When I first started trading the markets, I was very inconsistent with both my methodologies and execution. It was a painful and long learning process because of it. It took me a while to understand that there is no thing such as the holy grail when it came to any trading strategy; what it worked for other successful traders didn't necessarily work for me, even if I was doing exactly the same thing. Why would you ask? Because I struggled with consistency.

My trading begun improving after I begun recording my trades. This tedious process helped me find that consistency, and the reason why I wanted to share a journal of a live account here on Steemit for new traders to understand the importance of journaling. This can give you the edge that you need.

Journaling the trades help in many ways:

- Slows down the tendency to over-trade.

- Reduces the number of times making previous errors

- Reinforce good trading habits

- Fine-tune trading strategies

- Helps in recognizing market environments

. . .

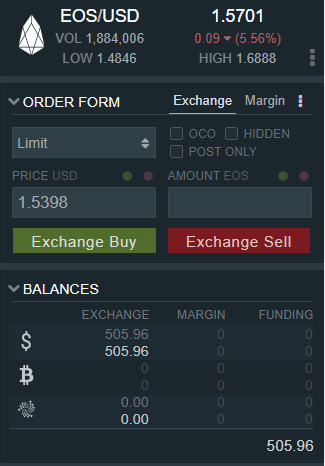

So I begun by setting up a small crypto account of $500 USD to do this, first as a challenge to myself, and second to show that it is possible to grow a small account into something big. Hopefully I am not misleading any new traders that it is easy to do, and not encouraging anyone to follow and copy my trades. Sharing personal trades publicly can be a curse for a trader, sort of like telegraphing your moves before your opposing side make theirs. So in my own best interest, I will provide scenarios of how-the trade may play out, and have the liberty to choose which ones I take depending on price-action. Then once the trade is completed, I will publicly post it as part of my trade review process.

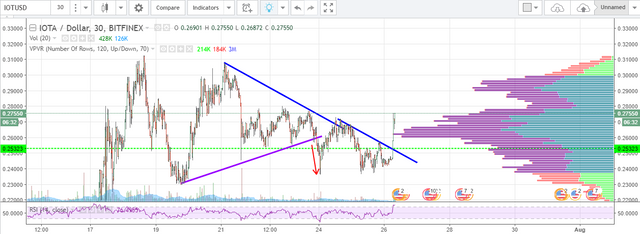

My first trading ideas were posted couple of days ago 001-IOTUSD and 002-EOSUSD. They both were looking to go Long on a break to the upside. The IOTUSD trade didn't trigger, as it broke to the downside (purple line):

As the time of writing this post, funny to see to that it exploded the way I was looking for, you can see the second blue line I drew and how much energy this squeeze has. I am keeping an eye on it now that it has popped.

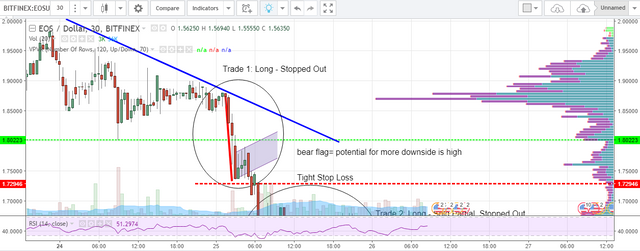

For the EOSUSD, I entered twice, both looking for a bounce:

Entered on the bounce after some minor consolidation, placing a stop below the recent low. Due to the sharpness of the fall, this types of trades need to be timed carefully and not a beginner's type of trade. The idea is that if it bounces quickly with volume, then it becomes a bear trap.

Trade 1: Stopped out:

Once it started forming a bear flag, I knew it had a potential for further downside. I look at the BTC chart simultaneously; it typically makes a moves before the alt coins, so when I saw it was breaking the nearest resistance

Trade 2: Sold Partial at R1 on weakness, Stop Loss to Break Even, Stopped Out:

As a summary for my first journal entry, I cannot emphazise more the important of account protection. Even if the idea did not fully pan out, it is critical to know when to get out of the trade and move on to the next. As much as I wanted to start with a big win, a small win can also account.

Lessons Learned:

- Protect your trading account & keep your losses small.

- Take partial at first line of resistance.

- ALWAYS use a Stop Loss.

Now onto the next trade. Until my next post & have a great Wednesday!

Hi friend, very good !!!!!

You would help me with a vote in my post., Thanks !!! ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post received a 3.3% upvote from @randowhale thanks to @architrader! For more information, click here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Much respect dude definitely following to see where this goes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks bud. Trying my best :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit