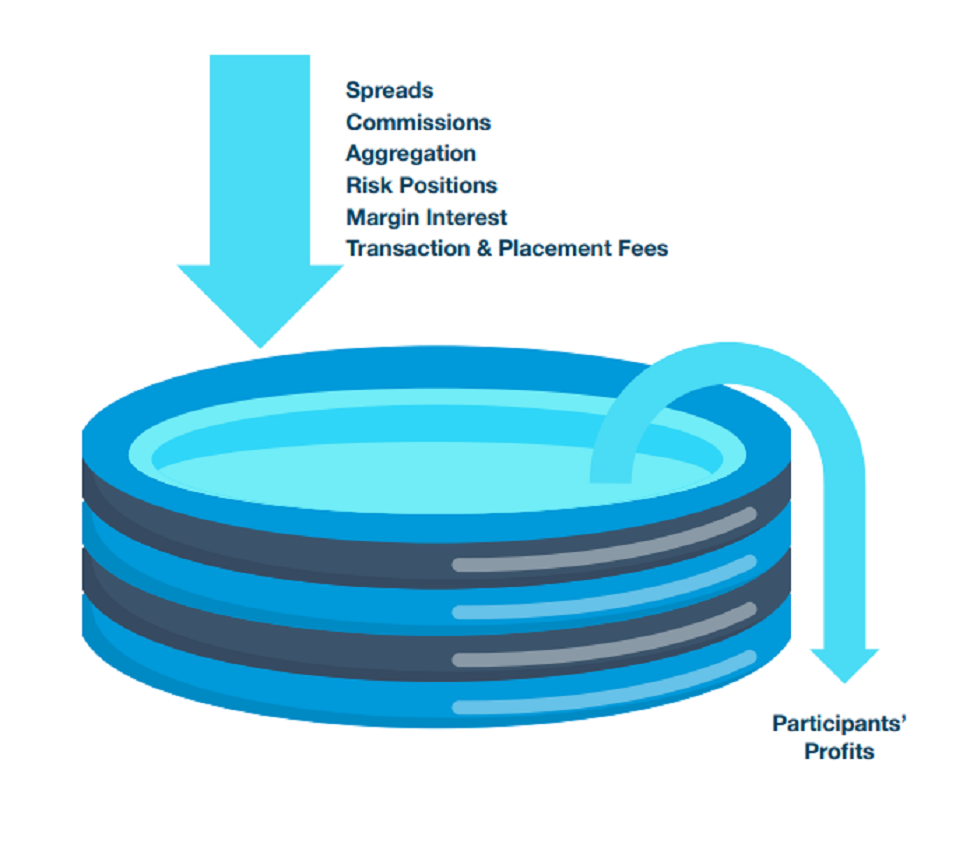

One of the principal benefits for holders of Trade Tokens that participate within the

trade.io ecosystem for trading and probably the most groundbreaking feature of

our platform, is the opportunity they’ll be given to contribute a selected amount of

the assets contained within their e-wallets to the shared, P2P liquidity pool. Half of

the profits (or losses) generated will be allocated (or debited) from the liquidity pool

with those subsequently allocated pro-rata to the participants and paid out on a daily

basis. In other words, 50% of the daily revenues (or losses) trade.io generates will be

paid or debited to or from the liquidity pool. Participants will receive their portion of the

liquidity pool distribution on a daily basis

Liquidity Pool Revenues

Spreads: All trading instruments in any marketplace or platform will have a bid and ask price. The difference between these two prices are called the spread. This is standard in all brokerage firms for both retail and institutional investors. 50% of the spread, the price difference between bid (buying) and asking (selling) price, on all transactions completed on

trade.io’s platform will go into the liquidity pool so that every participant will have a share of the profits.

Commission: When spreads are very tight, there is little room for profit margins for the brokerage firm. While being advantageous to the client/investor most brokerages charge a commission on a per trade basis to make up the lack of revenue from the tight spreads. Therefore, 50% of all commissions charged, will go into the liquidity pool.

Aggregation: We’re able to combine many unmatched small orders into one large order before passing back into the liquidity pool. As a result, all of those transactions that couldn’t be processed due to the inability to match, will be collected and processed once pricing can be matched. This ensures that value is being maximized on each and every transaction regardless of size, and passed back into the liquidity pool.

Risk positions: Depending on the risk management strategy of the brokerage firm, hedging the overall trading risk of client positions is a major and profitable source of revenue for the company. Risk management is done using sophisticated proprietary algorithms, and by leveraging the experience of risk managers who have been involved in the markets for decades. Risk management is done on a macro level along with a granular level, thus maximizing the profit potential for the liquidity pool.

Margin interest: One of the features of the trade.io e-wallet will be to allow clients to take a loan utilizing the funds in their e-wallet as collateral. The creditors of these loans will be other clients who are interested in earning interest revenue from the peer to peer lending program. trade.io will earn a small fee as revenue for providing this service and facilitating the P2P lending. Half of this generated revenue will go into the liquidity pool.

Transaction & placement fees: This is through investment banking activity that the firm is participating in, which means assisting companies to get “tokenized” or listed on the trade.io platform. This feature is highly important as the Trade Token will essentially become the ONLY cryptocurrency with real world value as participating companies will have locked real-world assets in order to receive Trade Token in exchange.As mentioned previously, all of the revenue streams detailed above are then collected with 50% of this amount going into the liquidity pool and then distributed to all of the participants. In order to participate in the liquidity pool, clients must have a minimum of 5,000 Trade Tokens (TIO) as a membership fee. Assets placed and locked for use by the liquidity pool by the participants, might include alternative currencies such as bitcoins or altcoins and even fiat currency. Participants will receive their daily payment or have losses debited accordingly. Participation in Trade Token will yield the maximum profit, cryptocurrency investments less and fiat currency the least. Details in regards to the exact numbers will be published at a later stage.

To invest or learn more visit - https://trade.io/ Download whitepaper here - https://trade.io/whitepaper/EN.pdf

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://trade.io/whitepaper/EN.pdf

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit