This is the first lesson in my lessons that teache you the very basics of trading and take you behind the scenes, why we use them and why they are effective.

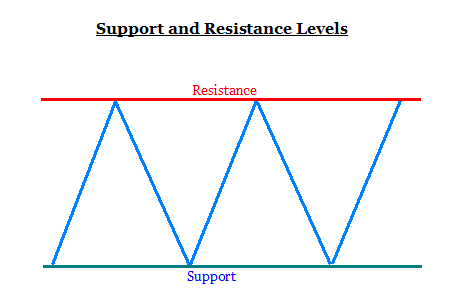

1. What is a Support/Resistance line?

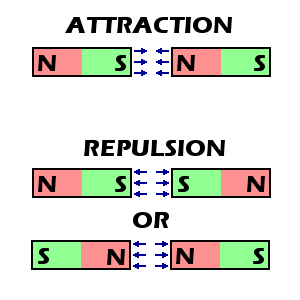

Support and resistance lines are price areas or psychological levels that attract or repel the price, exactly like magnets.

Those lines become more important as much as they attract/ repel the price and we call the point when the price touches a line : "touching points".

2. What is the difference between Support and Resistance lines?

- Support line: is a psychological based on 2 touching points (at least), when the price touches this line it rebounds and

pull up again, it is called "support line" because it holds the price from falling down. - Resistance line: is a psychological line based on 2 touching points(at least), when the price touches this line it drops

back down, it is called "resistance line" because it prevents the price from going higher

NOTE:Resistance levels can become Support levels when the price breaks above and Support levels can become

Resistance levels when the price drops below.

3. How to trade Support/resistance Breakouts?

Trading Resistance/Support level breakout is really simple. Remember that in Resistance level , its only buy trades you are going to take here.

Here are the buy trading rules:

- Identify the resistance level and you can draw a horizontal line if you wish too but it does not really matter as long as

you can identify the resistance level and wait for price to come to it. - when price head up and touches that resistance level, you must sit up and take notice and wait for the breakout

candlestick. The breakout candlestick is the candlestick that close above the resistance level after intersecting it. - Place a buy stop order ABOVE the low of the breakout candlestick.

- Place your stop loss BELOW the low of the breakout candlestick or below the low of the nearest swing low.

- Take profit should at least be 2-3 times what you risked, you can use Fibonacci tools to plan your profit target when

there is an all time high or you can use the next resistance level as a profit target if the

Risk : Reward Ratio is respected .

In Support level , its only Sell trades you are going to take here.

Here are the trading rules:

- identify the support level and you can draw a horizontal line if you wish too but it does not really matter as long as you

can see the support line. - when price comes down and touches that support level, you must sit up and take notice and wait for the breakout

candlestick. The breakout candlestick is the candlestick that closes below the support line after intersecting it. - Place a sell stop order BELOW the low of the breakout candlestick.

- Place your stop loss above the high of the breakout candlestick or just above the high of the nearest

swing high. - Take profit should at least be 2-3 times what you risked, you can use Fibonacci tools to plan your profit target when

there is an all time high or you can use the next support level as a profit target if the

Risk : Reward Ratio is respected .

An example of trading Resistance breakout

This is a swing trade that i took days ago in my live trading account and simulated it in Tradingview, it shows you the entry point and the Stop-Loss point and also the next profit target , i am using the Trend-Bases Fibonacci Extension to measure the movement of the price in all time highs .

Important: Always take a look at the volume, if the volume started to reduce after breaking out than it's time to abandon your position because the percentage of uncertainty in now bigger than the percentage of certainty and as we speculate about the price movements and the profit target we should be able to anticipate a losing trade, that's how we improve our trading skills especially, our strategy accuracy.

4. Why is this simple strategy so effective?

we will discuss this question in the comment section !

if you have any question or something you want to say about the topic , feel free to to write it in the comment section.