Armed with an understanding of the stock market investors can earn substantial returns from investing in this asset class. Investing in the stock market can seem intimidating to newcomers to the market. However, investing in the stock market is not as scary as it may seem.Let’s take a look at the essential facts of how the stock market operates.

1) What Is a Stock?

A stock, also referred to as a share, is a part of a company. When an investor buys a share of a company they are buying a small piece of ownership of that business. Companies raise capital for their business needs by issuing shares to the public.

2) IPO

To raise capital for investment a company executes an initial public offering (IPO) – this is done on a stock exchange. An IPO is when the company decides to sell shares of the business in exchange for investment from public investors – the company lists itself on the public market through the stock exchange.The company uses the capital raised to grow the business, and the shares of the company continue to trade on the stock exchange after this time between buyers and sellers of the public. Shares traded in an IPO are referred to as the “primary” trading market and shares traded after IPO between external buyers and sellers are referred to as the “secondary” trading market.

3) Stock Exchange

Shares are bought and sold on a stock exchange – such as the New York Stock Exchange. In the case of an IPO the stock exchange acts as the middleman between the company issuing the shares and the public. In all other cases, the exchange acts as the intermediary between buyers and sellers of shares.After an IPO traders and investors continue to buy and sell the shares of the company on the exchange, however, the company no longer receives any proceeds from this trading.

4) Orders

The stock market used to be a physical place where investors would meet to buy and sell shares – implemented through trading floors across the globe, in New York, London and Tokyo, for example. Stock trading prices were negotiated between real people in an ongoing open live auction.Today, most trading takes place electronically. Orders to buy and sell are placed through brokers – who interface with the stock exchange and execute orders for investors. Most trading orders are processed through electronic systems and algorithms that determine in what sequence orders are executed.

5) Ticker Symbols

Stocks are listed on the market by what is known as “ticker symbols”, also referred to as “tickers”. These are short form codes or names which make searching and communicating about each individual stock consistent, convenient and accessible.For example, the ticker symbol “MSFT” refers to shares of Microsoft. This system avoids ambiguities – when you see a price quoted from MSFT or a news article referring to MSFT stock you can be assured they are both referring to the same asset – Microsoft shares.

6) Indices

Market participants track well known stock market indices as an indication of the overall performance of the stock market. Three of the most followed are the Dow Jones Industrial Average, (referred to as the Dow), the S&P 500 and the Nasdaq Composite. The Dow is an index of stocks that follows the 30 top US companies, while the S&P 500 follows the 500 biggest US companies by market capitalisation and the Nasdaq Composite measures companies listed on the Nasdaq exchange – and is therefore heavily weighted to high-growth and technology businesses.

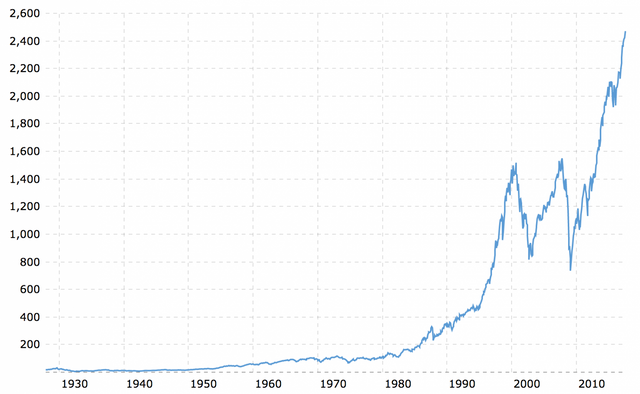

S&P 500 Stock Market Index Price History since 1927

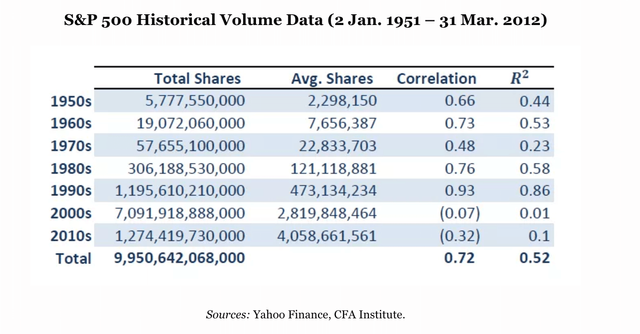

7) Stock Market Volumes

Daily volume is the number of shares traded each trading day. Stocks that have high daily volume are preferable to investors because this creates liquidity and this means traders can buy and sell shares with greater ease. When volume is low an investor may not be able to buy and sell shares at the time and size that they find most fortuitous.

Aided by a boom in technological infrastructure and wealth, trading volumes have been growing rapidly each decade.

8) When to Buy?

The primary reason to buy shares as an investor is if you believe the value of the shares will go up over time. Over the long term, stock market investments have been shown to grow at the fastest rate of all asset classes – but this is a long-term overarching trend rather than a certainty in each individual investment case. Many investors buy a basket of stocks to benefit from diversification and to capture this overall growth trend.

9) Dividends

Many companies, especially those that are more mature, pay dividends to shareholders. A dividend is a share of company profits and is paid periodically to investors – usually quarterly. Dividends are independent to the fluctuations in share price.While the share price depends on the external buyers and sellers in the market, the dividend depends on internal profit-making performance as well as dividend policy – the company may choose to reinvest all profits rather than disburse profits as a dividend.

10) Share Price Fluctuations

Share prices can move fast and for a number of reasons – including political factors, economic factors, social changes, natural disaster, news coverage, investor moods and many more. Overall share prices fluctuate based on how these factors impact demand and supply of the companies shares – if supply exceeds demand, stock prices will tend to fall and when demand exceeds supply shares prices can be expected to rise.When trading stocks the difficult lies in identifying when demand and supply in the market will shift and to what extent – a large part of which is based on investor psychology. Identifying fundamental value opportunities in certain businesses is only one part of the equation – anticipating external events and investor sentiment are also core components to identifying stock market opportunities.

NOTE: This article is not an investment advice. Any references to historical price movements or levels is informational and based on external analysis and we do not warranty that any such movements or levels are likely to reoccur in the future.

Nice article man.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks man.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

अपकी वोट हमारे लिए महत्यपूर्ण है। जिसके लिए हम आपको धन्यवाद करते है। और वोट करते रहे।

Your vote is important to us. For which we thank you. And keep voting

https://steemit.com/sex/@piyushkansal/social-issue-legalizing-same-sex-marriage

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Love this, Thanks for sharing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting post. Following and upvoted. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hiii

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

First of all, a very good and easy to read post.

Stock markets (definition) play a vital role in our day-to-day lives even if we don't notice it, for example, if you have a private pention you insurance company will invest your contributions into shares (stocks) of many different companies.

I think it's important general public understands the basics of stock markets and how to benefit from them. It never hurts to get some extra knowledge and plan for the future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit