Much has already been written about the lack of real transparency of Tether Limited’s (“Tether”) finances and whether all the Tether (USDT) issued and in circulation are backed 1:1 by fiat US Dollars.

The Great Wall of Numbers blog (http://www.ofnumbers.com/2017/11/09/a-note-from-bob-on-the-transparency-of-tether/) is especially illuminating on this issue and the article referenced above sets out the somewhat murky relationship between Bitfinex and Tether, and how it may be supporting and distorting the price of BTC. This article however, will focus on the contents of a Memorandum regarding consulting services performed September 28, 2017 from Friedman LLP to the Management of Tether Limited as published here https://tether.to/wp-content/uploads/2017/09/Final-Tether-Consulting-Report-9-15-17_Redacted.pdf on 30 September 2017 ("Memo").

All quoted text in this article are extracts from the Memo. All image captures are extracts from the Memo.

In spite of their so-called Transparency page (https://wallet.tether.to/transparency), no independent audit of Tether’s reserves has been published. To counter growing questions from the crypto community about the state of their finances, Tether instructed Friedman LLP, a Manhattan headquartered accounting, tax and business consultancy to “develop findings of the cash and Tether token balances as at September 15, 2017 ” .

As someone who has some experience of writing these types of formal opinions or memos, I thought I would take a look in detail at what this Memo actually confirms, and what it does not.

No Reliance

As is usual with any kind of formal legal, tax or accountancy opinion, the Memo is addressed to the management of Tether and may not be relied upon by any other party. There is nothing untoward in this but naturally anyone with an interest in Tether should be aware that this Memo does not give them any right of action if they rely on statements made in the Memo.

Nature of Tether tokens

The first thing to note from the “Background” section of the Memo is that all the statements regarding the nature of USDT being backed by US Dollars or Euros are simply statements from Tether and Friedman is not confirming that these statements are statements of fact. This is shown by the phrases “According to Tether” and “according to the Client”. This is a theme which runs through the Memo. Friedman rely, with limited or no further investigation, on certain key statements made by Tether.

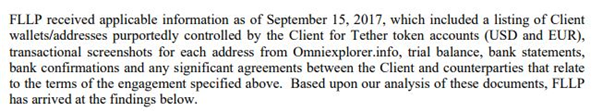

No confirmation that account details provided are controlled by Tether

At the bottom of page 2 of the Memo, Friedman sets out the documents on which it has relied to come to its conclusions, which include “wallets/addresses purportedly controlled by the Client” (my emphasis added). This means that Friedman has not confirmed that Tether does in fact control these wallets and addresses and is therefore relying on Tether’s assertion on the point.

Limited documents reviewed

The list of documents requested at the bottom of page 3 includes:

• “Screenshots from the Client of the balances in each Tether address purportedly controlled by the Client” ;

• “The Client’s engagement letter for an interim settlement plan for [redacted] to hold funds in trust and received, assess and where appropriate, settle demands for payment or other proper claims brought by customers or accounts holders of Client”.

I was surprised to see that an accounting firm relied on screenshots from Tether to prove a set of facts and took that at face value, with no further investigation. Naturally, such images could be doctored or created at a time different to the stated time of the screenshot. Friedman does not state that the images were verified as being created at a certain time and date so we must assume they are unverified.

The second document, the trust engagement letter is even more concerning. The name of the account holder is redacted and we do not know by whom this trust is controlled. Furthermore, Friedman notes that they have not reviewed the trust agreement so we have no insight as to how this trust operates.

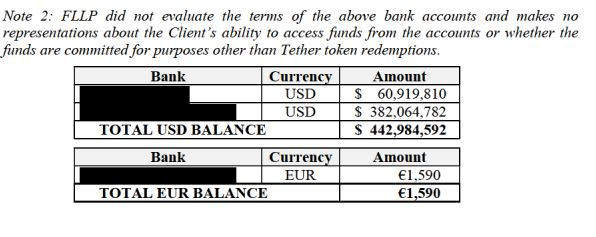

Status of funds in bank accounts disclosed

While on the face of it the findings set out by Friedman as to the account balances show US Dollar cash balances in excess of the number of USDT issued, the limited information provided to Friedman means that we cannot be sure that these balances are:

a) committed solely for the purpose of token redemptions on a 1:1 basis; and

b) accessible by Tether due to the lack of transparency over the bank account terms and trust arrangements.

It is quite possible that the balances shown to Friedman were overnight balances, funded for the purposes of producing the Memo, which could have been removed to other accounts later that same day.

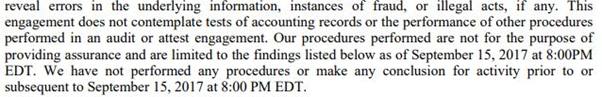

A memo not an audit

This very limited Memo purports to show a snapshot of mainly US Dollar cash balances in certain bank accounts which may or may not be controlled by the management of Tether. The limited information provided to Friedman and the heavily caveated language used, means that there is little to no comfort to be found in this Memo for those concerned with the backing of USDT by fiat currency. The Memo is at pains to state that it is not an audit and should not be used as assurance.

Conclusion

In spite of what you may have read in Tether announcements or bogus Op-eds by Bitfinex’s PR company (https://bitcoinschannel.com/op-ed-bitfinex-official-communication-regarding-recent-events-and-panic/) this Memo is not an audit and it does not clear up the confusion regarding Tether’s US Dollar reserves to support its issued and circulating USDT.

Anyone holding USDT should consider if they have sufficient confidence from the information provided, that they will be able to redeem USDT for USD in the future. While this may be happening currently, in the event of a market downturn or crash in the price of BTC then Tether is quite within its rights, per its Terms of Service, to decline to redeem your Tether for USD if it does not have sufficient USD reserves to do so, or if the terms of its banking and trust arrangements do not permit it to do so.

Personally speaking, I do not and will not hold USDT for my crypto trading as a result of the lack of transparency over Tether's finances.