior to the centralised alternative due to their trust-less nature, censorship resistance and ability to bypass laws imposed by local governments.

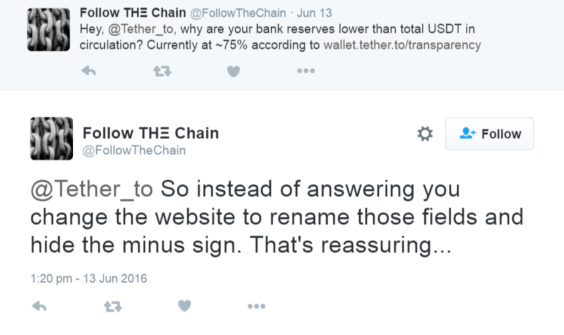

On June 13th I asked Tether out of curiosity why they were under collateralized:

https://twitter.com/FollowTheChain/status/742373658019012608

To my surprise a few moments later they simply changed some names in the Transparency page.

"Bank Reserves" became "Reserve Balance".

"Total USDT in Circulation" became "Total USDT Authorized".

The middle column (what is now "Issuance Pool") had a negative value and I think it was named something like "Excess Reserves".

Compare the USDT and EURT lines and you'll see the math doesn't add up... They blatantly removed the minus sign!

The whitepaper doesn't mention an "issuance pool" or "authorized" USDT. The document clearly states:

I couldn't find a recent capture from that page. Here's an old one:

http://web.archive.org/web/20150921165318/https://wallet.tether.to/transparency

The page then got removed from main search engines, and a google cache search redirects you to the Press page:

http://webcache.googleusercontent.com/search?q=cache%3Ahttps%3A%2F%2Fwallet.tether.to%2Ftransparency

How weird is that?? Why all this trickery?

A wild guess: maybe they really are under collateralized. In this case, issuing a lot of USDT would be a way to:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great info @followthecoin!; i too searched the white paper for a better understanding of the meaning of the terms on the transparency page; but it seems a clear definition is lacking..

Your information is really helpful and i appreciate you sharing with the community :).

I am adding a picture of your tweet as it add's clarity to the story

as linked above [https://twitter.com/FollowTheChain/status/742373658019012608]

(https://twitter.com/FollowTheChain/status/742373658019012608)

Seems like there is definitely something suspicious about this; as mentioned above Tether have remove the minus sign to presumably make is less visible that they are under their collateral requirements.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Tether is a CriptoBucks?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit