2018 is a continuous year for the cryptography and appears to have been transferred from "HODL" to "BUIDL". While the prices are correcting their sweet times, Blockchain is full of development, so many of us are hoping to prepare for the next bull run.

In this article, let's see what Top 10 crypto-analysts do with their capital. For a description, there are some variations that you can hear from the top 10 of the credits. That's why the differences are, we'll save for another article.

It's also not without a work product yet these projects have a significant value: EOS, TRON, and Cardano. In fact, there are controversial arguments, but this line is somewhere to be loaded, sometimes the bar is used to set a high set. For more details on this evaluation, see our article on cryptographic analysis with productive products.

The door next door is in store for the top 10 crypto-currencies in 2019.

Top 10 Crypto-currencies: Developments You Forward to Two In 2019

1. Bitcoin (BTC)

Bitcoin is set up for an interesting 2019, and why there are 2 main reasons: increasing transaction speed and scalability, and closing the approval of institutional investors.

This combination has the ability to start the entire market as another bull run, yet it needs time to get traction.

Lightning Network

The use of Bitcoin's plaguing 7 second transaction has led to increased transaction fees and a strong edge of competition. Wikipedia developers are responding by launching the Lightning Network, which is separated from Bitcoin's main blockchain.

You can learn more about how the lightning network works by clicking here, but solving current scaling issues, Wikipedia's mass receipt. Due to incoming institutional interest, time is not good.

Institutional Involvement

Massive financial institutions are heating up cryptography and release products to meet demand.

Credibility launched their digital property platform Q4 2018 and decided to launch Fidelity Digital Asset Services (FDAS) platform in Q1 2019 to meet growing demand. The FDAS access gives the majority of access to top 10 cryptocurrencies rather than limiting access to Bitcoin and Ethereum to their clients.

Then there is the launch of Bakkt, the Q1 delays until 2019, which provides regulatory compliance for cryptography, and also provides Bitcoin futures contracts.

2. Ripple (XRP)

Like most multicons, there is no publicly available road map for waves. To get a glimpse of what the 2019 XRP is for, let's see what the fatigue team should do, and see what they're doing.

Fast and scalable

While Bitcoin is attempting to overcome scalability issues next year, filtration software already holds 1,500 transactions per second, equivalent to the average 1,700 Tx / s of the visa.

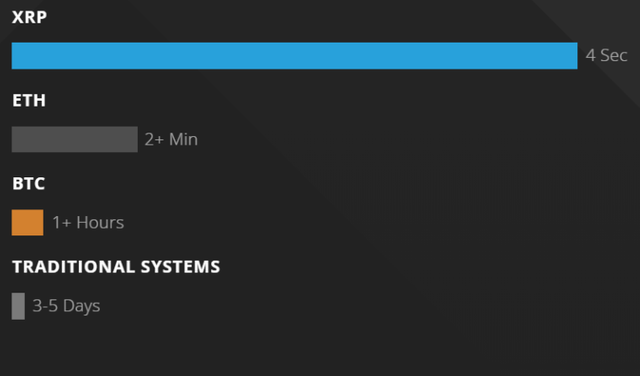

To keep these numbers in perspective, consider the image below, which shows the transaction times of the top 3 cryptocurrencies and traditional systems. The speed brings the Blockchain technology to the table, is impressive, the wave is on the head of the pack.

Global Bank Partnerships

The ability to handle trades thousands of times than other major payment gateways can do so internationally. Audit Center is focused on buying shares with RippleNet, a global pay network, increasing liquidity and reduction of transaction fees.

At present, there are currently 100 Ripplenet partners, some of which are American Express, MoneyGram, and Swift. While these partnerships are not automatically equivalent to the price rise of XRP, there is a plan to create a digital asset to promote global volume management, partnerships with digital partnerships, plans, and savings.

The wave is essentially a measurable ecosystem and powerful partnerships, and we can see the inspired twists in 2019.

3. Ethereum (ETH)

Ethereum is an important part of the industry, which was introduced in 2014, which will enable smart contracts and dip to construct the top cryptocurrency.

This led to 94 of the top 100 coins built on Ethereum. However, sharp increase in performance in blockchain also increased in the face of depression issues.

Scalability Solutions

Ethereum founder Vitalik Buterin seems confident in his solution to the blockchain’s current lack of scalability. The first update, called Constantinople, would require an Ethereum hard fork, and could happen as soon as January 2019.

