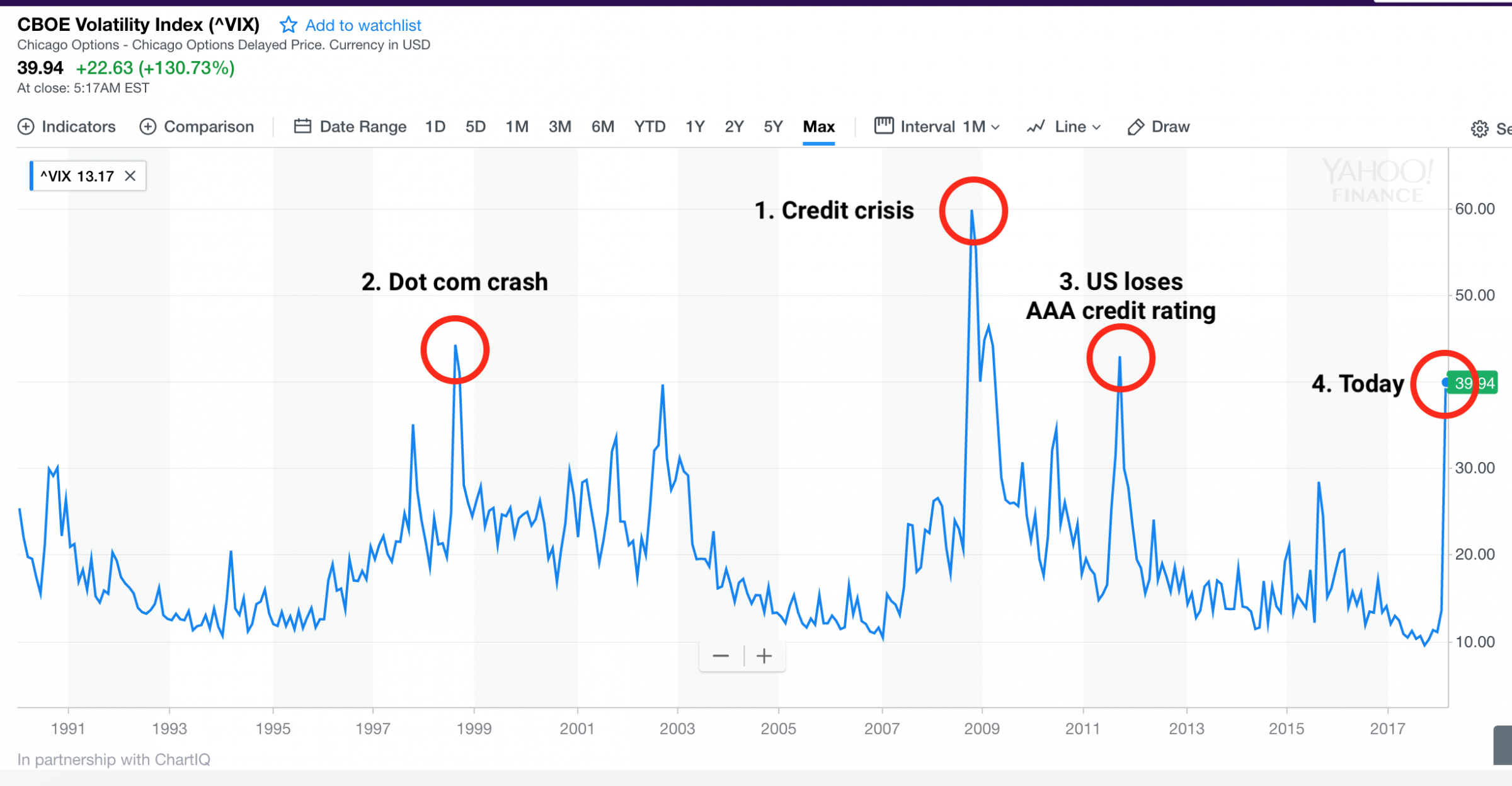

As stock markets around the world continue into their third day of plunges, the VIX has only been this high on three prior occasions.

The Cboe's Volatility Index, which measures investors' expectations of future stock price fluctuations and is commonly referred to as the "fear index," usually spikes during stock market crashes. Traders can bet on VIX spikes in order to offset their losses from stock declines.

The VIX closed yesterday at 39.94, its fourth "worst" day since the index was created in 1990. The only three periods where the VIX signalled even greater alarm were:

- The dot-com crash of 1999.

- The credit crisis of 2009.

- In 2011 when congressional gridlock over the US debt ceiling triggered the S&P ratings agency to downgrade US credit from AAA to AA+.

With this we see a bloodbath across all stock markets.

Asian Markets

US markets

Even the recent "darling" Bitcoin (BTC) got a big hit

BTCUSD

Will this be a start of another crisis?

thank you for great insight. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit