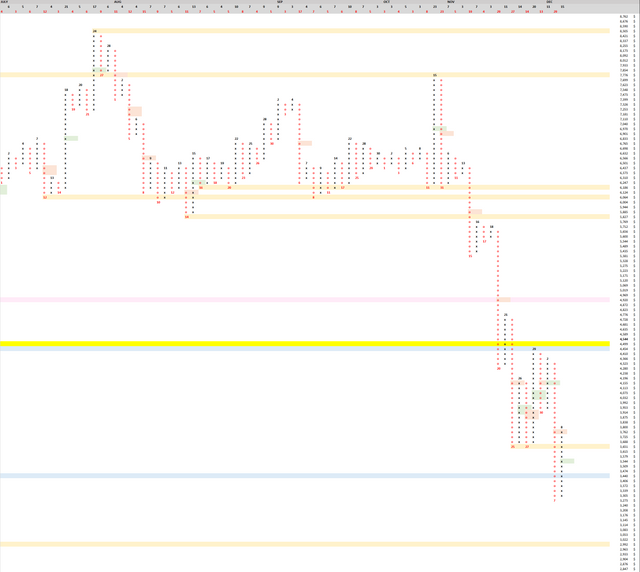

Point and Figure  We've confirmed a column of 15 X's (a long pole). We will have to move below 3,544 to resolve this column of X's (which we already have as of this writing). We've retraced our previous long pole of 29 O's 50%. We are in a range between 3273 and 4454.

We've confirmed a column of 15 X's (a long pole). We will have to move below 3,544 to resolve this column of X's (which we already have as of this writing). We've retraced our previous long pole of 29 O's 50%. We are in a range between 3273 and 4454.

Here are the recent long pole of O's, from the big wedge breaking down, which have not resolved 50%: 10/31/2018: 23 O's, resolves if price moves above $6,901. 11/15/2018: 19 O's, resolves if price moves above $5,885. 11/20/2018: 29 O's, resolves if price moves above $4,920. It could be a while before we see all 3 resolved, but I would be cautious shorting until at least the third is resolved with a price move above $4,920.

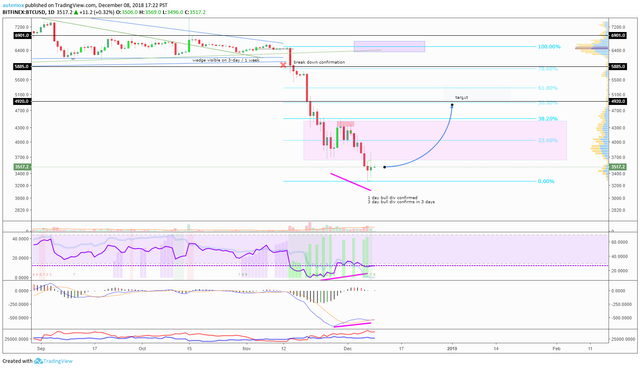

1 day bull div confirmed on RSI and MACD  If this 1 day bull div plays out successfully, it will cascade into a 3 day bull div, which will not confirm until 3 days from now (a little more ideal if 3 day closed tomorrow but thats still ok, still bullish).

If this 1 day bull div plays out successfully, it will cascade into a 3 day bull div, which will not confirm until 3 days from now (a little more ideal if 3 day closed tomorrow but thats still ok, still bullish).

Last time I posted, I discussed what to look for during this downward price exploration following the break of the large wedge that would show that we have found a bottom (even if temporary). I recommended looking for a 3-day bull div. Having closed a 1-day bull div today was the first step towards what i've described in last post. Continue watching for the three day bull div. This is a common thing to happen, momentum indicators cascade from lower timeframes to higher timeframes.

TLDR, bulls likely to get some relief on 1 day and 3 day timeframe. Enter long here at today's close of daily to play the 1 day timeframe and hold until 3 day bull div plays out. Stop around the lower low.