The second upgrade would introduce the Casper protocol as well as sharding, which would happen in the later half of 2019.

The next scheduled update is called Serenity, which requires the creation of an entirely new blockchain, and is a multi-update plan to move Ethereum from a Proof-of-Work consensus algorithm to Proof-of-Stake.

Ethereum has a strong, proactive response to the scalability issues that came to a head throughout 2017 and 2018. With multiple cryptocurrencies battling for the top platform coin spot, Ethereum will need to make the most of next year if it wants to hold onto its first mover advantage.

4. Bitcoin Cash (BCH)

Despite the hash wars of 2018, Bitcoin Cash remains ranked at #4, and their recently updated website comes complete with a roadmap for 2019, which has been divided into 3 sections: scaling, usability, and extensibility.

The team admits that although they believe the design of their product is sound, it is not perfect, and requires carefully implemented upgrades if it wants to accomplish its aim to become “usable by everyone in the world.”

Their 3 main goals are:

1.Bring Bitcoin Cash’s capabilities from 100 Tx/s to over 5,000,000 Tx/s.

2.Shorten average transaction time to 3 seconds.

3.Create an extensible protocol that makes future updates easier to implement.

This roadmap is intended to provide high-level technical direction, and enable different technical teams to work together towards a common goal for advancing Bitcoin Cash.

—Bitcoincash.org

Aside from the regularly scheduled maintenance that’s set for May 2019, there is another developmental upgrade set to launch sometime next year called Coin Shuffle. The protocol will add an extra privacy layer, obfuscating transactional data at no additional fee.

5. Stellar (XLM)

The cryptocurrencies that are able to make developmental improvements, as well as partnerships, during bear markets are the ones that stand the best chance of survival.

While we haven’t been blessed with a roadmap for 2019 yet, we can start to put the picture together already based on what Stellar accomplished throughout 2018.

Stellar is similar to Ripple in a few ways, but 1 of the most prominent similarities moving into 2019 is their success in building partnerships with massive corporations, and what their plans for next year entail.

IBM and Blockchain World Wire

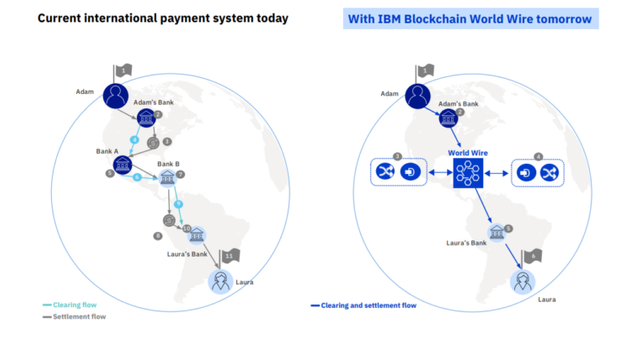

IBM has been an industry leader in in the computer field, so it’s not surprising they’re looking into blockchain technology ahead of the curve. A partnership with IBM is almost like a shortcut into the financial industry.

According to IBM’s website, 90% of credit card transactions are processed using the IBM mainframes, and 97% of world banks are IBM clients.

IBM is in the process of launching Blockchain World Wire (BWW), which they describe as “the new financial rail that simultaneously clears and settles cross-border payments in near real-time”— and they have chosen Stellar to be the platform behind it all.

2019 should be the first year the BWW sees significant traction, which should boost Stellar on the crypto radar considerably.

6. Litecoin (LTC)

Litecoin is commonly referred to as the silver to Bitcoin’s gold, given users’ proclivity to store their Bitcoin rather than use it for everyday transactions. It’s a loose analogy, but Litecoin’s goal as “silver” is to come in a smaller denomination than BTC, and thus be more practical to use for everyday transactions.

It’s worth noting that in general, since Litecoin is a fork of Bitcoin, Litecoin updates happen after those of Bitcoin. That said, Litecoin has a few technological updates due for release throughout 2019.

Mainnet Update

Litecoin transaction fees are set to take a significant dive with the release of Litecoin Core 0.17, which was announced in October 2017. The announcement post started off by claiming the update would reduce fees by a factor of 10, bringing the average transaction cost from $0.05 to $0.005.

Lightning Network and Private Transactions

As Bitcoin developers build and release the Lightning Network, Litecoin developers will be right behind them, looking to lower transaction times and costs even further. The founder of Litecoin, Charlie Lee, also hinted at the development of private transactions in a recent interview.

7. EOS (EOS)

The current EOS roadmap isn’t very detailed in terms of dates, but we can assume a major focus in 2019 will be the funding and development of dapps within the EOS ecosystem.

We can also assume they’ll be implementing updates on the mainchain to make it an attractive option for blockchain developers.

It’s difficult to know for sure what will be taking place next year. The official EOS roadmap vaguely points out that their 5th and final phase, titled Cluster Implementation, will occur sometime in the future.

Aside from that, the most convincing information publicly available is on EOS.io’s StackExchange, and it provides details on what EOS developers will be focused on next.

The EOS answer to the scalability question involves the utilization of sidechains and sisterchains, which would require the finishing of their Inter-Block Communication (IBC) protocol.

It’s also likely that EOS will be working to improve their irreversibility times by working on the asynchronous Byzantine fault tolerant (aBFT) protocol. For a technical, in-depth overview of aBFT, check out this video by Dan Larimer, the founder of EOS.

8. TRON (TRX)

TRON has grown immensely since its mainnet launch in June 2018, reaching an impressive ranking of #8 in terms of marketcap. They’ve also managed to exceed Ethereum dapp usage in this short time frame, making it a serious platform coin contender.

On top of that, TRON has a list of ambitious goals set for 2019.

User Privacy

The CEO of TRON, Justin Sun, recently explained that TRON will implement zk-SNARKS technology, giving users the option to obfuscate their transaction information. The update is scheduled to take place as soon as Q1 2019.

Stage 2: Odyssey

TRON is currently operating on a 6-stage plan, and Stage 2 is set to begin in early 2019.

The main goal of 2018 was implementing Stage 1, which can be summarized as getting the Tron mainnet up and running. Stage 2 focuses on solidifying the overall use case of their ecosystem.

Titled Odyssey, Stage 2 will focus on dapp creation and distribution, as well as compensation for said content via TRX. Their recent acquisition of BitTorrent will undoubtedly be utilized to prove Tron’s capabilities.

9. Binance Coin (BNB)

In a Christmas Eve blog post, Binance CEO Changpeng “CZ” Zhao reviewed Binance’s developments throughout 2018, and went on to describe what 2019 has in store. The post was mostly about the Binance exchange itself, but there was some mention of the BNB token specifically.

That said, BNB is tightly woven into Binance’s ecosystem, with users incentivized to use the token in return for reduced fees.

Binance in 2019

Taken straight from the year-end review, here’s what Binance’s CEO sees for Binance next year.

1More features on Binance.com.

2Binance Chain mainnet live, with a native high-performance DEX, as well as 1-second transaction confirmation time, enabling true instant transactions.

3Up to 10 fiat exchanges around the world.

4More partnerships with industry leaders.

5More use cases and adoption of BNB.

6More interesting projects invested in or acquired by Binance.

7True transparent charities.

Not only is Binance working to solidify their position as 1 of the best crypto exchanges in the world, but they’re looking into additional use cases for their native token, BNB.

10. Cardano (ADA)

Out of all the projects in this article, Cardano has the most detailed roadmap publicly available, and they even have a countdown available for their next roadmap update.

Charles Hoskinson, the founder of Cardano, maintains a high level of communication with the community and consistently releases video updates on the project.

Cardano’s academic approach is slow and steady, and they have a lot on their plate. Here are some of the more notable items on that list.

Shelley and Staking

Shelley is the next step for Cardano, and it’s aiming to produce a fully decentralized ecosystem. The update is scheduled to release in early 2019, beginning with the implementation of voting and stake pool testnets.

Cardano experiments have revealed their ecosystem is able to handle 1,000 stake pools, so now they’re focused on creating a user-friendly way of presenting so many options to their users.

Ledger Wallet and Light Client Support

At the time of writing, wallet options for ADA are mostly limited to the Daedalus desktop wallet (which requires the user to download the entire blockchain), or the light wallet Yoroi. In 2019, we’re likely to see Ledger wallet support, as well as a light option when using the Daedalus wallet.

Please upvote, resteem and follow me if you like my post.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@smartbot tip 1

Your post has been resteemed. Thanks for using my resteem service

Get more rewards in my discord server

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit