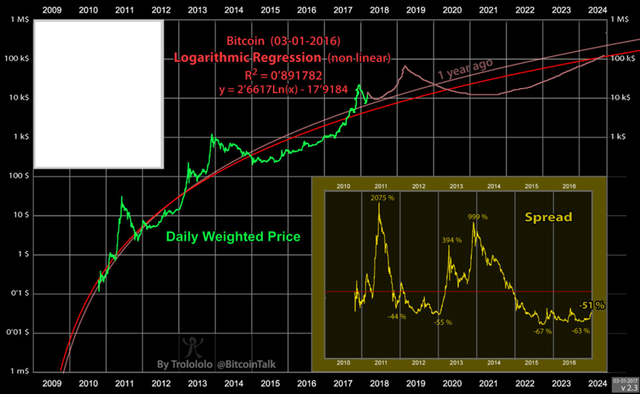

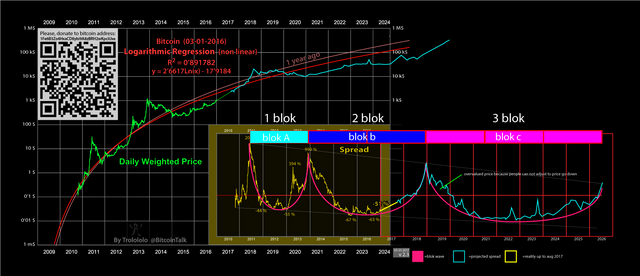

Chart below depicts a possible scenario for the Bitcoin price over the next several years:

click to zoom

The chart above and its red non-linear regression fit curve was computed in early 2017. The green price curve was extended from early 2017 as hand-drawn by myself to a rough approximation of the actual price movements. I have also drawn a pink curve which is a rough estimate of one possible scenario for the future as will be explained below. Note if the chart were recomputed, the actual regression fit as of today would probably be between the computed (not my hand-drawn curve) pink and red regression fit curves depicted above.

Crypto Winter?

I helped to popularize the “crypto winter” concept, which is by now even mentioned on CNBC.

Western Civilization Collapse Coming: Fastest Solar Decline in almost 10,000 Years

The important question is whether this recent Dec 2017 peak of $19660 is the start of a long drawn out crypto winter similar to the period from the peak in Dec 2013 until the bottom in 2015, with new ATHs not attained until more than 3 years later in 2017?

Or whether the recent Dec 2017 peak is mimicking the Apr 2013 peak which bottomed in July, with new ATHs in the Dec 2013 peak just 8 months later?

Referring to the above chart, one concern possibly indicating that a crypto winter could ensue, is that the recent Dec 2017 peak is 16 times greater than the Dec 2013 peak; whereas, the Apr 2013 peak was only 8 times greater than the Jun 2011 peak. That observation taken in isolation from other observations, seems to indicate that the recent Dec 2017 peak might be not be mimicking Apr 2013 and thus instead mimicking Dec 2013. The Apr 2013 peak is distinguished from a crypto winter, because the Jun 2011 peak demarcated the start of the previous crypto winter. However, this concern seems likely overruled by the following…

Flattening Curve As Adoption Spreads

Technology adoption typically follows an S-curve. So it’s not unreasonable for the market capitalization (and price if supply is capped as is the case for Amazon stock and Bitcoin) to have a logistic curve fit as shown on the above chart.

There were three preceding crypto winters measured from peak to new ATHs:

| crypto winter peak | peak price | new ATHs attained |

|---|---|---|

Nov 2010 | $0.50 | Q1/2011 |

Jun 2011 | $32 | Q1/2013 |

Dec 2013 | $1250 | Q1/2017 |

Feb 2019? | $31,250? | Q1/2024? |

Aug 2026? | $500,000? | ? |

Note on the above chart that as the crypto winters become longer in duration, the non-crypto winter peak (visibly Feb 2011 and Apr 2013) on the way up from the bottom to the next crypto winter peak (Jun 2011 and Dec 2013 respectively), moves closer to the crypto winter peak and becomes greater in magnitude. Also notice that the crypto winter peaks are becoming lesser multiples of their preceding crypto winter peaks:

