What is TokenSets?

TokenSets is a cryptocurrency automated asset management. There are two types of trading strategies available: Robo Sets (which are based on algorithms created by the Set team), Social Trading Sets (which are built by a trader) and Portfolios (that include 2 portfolios operated by Set and DeFi Pulse Index). They are all decentralized - meaning you remain in control of your assets. To get exposure to a strategy you simply buy a token that represents a portfolio of assets managed according to that strategy.

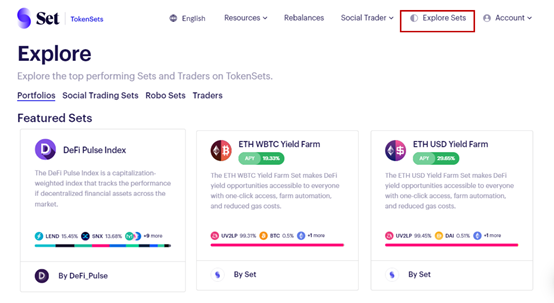

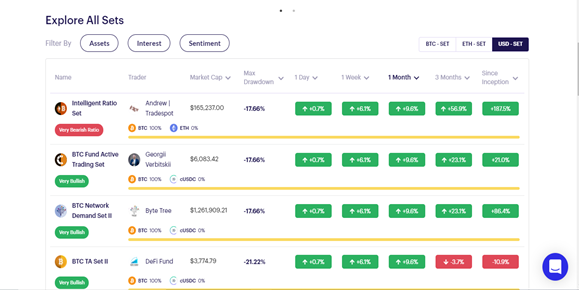

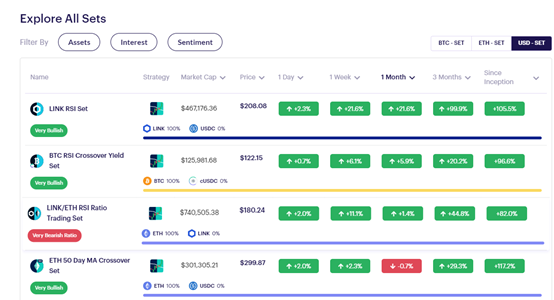

1.Click ‘Explore Sets’. In exploration page (let’s view Social Trading Sets first) you can view profit of the sets in BTC, ETH or USD and their tendencies. The trader can trade only with the currencies that are stated in portfolio.

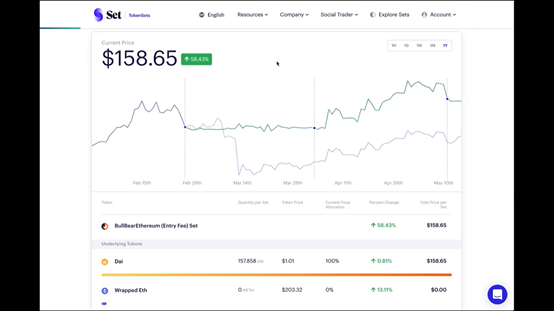

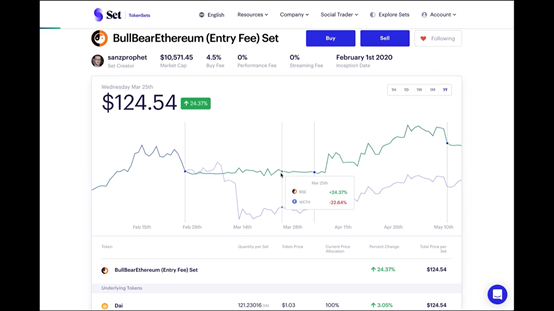

2.Click on set and check trader’s strategy, fees and performance of the set.

3.Blue line is price of ETH and green line is price of the set or smart contract.

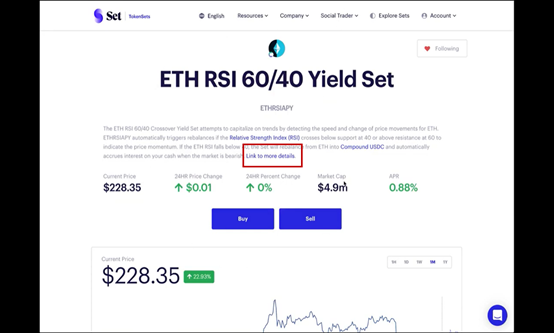

4.Let’s take a look at Robo Sets. Robo Sets don’t have any fees and have a fixed trading strategy.

5.Each chart has history of set performance. Tap on ‘Link to more details’ to get more information about the set.

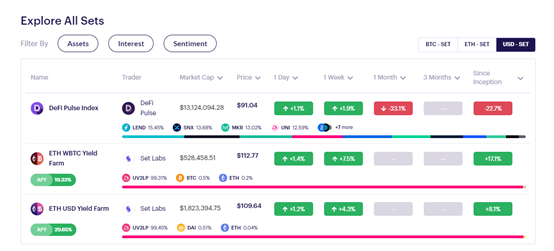

6.Now let’s see ‘Portfolios’. The DeFi Pulse Index consists of 10 DeFi tokens — LEND, YFI, COMP, SNX, MKR, REN, KNC, LRC, BAL and REPv2. It is rebalanced monthly. With the other 2 sets operated by Set are providing liquidity to Uniswap to obtain UNI.

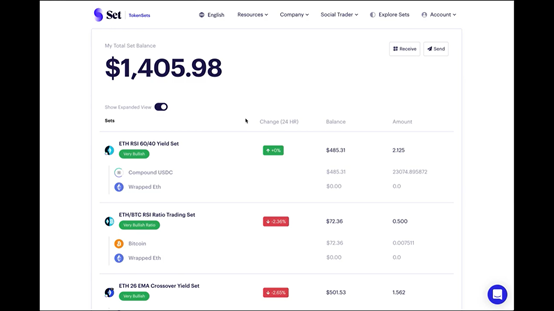

7.Enter ‘Account’ to view details of sets you are using. And all trades that were conducted.

You can also join Discord to be able to talk to social traders.

*Please pay attention that every financial operation and decision has a potential investment risk, when making an investment think carefully, do not take any impulsive decision.