TheStandard Project Overview

The Standard Protocol is a cutting-edge decentralized finance (DeFi) lending platform that provides users access to trillions of dollars in rare assets, including gold, cryptocurrencies, and in-game item NFTs. Users can borrow stable cryptocurrencies pegged to their local fiat currency by collateralizing their assets, securely stored in decentralized smart contracts called "Smart Vaults." This ensures that users retain control of their private keys, preventing third-party speculation on their collateral. The protocol allows for 0% interest borrowing without relying on a third party.

Initially, users can borrow "Standard Euro (sEURO)," a fiat Euro pegged stablecoin, with other stablecoins like sUSD and sYen to follow. The protocol supports multiple collateral types in a single vault, enabling the trading of locked assets within the smart vault while maintaining their collateral status. Smart vaults and associated debt can be sold as NFTs, offering flexibility in debt management.

Governance of the protocol is vested in the Standard DAO, a Decentralized Autonomous Organization comprised of Standard Token (TST) holders. TST holders participate in governing the protocol through smart voting mechanisms, earning staking rewards and income from global lending and other fees.

The Standard Protocol distinguishes itself from failed stablecoins by being backed by real-world value rather than relying solely on algorithms. Operating on a decentralized Layer 2 solution for Ethereum, the Standard smart contracts utilize zero-knowledge proof (zkEVM) technology for trustless and secure transactions. Inspired by the historical Gold Standard, The Standard introduces a new era of privatized and decentralized stable virtual currencies backed by valuable rare assets, offering unprecedented flexibility and security for borrowers.

Problems with Solutions

Current DeFi lending platforms encounter challenges such as variable interest rates, rigid collateral management, limited asset types, centralization risks, and high transaction fees on Layer 1 Ethereum. The proposed solution is The Standard Protocol, introducing a global standard for decentralized lending and stablecoins. Unlike fiat-backed stablecoins like Tether and USDC, The Standard Protocol backs stablecoins with tokenized physical and blue-chip crypto assets, aiming to create a decentralized pegging mechanism for a digital mirror of every fiat currency.

Key features of The Standard Protocol include stable 0% interest rates, improved collateral management allowing users to swap locked collateral without debt repayment, support for multiple collateral types, and the exclusion of centralized fiat coins like USDC as collateral. Users can mint stablecoins pegged to their local currency, contributing to the development of a blockchain FX market with a stablecoin for every major global currency.

The protocol utilizes Layer 2 implementation, specifically zkEVM, for efficient transaction processing and reduced fees compared to Layer 1 Ethereum-based platforms. Overall, The Standard Protocol seeks to address challenges in the DeFi lending ecosystem, providing innovative solutions for long-term financial planning, diverse lending options, and accessibility on a global scale.

The Standard Protocol aims to launch the first stablecoin, Standard Euro (sEURO), and subsequently create stablecoins for major fiat currencies. sEURO will be minted by locking up tokenized hard and digital assets in Smart Vaults, similar to collateralized debt positions, allowing users to retain assets while borrowing liquidity. The launch strategy involves an Initial Discount Curve Offering, an Initial Bonding Curve, TST Staking, and the introduction of Private Smart Vaults.

To ensure success, the protocol accumulates Protocol Controlled Value (PCV) managed by the DAO, serving as a stability pool and deployed on secondary markets for liquidity. The launch phases involve discounts, bonding curves, and TST staking to incentivize user participation and over-collateralize the stability pool.

The use cases of The Standard Protocol encompass generating staking income, protecting savings against inflation, leveraging fiat devaluation, facilitating instant peer-to-peer payments, participating in DeFi with physical collateral, and saving mortgage and loan costs. The protocol aims to enable exotic collateral types like tokenized stock, real estate, and in-game item NFTs, unlocking liquidity without selling and attracting capital gains taxes.

For gold/silver vaulting facilities, the protocol enables income streams by tokenizing assets and offering borrowing against them at 0% interest. It also attracts new customers and adds DeFi use cases for precious metals. For DAOs, it facilitates payments in local currency, hedging for governance tokens, and benefits from a growing ecosystem, allowing cross-chain payments and collateralizing Smart Vaults with governance tokens. Overall, The Standard Protocol strives to address diverse financial needs and unlock liquidity through innovative stablecoin solutions.

Asset Custodians in The Standard Protocol are typically gold retailers offering allocated bullion products secured in high-security vaults like Brinks. Commodity Token projects, specializing in asset tokenization, can be accepted as collateral in Smart Vaults after evaluation by The Standard DAO. The protocol assists traditional vaulting facilities in tokenizing assets to meet DAO criteria.

Requirements for Commodity Token Projects include 99.99% certified gold bars, LBMA Good Delivery Standard manufacturing, top-tier vaulting, 100% insurance, biannual audits by recognized firms, and a minimum five-year operating history. Becoming a custodian is facilitated by community consultants within The Standard Protocol.

The primary income streams for the protocol include fees and deployment of protocol-controlled value. Fees include a one-time Minting Fee for borrowers, a Burning Fee for debt repayment, and an Emergency Stability Fee to control fiat pegs. Additional fees, paid in TST, cover services like alarms, NFT sales of smart vaults, and trading locked collateral, contributing to platform functionality and stability. In summary, The Standard Protocol charges fees to ensure stability, generate income, and maintain the ecosystem, supporting its growth and success.

The liquidation pool in The Standard Protocol is a crucial element allowing users to commit sEURO and TST in equal proportions to acquire liquidated assets at a discount when a smart vault's collateralization falls below 110%. Participants can withdraw their tokens from the pool, but they must maintain an equal or higher TST amount compared to sEURO staked.

The minimum stake for the pool is 100 sEURO, subject to DAO adjustments for adaptability. The distribution formula ensures fair asset distribution based on participants' contributions. A liquidation bonus, around 10% of total assets, is granted to pool participants when a smart vault is liquidated.

Gas fees during liquidation are covered by a portion of participants' profits, calculated based on net profit and prevailing gas prices. Burning sEURO when paying off liquidated vaults maintains system stability, reducing circulating sEURO.

Liquidated assets are distributed among pool participants based on their distributions, incentivizing TST holders to participate. This mechanism ensures over-collateralization, burns sEURO for a balanced ratio, and fosters a stable system. The revised distribution guarantees all participants profit, enhancing equity and stability.

● ETH worth 5,000 sEURO

● WBTC worth 10,000 sEURO

● PAXG worth 5,000 sEURO

The total value of assets in the vault is 20,000 sEURO

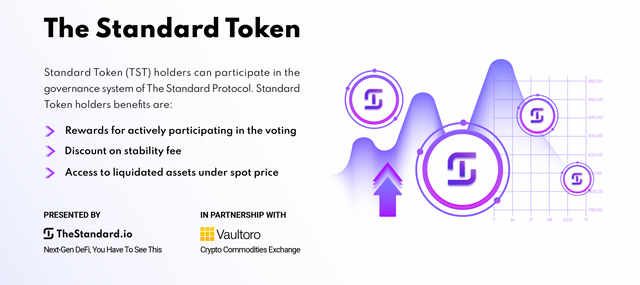

The Standard Token (TST) is a utility token central to The Standard Protocol, a cutting-edge DeFi lending platform. TST offers features such as earning a share of minting and burning fees, providing ongoing rewards for users involved in loans globally. TST holders also enjoy a 10% discount on exclusive access to liquidated assets, enhancing the token's value proposition.

The utility of TST extends to various platform functions, including collateral alarms, trading locked collateral, and enabling the sale of smart vaults as NFTs. The use of TST in these functionalities results in token burning, contributing to its scarcity and long-term sustainability.

Functioning as a governance token, TST empowers holders to actively participate in shaping the platform's future. This community-driven approach ensures alignment with user interests and ongoing innovation in the dynamic DeFi landscape.

TST holders are motivated by staking rewards, distributed from protocol income sources such as minting fees, burning fees, and fees from the Protocol-Controlled Value (PCV) in liquidity pools. Exclusive access to the liquidation pool further incentivizes staking. To qualify for rewards, TST stakers engage in activities like voting on governance issues and promoting The Standard, actively contributing to the ecosystem's stability and growth.

As the Standard ecosystem expands, incorporating new financial instruments like Multiply Vaults, additional income streams are expected, providing more incentives for TST holders to stake and reducing the token's available supply in secondary markets. This unique staking approach offers users a compelling and potentially lucrative engagement with the future of decentralized finance while actively participating in its development.

The Standard Token (TST) is a utility token central to The Standard Protocol, a cutting-edge DeFi lending platform. TST offers features such as earning a share of minting and burning fees, providing ongoing rewards for users involved in loans globally. TST holders also enjoy a 10% discount on exclusive access to liquidated assets, enhancing the token's value proposition.

The utility of TST extends to various platform functions, including collateral alarms, trading locked collateral, and enabling the sale of smart vaults as NFTs. The use of TST in these functionalities results in token burning, contributing to its scarcity and long-term sustainability.

Functioning as a governance token, TST empowers holders to actively participate in shaping the platform's future. This community-driven approach ensures alignment with user interests and ongoing innovation in the dynamic DeFi landscape.

TST holders are motivated by staking rewards, distributed from protocol income sources such as minting fees, burning fees, and fees from the Protocol-Controlled Value (PCV) in liquidity pools. Exclusive access to the liquidation pool further incentivizes staking. To qualify for rewards, TST stakers engage in activities like voting on governance issues and promoting The Standard, actively contributing to the ecosystem's stability and growth.

As the Standard ecosystem expands, incorporating new financial instruments like Multiply Vaults, additional income streams are expected, providing more incentives for TST holders to stake and reducing the token's available supply in secondary markets. This unique staking approach offers users a compelling and potentially lucrative engagement with the future of decentralized finance while actively participating in its development.

The governance concept of The Standard Protocol emphasizes security, decentralization, and efficiency. All Standard Token (TST) holders have the authority to participate in the governance system. Off-chain voting on snapshot.org is used, where voting power is directly proportional to the number of tokens held, aligning with game theory principles to discourage detrimental actions by large token holders. This structure aims to achieve a critical mass of token holders for decentralization and stakeholder protection.

TST holders actively participate in the governance process, shaping the protocol's future to meet the evolving needs of decentralized finance. Each TST allows its holder to cast votes on multiple subjects simultaneously, empowering them to influence various aspects of the protocol.

Governance subjects include adding and modifying features, expanding collateral types, managing the Standard DAO treasury, initiating emergency shutdowns, and proposing Standard Improvement Proposals (SIPs). The DAO oversees the treasury, using a multi-signature wallet to prevent a single point of failure, and can vote on emergency shutdowns to address severe market failure or vulnerabilities. TST holders can develop SIPs, and the DAO discusses and votes on them.

The user-friendly interface of The Standard Protocol aims to provide a seamless experience for creating and managing Smart Vaults, enhancing the overall appeal and usability of the ecosystem. TST holders actively contribute to shaping the protocol's future, making it an attractive, resilient, and innovative DeFi ecosystem.

For more information visit the links below

Website: https://thestandard.io/

Twitter: https://twitter.com/thestandard_io

Telegram: https://t.me/TheStandard_io

Linkedin: https://www.linkedin.com/company/the-standard-io/

Btt link: https://bitcointalk.org/index.php?action=profile;u=2247475

Author: Abeexy

Arb wallet: 0x40fb7381b288245e678db5E57D095e260a8E2E2F