Finally, CBN signed $2.5bn currency swap deal with China

— 4th May 2018

The currency swap between Nigeria and China, mooted two years ago by the Federal Government, has finally been consummated by the two countries.

This was announced Thursday in Abuja by the Central Bank of Nigeria (CBN). According to its spokesman, Mr. Isaac Okorafor, the execution of the $2.5 billion or Renminbi (RMB) 16 billion bilateral currency swap agreement has taken off with the signing of necessary papers by the central banks of the two countries.

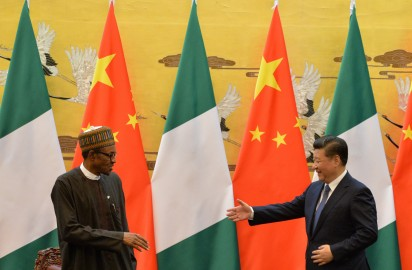

Okorafor explained in a statement that Mr. Godwin Emefiele led the CBN officials while the Governor of the People’s Bank of China (PBoC), Dr. Yi Gang, led the Chinese team at the official signing ceremony in Beijing, China, last Friday. He added that the deal was a culmination of over two years of painstaking negotiations by both apex banks.

Okorafor noted that the transaction was aimed at providing adequate local currency liquidity to Nigerian and Chinese industrialists and other businesses thereby reducing the difficulties encountered in the search for third currencies.

“Among other benefits, this agreement will provide naira liquidity to Chinese businesses and provide RMB liquidity to Nigerian businesses respectively, thereby improving the speed, convenience and volume of transactions between the two countries. It will also assist both countries in their foreign exchange reserves management, enhance financial stability and promote broader economic cooperation between the two countries.

“With the operationalisation of this agreement, it will be easier for most Nigerian manufacturers, especially Small and Medium Enterprises (SMEs) and cottage industries in manufacturing and export businesses to import raw materials, spare parts and simple machinery to undertake their businesses by taking advantage of available RMB liquidity from Nigerian banks without being exposed to the difficulties of seeking other scarce foreign currencies,” he explained.

The deal, which is purely an exchange of currencies, will also make it easier for Chinese manufacturers seeking to buy raw materials from Nigeria to obtain enough naira from banks in China to pay for their imports from Nigeria. Indeed, the deal will protect Nigerian business people from the harsh effects of third currency fluctuations.

Commenting on the new deal, experts have, however, ruled out added advantage such as the crash in the prices of Chinese products.

According to Mr. Johnson Chukwu, the Managing Director of Cowries Assets Management Ltd., the deal will just make it easier to import from China without going through the third currency exchange.

I think what the Chinese are trying to do now with this currency swap arrangement is a way of wooing back Nigeria to further deepen the trade relations between the two countries as a response to the evolving relationship between Nigeria and US that was consummated during the president’s visit to US, added to the fact that there is a trade war going on now between the US and China.

“China is also looking at how to support other markets for its exports, and Nigeria is one of those strong markets for Chinese exports. Of course, China is Nigeria’s biggest trading partner, and the trade is more of one dimensional flow. One dimensional flow in the sense that we see more of the Chinese goods come to Nigeria instead of our goods going to China. So with this currency swap, what the Chinese government has succeeded in doing is to smoothen the process of trade between the two countries to make it much easier for Nigerian businesses to import from China.

Will it bring down cost of goods? “Not necessarily! What you would rather see is that it makes it easier to import without going through the third currency exchange. It is a form of effective lending because the trade between the two countries is not balanced. The trade is skewed in favour of China.What it has done is to effectively afford us $2.5 billion line.What is going to happen now is that it is going to facilitate trade, Nigeria is going to access $2.5 billion from China.It will not necessarily crash prices.This is not going to lead to the Federal Government’s revaluing the currency.”

Toeing the same line, Ayodele Ebo, the Managing Director of Afrinvest Securities Ltd. said he could not foresee any immediate drop in the prices of the Chinese imports.”It will just ease importation and doing business with China,” he said.

He, however, praised the policy as being positive for more imports from the Asian country:

“The deal is positive for imports since the majority of Nigerian imports is from China.It is going to ease the process of doing business with China and boost business opportunities.

Just hope this will not end up like the usual Nigeria adage "voice mail" or popular June 12th stories in Nigeria.

Naija na my country!

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit