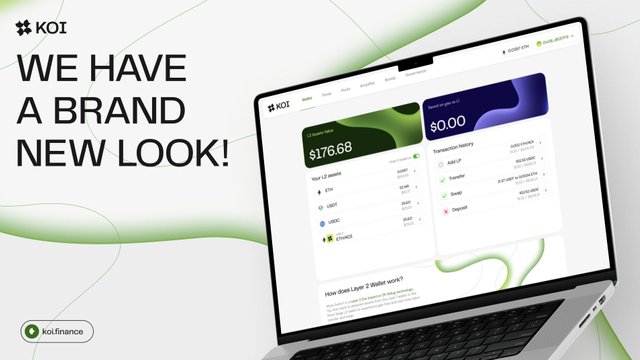

Introduction of Koi Finance

Koi Finance is a Layer 2 DeFi platform based on zk-Rollup technology. You first need to deposit assets into the zkSync Era network to experience frictionless and low cost DeFi. KOI is a lightning fast DEX, yield, and bond platform built on zkSync. A next generation DAO governed. ZkRollup DeFi Platform. Trade,earn yields and participate in Bonds all on one decentralized, community driven platform. The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol. I strongly recommend to don't avoid this and also advice to everyone to join KOI FINANCE. It definitely deserves to be invested in. you can see the good opportunity. you can get good profit,if you join and invest into here.

Koi Finance Liquidity Pools

Pool Design

Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

- Stable Pool- Assets that trade within a close price range (e.g USDC/DAI)

- Normal Pool- Assets that trade with no correlation (eg. ETH / WBTC)

There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type.

Fees for each pool are independent of other pools. Each type of pool has a min-max fee that can be set by LPs:

- Stable: 0.01%-2%

- Normal: 0.01%-10%

Stable Pools

Stable pools are designed for assets that should be traded within a tight price range. This allows high volume trades to have capital efficient swaps. Once pricing is set upon pool creation, the trade price maintains tight a spread - make sure to set the proper pricing for these pools.

Normal Pools

Normal pools are designed for non correlated and volatile priced assets. These pools use a generic AMM formula and are used for most trading pairs.

Dynamic Pools

Koi allows for pools to be created with LP fees ranging from 0.01% all the way up to 10% for normal pools, and 2% for stable pools. Once set upon pair creation, these fees can only be changed with the LP governance system. An LP provider (or delegated provider) with 50%+ vote weight can always change this fee. To prevent from gaming the system, there is a 0.1% fee on total votes when changing the fee of pools. This prevents flash loans from changing fee structures without some sort of losses.

The simplicity of the dynamic fee pool w/ governance allows for a powerful system and tool for many projects in DeFi & crypto.

Game Theory

By observing traditional CEX markets and even most NFT marketplaces, it has been normalized for fees of 1%+ to be in place via marketmakers (spread), and content creators & teams (nfts). This fee system should empower not only individual LP providers, but also projects that focus on Protocol Owned Liquidity (POL) to set their base fee for their pairs to be able to build up a larger revenue stream for the project, versus what they can find on most traditional AMM based DEXs.

Governance

Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Each LP pool has a LP fee set upon pair creation. These fees can range from 0.1%-10%, depending on what the LP provider wants to set as the creator of the pool. Only one fee can be set at a time, meaning all LPs will be participating within that fee range.

The LP governance system allows for the fee of the pool to be changed based on an account that controls more than 50% of the pool votes. Votes are directly correlated to the LP token supply balances. However, a LP provider may choose to delegate their 'votes' to another provider, allowing parties to lobby for delegates, thus increasing their pool weight.

Mute has opted for this design, instead of a multi fee pool type for numerous reasons; the major one being that the pool with the deepest liquidity will always be traded on in comparison to its counterparts (pools with lower fees & lower liquidity). Thus, it is better to concentrate liquidity within one pool, and allow a governance system that allows for dynamic fees.

Protocol Fees

The protocol has 2 type of fees:

- Dynamic (% of the LP pool fees)

- Fixed (fixed % of the overall trade)

If the protocol fixed fee is set and is larger than what the LP pool fees are, then LP providers earn no fees for trades. Protocol Fixed fees will only be used early upon launch until LP TVL grows to a sustainable amount.

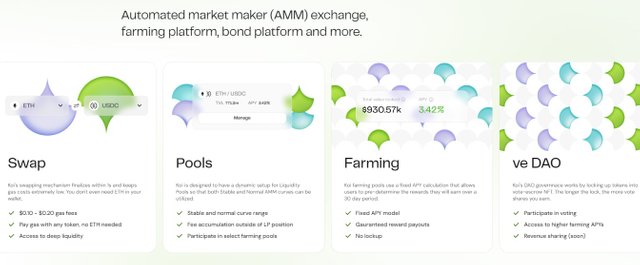

Koi finance FEATURES

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

- $0.10 - $0.20 gas fees

- Pay gas with any token, no ETH needed

- Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

- Stable and normal curve range

- Fee accumulation outside of LP position

- Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

- Fixed APY model

- Gauranteed reward payouts

- No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

- Participate in voting

- Access to higher farming APYs

- Revenue sharing (soon)

KOI Tokenomics

Max Supply: 1,000,000,000 KOI

Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated.

Circulating (prev. Mute token swap): 50%

Ecosystem Incentives: 30%

Future Investors (reserved): 7%

DAO: 6%

Future Advisors (reserved): 4%

Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release

May, 2023.Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

- Mute -> Koi rebrand & token swap

- Rebranded ecosystem with overhauled tokenomics

- veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

- Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

VISIT HERE:

Website: https://koi.finance/

Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1

Twitter: https://twitter.com/koi_finance

Discord: https://discord.com/invite/muteio

Telegram Community: https://t.me/mute_iol

Author details

Bitcointalk name: Zayd Easton

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3386257

Telegram Username: @ZaydEaston

wallet address: 0xe11E60615Fe456A880c5FC7A31c372CeCaaec11d