Point and Figure  We've resolved our long pole of X's from 7/24 and touched down on horizontal level on our PnF. This is fairly bullish. There is still a unresolved long pole from 7/18, a move below $6,901 would resolve it. But I believe we could move higher before this gets resolved.

We've resolved our long pole of X's from 7/24 and touched down on horizontal level on our PnF. This is fairly bullish. There is still a unresolved long pole from 7/18, a move below $6,901 would resolve it. But I believe we could move higher before this gets resolved.

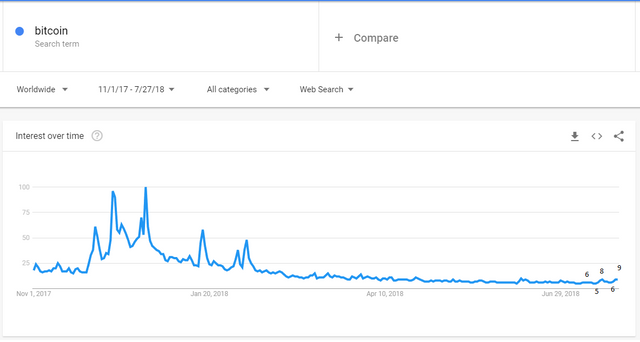

Google Trend Results for "Bitcoin"  This shows first signs of higher high higher low, starting this month.

This shows first signs of higher high higher low, starting this month.

FIB Interactions  We found resistance at 62% local FIB and more recently found support at the 50% FIB and the point of higher high/breakout from 6/3 high. This doesn't tell us a lot- boucing between FIBs would happen regardless if you are bullish or bearish. So lets take a look at our trendline here: The thick green trendline has been broken and we closed above it on 7/24. This is very bullish.

We found resistance at 62% local FIB and more recently found support at the 50% FIB and the point of higher high/breakout from 6/3 high. This doesn't tell us a lot- boucing between FIBs would happen regardless if you are bullish or bearish. So lets take a look at our trendline here: The thick green trendline has been broken and we closed above it on 7/24. This is very bullish.

So where is major resistance? I've been preaching about shorting somewhere between local 62% FIB (8,450) and major 23% FIB (9,000) for a while now, and I will stick to that. We've reached the first area but the risk:reward was not great enough to enter a short. I believe we will move up to 9,000 and fail somewhere before making a higher high against 05/04 (9,920). Stop loss would be set at a break of 10k.