| crypto winter peak | peak price | # of times greater than | preceding crypto winter peak |

|---|---|---|---|

Jun 2011 | $32 | 64X | Nov 2010 |

Dec 2013 | $1250 | 40X | Jun 2011 |

Feb 2019? | $31,250? | 25X? | Dec 2013 |

Aug 2026? | $500,000? | 16X? | Feb 2019? |

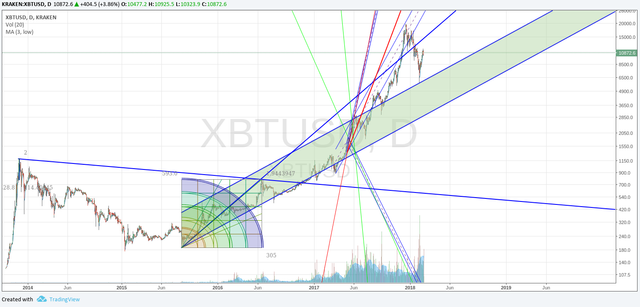

In my most recent comment of my prior blog POSSIBLE SLINGSHOT BITCOIN CRASH AHEAD, I recognized an inverted head and shoulders pattern which Coindesk also mentioned (EDIT 4 days later: the H&S pattern which the speculators on BCT are starting to sniff). This appears to be targeting $13000 in March with a possible spike to $15000 before the renewed decline towards a possible higher low in June of approximately $8500. The $15000 would mimick the 67% retracement in the corresponding Apr 2013 non-crypto winter peak. Both of those price targets are cordoned by the blue lines that were projected on the following chart:

click to zoom

If we instead move up to $17000 on this bounce mimicking the retracement in Dec 2013 and then subsequently decline below the top of the channel on the above chart, that could warn of a drop below $5850 and a crypto winter ensuing in 2018 instead of in 2019.

But this crypto winter in 2018 scenario doesn’t match as well the first chart above, because it would imply a low of perhaps $3750if it occurred too soon in 2018 thus either fall too far below the computed regression fit curve or not be low enough (i.e. ≥ $5850) if occurred on the projected timing of 2020 for the low of such a premature crypto winter that would underway now. Whereas, a crypto winter peak in Q1/2019 at new ATHs would produce a subsequent low without those aforementioned issues.

Possible Causes of Crypto Winter 2019 – 2024

The securities regulators are ramping up their worldwide enforcement planning as I had warned in my blog Are Most Cryptocurrencies Doomed to Collapse — because they’re “ICO-issued”? and followed up with analysis of the recent Senate hearing and then some related to future enforcement analysis of the purchase of the Poloniex exchange by Circle. SEC Chairman Clayton has even put his warnings in writing recently. And today we have the WSJ article about large scale probe of ICOs with subpoenas initiated by the SEC. Cointelegraph also relayed this news. I posit they won’t likely begin a large-scale crackdown until they’ve got many of the ICO tokens stored on exchanges they can confiscate and with adequate coordination with other securities regulators worldwide. So this crackdown will probably ramp up over the 2019 – 2024 period providing an endless series of (“death by a thousand paper cuts”) bad news for ICO speculation and the crypto markets.

The regulators/banks have also been ramping up their probe/pressure on Tether (USDT). Estimates are some 15% of exchange volume and capital is tied up into USDT, and that the peg has been excessively printed out-of-thin-air. Pegs always fail, because the math of markets will not allow them to be viable (no matter how they’re constructed).

The SegWit theft and reversion to Satoshi’s Bitcoin protocol is still on the table as a possibility which I covered in my blogs The Real Bitcoin: which Bitcoin fork will win? and Shocking Crisis Coming to Cryptocurrency , as well as a Bitcointalk thread I started. If this happens, it could potentially bankrupt many exchanges.

$100,000 Probably Not Until 2024+

Until the regression curve fit becomes more flat and linear, then long-term TA requires curve fitting on a logarithmic chart, because rates of exponential growth slow down so prices movements will not remain proportional. Saplings grow very fast to oak trees, but oak trees don’t grow to the moon. Exponential growth slows; it’s always logistic growth in nature and physics, (certainly not linear and) not exponential without a decreasing exponent.

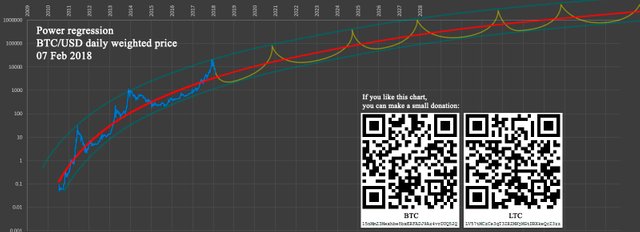

So that’s why I don’t think charts such as the following reflect reality. The trendlines drawn don’t hold from the prior crypto winter peaks to the most recent one, because the regression curve was not flat enough. IOW, it can’t be backtested. Whereas, my holistic model was backtested (although correlation doesn’t guarantee cause & effect, because for example we can find patterns in the clouds which are meaningless).

Another hint that the following chart doesn’t reflect reality is that if the next peak comes in Q1/2019 as I expect, then the chart below projects a $180,000 price which is a nice fantasy, but that would be a 150X gain from the prior crypto winter peak. It doesn’t seem likely. Japan for example has already attained significant adoption with 2.7% of its population owning some Bitcoin. Adoption is far more mature than it was in 2013. The surge has already occurred. We’re looking for the final blow off peak later in 2018 as the laggard greater fools come on board to get slaughtered before the next crypto winter.

click to zoom

Here’s another chart that @rajsallin sent me. I think the upper line on the following chart is not a computed regression curve. What they apparently did was compute the regression fit curve that is the middle curve (which is congruent with the regression fit curve in the first chart on this blog) and they then kept the curvature on the upper and lower curves consistent with the middle curve. But in fact the peaks are becoming lesser multiples, so the upper curve should becoming flatter sooner than the middle curve and thus becoming closer to the middle curve. So we can say the following chart is propaganda.

click to zoom

click to zoom

ICO-issued Tokens Will Collapse?

Analogous to Amazon not being in a bubble during the dot.com boom & bust, the demand for crypto-tokens isn’t in a bubble. Yet analogous to Amazon, that doesn’t mean the sector can’t become overheated and crash along the way towards full adoption and greater ATHs. Specifically, the liquidity, quality, and overemphasis on advisers as metric of quality of ICO speculation is in a bubble.

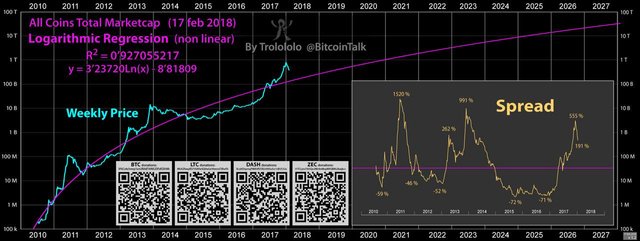

Found some new charts below which caught my attention after the discussion I’ve been having with @cryptomancer about whether there will be crackdown on ICO-issued tokens in the next crypto winter.

click to zoom

click to zoom

The first chart is the total crypto market capitalization and the second one for the Bitcoin price, and what we want to pay attention to on these two charts is the percentage “Spread” above the (purple in the first and closer to the pink curve in the second) regression curve trendline.

Notice that in December we only reached about 300% overbought for the Spread on the Bitcoin chart (which did not reach the maximum overbought projection) which is projecting to 400% maximum overbought by Q1/2019. But for total crypto market capitalization (including all altcoins) chart, the maximum 555% overbought Spread level was achieved and which is only projecting to 300% maximum overbought by Q1/2019. Draw a line from through 1520% and 991% Spread and it projects through just a tad bit below 555% and projects to 300% by Q1/2019. That’s an ominous warning about altcoins as follows!

So if Bitcoin peaks at 400% as projected in Q1/2019, that would put the BTC price pre-crypto winter peak at roughly $32,000 – $44,000. Which means the Bitcoin market capitalization would be $560B to $770B, which would be roughly 200% – 300% Spread over the purple regression curve for the total crypto market capitalization. And note 300% is the projected maximum overbought level for Q1/2019 as stated in the prior paragraph!

Furthermore, if the crypto winter drops the Bitcoin price down from ~$40k to ~$10kby 20211, the Bitcoin market capitalization will be 18 million BTC multiplied by $10,000which equals $180 billion. That would be approximately -80% Spread below the purple regression curve for 20211, which is approximately what the line drawn through -59% to -72% projects to!

Both prior paragraphs, project that Bitcoin will become nearly 100% of the total crypto market capitalization again!

Bear in mind though that at $770B market capitalization that could still allow leeway for some smaller market capitalization altcoins to appreciate significantly. For example, Litecoin which is currently at $12B market capitalization could double to an ATH and fit in within the variance of this roughly computed projection. But the question is if most of the altcoins are going to collapse in price while Bitcoin and a few others don’t, then what would be the distinguishing factor that prevents them from also collapsing? What springs to my mind is those which were illegally issued as ICOs (i.e. securities) and those which were not. The major proof-of-work issued tokens include Bitcoin, Litecoin, Monero, and Bitcoin Cash. Ethereum, Dash, Steem and few others are not so clearly ICOs or proof-of-work issued, because they were only partially issued by proof-of-work and/or issued via a sneaky instamine which obfuscated that they’re essentially securities. Presumably if the ERC-20 ICO-issued tokens are all taken down by the regulators, then Ethereum would also decline significantly in price. As for Bitcoin Cash (soon with anonymity, although perhaps that’s some damage control given Core just improved Confidential Transactions (which might explain the recent Monero price rise)?) currently at $22B market capitalization, it might languish/lag and then rise suddenly, perhaps as Bitcoin is crashing due to the aforementioned SegWit “donations” massive theft.

1 Note a 2020/21 low would also correspond to an expected bottoming for Asia in the recently rapidly accelerating coming global economic collapse which should only be a recession for Asia yet the start of an economic depression for Western Europe (i.e. the EU), noting what I wrote to @rajsallin about Asia being the early adopters of crypto en masse.

“You know you are a bag holder when...”

IMO, it’s simple to explain what the prior section appears to portend. The ICO illegal securities mania probably has everyone thinking that’s the new normal. The altcoins are extremely overvalued with 99% of them being complete nonsense and scammy money grabs. There’s going to be a reversion to the reality starting very soon. If something seems to be too good to be true and you’ve made a fortune in a very short period of time, you probably should be thinking about it probably is too good to be true. You’d probably be well advised to catch up on my latest analysis of the securities regulation juggernaut developing.

We old timers remember classics such as these from 2014 when frenzy for altcoins towards the end of 2013 had turned into…

Altcoin Bagholders Support Group

Lets get together and talk about the giant bags of shit/scamcoins we hold.

We can use this thread to discuss:

-what giant bags are we holding

-How we got suckered into bagholding

-How are we dealing with the burden of bagholding

-what do we plan to do about the bags we are holding

-how others can learn from our mistakes and avoid repeating them.My name is tokyoghetto and I am a Shieldcoin Bagholder.

The first piece of advice I found on these forums was "you only lose if you sell", which turned out to be the shittest piece of advice I have ever been given. I wish I had sold most of my shitcoins at a loss, rather than holding them until they were practically worthless. My name is bubble83 and I am a multiple shitcoin Bagholder.

I bought 1.6btc worth of vertcoin at .00128 and .0008. I failed to sell at the pump. Now vertcoin is being trading at .00028 and going down 3% everyday. My name is Joshuar and I am a Vertcoin bag holder.

LOL. I got stuck with almost 100,000 Hawaiicoins when it suddenly disappeared off Bittrex with no warning.

When did we go from 'hodling' to 'baghodling' ?? 😁😁

Anyone holding Flappy? oh god lol 😲

Yup! Lost 1 BTC on Flappycoin.

I know FLAP has been delisted from the major exchanges and I believe Poloniex just delisted it 4 days ago. Anyone bagholding FLAP will have a hard time dumping. Reading the thread it also mentions that the network isn't even moving anymore […] R.I.P Flappycoin Bagholders.

Bullcoin, Altcoin (ALT) and Inkcoin - no markets

I've got about 250k of TAK back when they did a quick pump I didn't sell fast enough apparently

EarthCoin was a bummer for me too , it went from 200 Sats to 2

i got still some bags … 300k mintcoin

0.5 BTC's worth of JuggaloCoin in my case, which I bought during its IPCO.

You have too much experience trading to buy retarded stuff like that.

The best dead coins out there are FCK & NDL 😛 I am a proud bag holder of both

Is this like Alcoholics Anonymous or something?

“You know you are a bag holder when...” (archived)

You purchase a coin and 5 minutes later the price drops...

15 minutes later the prices keeps dropping...

The next day it is worth half of what it was...

You read on the forums that weak hands are selling and tell yourself that you are a strong hand...

The next day it drops 15%...

You go back to the forums and see HOLD in big red text. You like the fact that it is in BIG BOLD RED text and listen...

The next day it drops another 15%...

You read on the forums that a HUGE announcement is coming... you realize you made the right decision and hold the coin...

The next day it drops another 15%...

You say FUCK it... I AM NOT A BAG HOLDER... and you SELL EVERYTHING for a HUGE LOSS... You probably have 25% of what you started with, but you console yourself that you did not lose everything...

Then you see the price skyrocket! To The MOON!...

In a PANICK you BUY as much as you can. Obviously it is much less than what you had before... But you are secure that you made the right choice...

The next day it drops 75%... Then gets delisted off the exchange... The Developer has run off to start another coin.

But there is hope... you see an announcement for another coin! — Judge Crypto

Just an FYI, the first image enlarge link led me here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for informing me. Yikes that was very bad for readers! Apparently

imgur.comrequires a user to visit their webpage for the image before they can visit the url for the zoomed image itself. So I can see the images zoomed, because I uploaded them toimgur.com.The corrected link you need is: https://imgur.com/a/p5afc

I will correct all the links in my blog so when zoomed they take you to the webpage for the image, not to the image url directly.

Does that fix the problem for all of you the readers?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post!

There are only 2 people I really listen to when it comes to cryptomarket predictions. The first is masterluc and the second is anonymint. This is a great example of anonymints deep understanding of both technical analysis (TA) and fundamental analysis (FA). It's very rare to see someone that understands both of these combine them in predictions. Like someone posted here before there are a bunch of TA experts that dive into every aspect of the charts but that don't see the bigger fundamental picture.

masterluc has a prediction from last May that so far has been amazingly accurate.

https://www.tradingview.com/chart/BTCUSD/YRZvdurN-The-target-of-current-bubble-lays-between-40k-and-110k/

I still think this prediction is very much valid. He is slightly off on the time scale but that is close to impossible to predict. The general look at his price waves is spot on. I agree with this prediction that when we indeed do get a new ath we will race to much higher prices very fast. In the past that is exactly what has happened when bitcoin has managed to take out highs. That is also when media turns to uber bullish and brings allong all the dumb money. Given that we went from $1200 to $19600 in a few months I really don't think that a new high in the range of $100k is that ambitious. Granted that it would certainly be a blow off top and a price that can't be sustained.

So taking anonymint's prediction and masterluc's my guess is that we will have some more choppiness in this range and then race up to new ath (but higher than anonymint predicts).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing that. I added a new section to the end of my my blog, to give my critique of his technical analysis (TA). We’ll observe the outcome…

And note the implications of being off on the time scale with his method. The price predictions totally change.

That

16Xmove that already transpired brought in 2.7% of Japan’s population into Bitcoin. Another10Xmove (to the $180k his chart predicts byQ1/2019) would need to bring that to 27% of the population if proportionality is required. Do you really think we’re ready for that level of transformation in the adoption that quickly? Rather I think we’re near a topping and then we’ll need a few years for the rest of the population to catch up with the early adopters. However, blow-off tops can spike in the short-term beyond the inertia of the fundamentals, i.e. proportionality of adoption doesn’t have to keep up with that blow-off move to a crypto winter peak.The Asians are the early adopters en masse. The Westerners are lagging and will be the greater fools. The Asians will be selling into this coming peak and then repurchasing at much lower prices. The Westerners are by now the milking cow for Asian to consume. We’re old and decadent demographically, economically, and culturally.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting analysis. It’s refreshing to see something meaty like this instead of the chart & 2 sentences of hand-waving that one finds on Steemit most often these days. I’ve been holding some Bitcoin long term but got greedy and failed to sell on the most recent $20k ATH. Your advice is some good food for thought and I’ll be watching for that $13-15k bounce you mentioned.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the upvote (to help the blog post get more visibility with a higher ranking). I hope the analysis can be helpful for others. As I wrote in another comment, I needed to write down the analysis for my internal group, so I figured better to share it and synergize with crowd sourcing of feedback and brainstorming.

Perhaps we’ll get a chance to collaborate in the future. I’m also a programmer. Interestingly you’re invested in SteemVoter, but I don’t think Steem’s voting model is the model that will prevail as a basis for decentralizing the Internet. Neither do I think consortium blockchains are the solution. (Did you see the blog Dan Larimer wrote debating me on that subject in response to to the blog I wrote about consortium blockchains not being economically/politically scalable?) I wrote a Gist about centralization of ledgers that you might find technically interesting. So I guess you might say I am working on trying to replace what you’re invested in, but in reality not likely that any altcoin will replace another altcoin. All altcoin boats are rising and falling with the general state of the crypto speculation markets.

The last crypto winter the altcoins were virtually comatose, no bid during 2014. Might be different during the next crypto winter though especially for those altcoin projects with significant adoption other than purely held for speculation.

Hey why do you say your math minor is useless? Afaics, math is very relevant in so many ways to computer science.

You should realize your dream to quit your office commute soon. I would not sell too much BTC at $15k. I think we’re still going higher into the end of the year after retest of support near the start of summer. Yet we need to observe carefully the price movements to confirm that we’re not in a crypto winter scenario decline now. To reiterate what I wrote in my blog, if we see the bounce extend to $17k and decline again significantly without making new ATHs, that would be the pattern of

Dec 2013and my concern would increase significantly. Whereas, a bounce to $15k, then declining to $8500 by June, would be consistent with the bottoming similar toApr 2013and a renewed ascent to ATHs to follow later in this year.P.S. Regarding your blogs, Doritos (and most processed foods with HFCs and other nasty chemicals) are incredibly unhealthy. And extreme sleep deprivation leads to brain damage and burnout. And I agree with the guy who suggested that day trading destroys productivity and reduces gains. Instead of caffeine I employ exercise and a Warrior diet to keep my energy level high at age 52. I appreciated the information transferred by the photos of life in Japan that you shared. I’m in the Philippines currently.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi @cryptomancer , i have some business proposal for you to help the steemit community, if you are interested we can have a little chat regarding that..hope to hear you soon this is my discord i.d @adityajainxds#3203 , this will benefit bot for us. thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Feel free to send me a DM on Discord anytime if there's something you wish to discuss.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting stuff for sure. I do a good amount of crypto analysis and trading but this takes it another level. A macro view. Loving it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you sir for sharing your thought. That is meaningful and motivational coming from someone who does trading and analysis (which btw is not my vocation at all, I’m a programmer, computer scientist, and developing an altcoin project). I had been trying to answer that question for a while now as to whether we have much probability of heading into a crypto winter now (because I have a responsibility to help manage/advise on the Bitcoin funds for my project), and I had that conflict about recent

Dec 2017peak ($19,660) being 16X higher than theApr 2013non-crypto winter peak. Then I found a way to analyze it the made sense holistically. Whether my theory will end up being true is another matter, but at least I’ve shared my logic on the matter. I also credit a full-time trader friend of mine, who created the second chart in my blog, which I have shared with his explicit permission.Note $100,000 before the next crypto winter seems much less likely to me than it did before I arrived at this latest analysis/conjecture. Rather $50,000 seems to be about the extent of the possible upside in early 2019. Okay maybe I could see some slight possibility of $70,000 on a spike intraday, but afaics $100,000 seems out-of-line with the possible extremes of the relationships of the patterns.

P.S. I had offered on the BCT forum to donate BTC to Trololo earlier in 2017 if he would update the first chart on my blog, and he didn’t respond. So I manually updated the BTC price history on the chart, but wasn’t able to recompute the regression curve fit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I would like to say just one sentence... YOu can't predict about digital currency

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I publicly predicted the crackdown on ICOs two days before it occurred.

In early 2017, I publicly predicted the Litcoin price would go from $6 to $50, and then as high as $500. It reached $300+ so far. I know a young man in his 20s who is now a $millionaire because of following that prediction and putting all his money into Litecoin.

I publicly predicted from prior version of that first chart that I had drawn originally in early December before the peak in

Dec 2017, that the price would rise to $20k then fall back down to the pink curve, which is precisely what it did. Here is the original version of the chart:click to zoom

In 2010, I correctly publicly predicted the moves of the silver price months in advance.

In early 2013, I privately agreed with my friend and former silver trading colleague Risto Pietilla (the guy who bought a castle in Estonia for $1 million in Bitcoins in 2014) to sell $100,000 of silver and buy 10,000 Bitcoins at $10 each.

there are many more examples…

P.S. It doesn’t mean I’ve never been wrong. I do provide my detailed rationale in this blog which is I think worthwhile regardless of the outcome.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

oh wao... i will remember you in who 2018... and now following you... lets see this time :p

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@scaredycatguide sent me your way and I too love your work, mate. I've given you a follow and look forward to seeing more from you in my feed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for following me. You may want to do so also to be informed about when I launch my altcoin project. I claim to be working on a “Bitcoin killer” of sorts (not actually kill Bitcoin but something very important). I think I may have been one of the first to refer to that term “Bitcoin killer” at the discussion BCT (bitcointalk.org) forum. Our project will not be an ICO illegal security offering. It will be important for decentralized ledgers and disintermediating the centralized Internet behemoths.

My blog posts tend to cover topics: trading, economics, political science/social issues, computer science, analysis of other projects/technologies in the crypto arena, and of course my R&D on decentralized ledgers and marketing of them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pilchard/Gorillazilla here, Hope development is going well for you sah, I'd like to see a true cryptocurrency made that be part of the solution to getting this vampire squid off the face of humanity. I'd like to help in whatever way I can. I've sent you an email matey.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Unless you’re a programmer, there’s nothing you can do to help my project until we get closer to launch. Apologies I’m not replying on BCT because they banned me there for speaking out against illegal securities and similar outspokenness. Can you give me the first several characters of your email address so I can search my Inbox for your email?

Did this blog get posted as a new thread at the Economics -> Speculation forum at BCT? Someone should.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That'd be gorilla sah. Let me know if you find the email.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Think of true fungibility… twitter.com/i/web/status/9…

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If buying QSP, ADA, SUB, IOTA, ICX and NANO over the last few days will turn me into a bagholder we're doomed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think I've seen this post the best and far post ever in posts. Which I am very fortunate. And in the whole year, I'll get good revenue by investing in bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit