Hi! In this article I want to share with you the top insights that I have gathered reading N.N. Taleb's books, Antifragile and The Black Swan and how these ideas helped me shape a trading system of my own and my trading philosophy.

Balancing Risk Short Term

I have learned the hard way that in trading, risk is the first thing (and might I add the only thing) that matters. Before I engage in fantasies about rewards I like to clearly define my risk. This is either a percentage of my account or a price move in points but it will always be set to 1 point of risk (i.e. the amount I risk any given trade is 1 stop loss). This is hand in hand with thinking in risk-multiple terms and not in dollar amounts or pips etc.

When you do this you will enter a different ball game altogether. As Taleb says in his books, I have a measured down exposure which cannot be greater than 1 point of my stops. But only now I'm setting myself favourably for the upside potential that's present in markets and cryptocurrencies.

I have friends who do not run with stop losses while trading Bitcoin but I am not sure they will still be in the game 2-3-5 years from now.

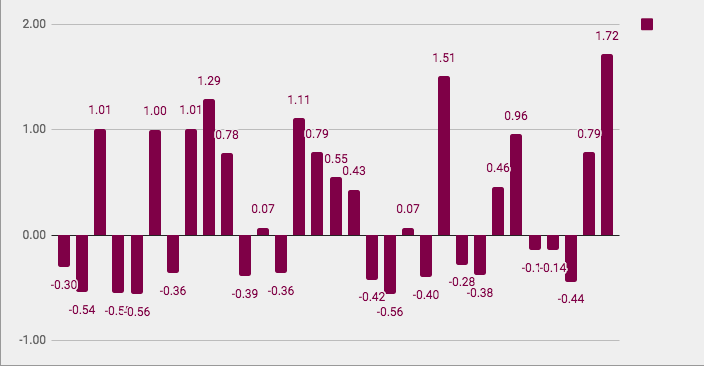

Here is an example of how I plot my trades into a Google Sheet: you can note that no trade has a greater risk than 1 (i.e. account blowup) while many of profitable trades have a multiple of 2 - this is only my lack of patience and monkey brain - I aim to have trades in many many multiples of risk from now on. Even 10 or 30 times the initial risk.

- A distributed payoff of risk assimetry - the Extremistan Payoff aims to visually grade the thin line between wins and losses - "Make your wins win more than your losses"

"The good is mostly in the absence of bad"

Good takes care of its own. It's the bad that you have to avoid. Shifting to this mindset alone can help you not FOMO in difficult times. Instead, stay in the back, calculate your steps and at all times try to play a favorable trader equation (probability wise) - the payoff is usually not in the obvious and if you find yourself doing what everyone is doing at all times, you will make mistakes often and not solicited.

"When arguing with a fool, make sure the other person isn't doing the same."

Once you have your analysis please please do not retract from it. Scrolling 5 minutes into Twitter can make a man broke. So many different biases, opinions and charts it's not worth it to change your trade because you saw something sexy. Engraining this habit will make you more disciplined and will allow you to stay in the game longer - enough to see their cards crumbling down when you play the long term trend.

From chasing BAD to ensuring GOOD.

This might be similar to first rule but in reverse. It's just an NLP way to program your brain and really see your fault. I was very faulty, chasing bad setups after bad setups when if only I would've played the good setups (that emerge eventually, every single time) you'd be far ahead. So my mantra is to not put breaks of my own. Keep a clear mind at all times and think: is this the next best thing I can do?

Balancing Risk Long Term

I thought to myself that if I want to balance risk long term I have to equip with the adequate tools and mindset, trading plan etc. What I found is that trading a slower timeframe (Daily and up) is the most liberating experience so far. And believe me I have tried everything (been an avid scalper for many years). But take this with a grain of salt - you have to account for your personality type (see Jung's work) and truly choose something that fits you like a glove. I like being able to hold a position for days or maybe weeks and cashing in the many many more risk multiples that I otherwise would've barely broken even if I was to actively day trade during this time. Frustration, agony, sweats - are not worth it for me anymore.

(Stochastic Resonance) Adding random noise to the background makes you hear the music better.

^^ this. This is OP. Do it. Change chart from 15 minutes to Daily. See all that noise go away. See beautiful movements, trends unfolding and smile. You've made it. You're now rowing the river in the large boat. And this one can go very far and be very profitable.

Part of long term strategy I want to use the Turtle's system and have this tool as a more accurate timer - a tipping point for trade validity.

Also something I'm looking at are Kelly Criterion with finite bets (part of my risk model above, %). Say if you started your month and are up 5 risk multiples. You can then risk 5 Multiples in a 3:1 trade and end the week/month with 15 initial stops. The rule here is trade size differs according to your objectives / history. But thinking is always through the lenses of 1 risk multiple.

"Understanding is curing ignorance and curing ignorance is abolishing fear." (Matt Marty)

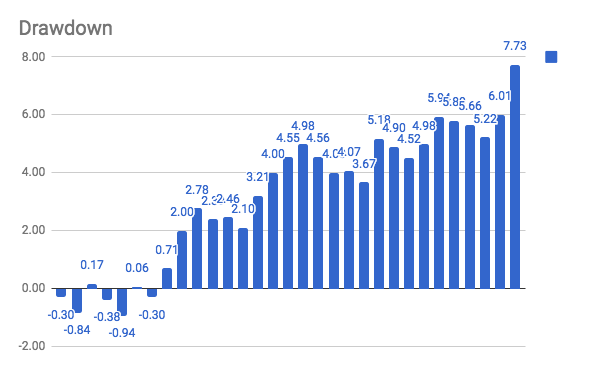

I try to understand my account and will plot a risk multiple curve to determine my overall profitability. If I'm good getting more than I risk at any point in time. This graphic also allows you to see at a glance if you're in a drawdown and also other historical drawdowns.

2 weeks worth of trades and 6 multiples ahead of the game. This allows you to extrapolate based on your goals and determine the trade size that you need to accomplish them (i.e. be financially free which is just another way of saying earning more than you're spending)

Key points so far:

1. Develop a market model trading strategy

2. Create barbell model of risk asymmetry of known losses vs possible payoffs and risk measure in units.

And now it's time for:

Law of the Jungle

This is a compendium of powerful affirmations, gathered from Taleb's books mostly that I will want to specifically visualize and be aware of.

Iatrogenics: "First do no harm"

The Dr.'s code, do no harm to the patient, your account, health. Rest will follow.

example: Closing this trade early to grab some profits because I am scared.. will do more harm or good?

(Fabian Effect) Do not look so much to achieve objectives, but try to accommodate that objectives are moving targets.

This is still something I'm struggling with.

Identify fragilities and take mirror bet

Self explanatory. But how can you do that if you're the one who's fragile? Step back. Let the singers sing, posters post and see how Trading View & Twitter can act as a contrarian indicator.

Look for a break-even point between benefits and harm.

Good one.

Prunning trees strengthens them.

Taking risk off the table.

Stress allows to find true equilibrium.

Ranges, trading squeezes, trends. It is all price discovery and stress.

Risk is in the future not in the past.

This is a golden one.

What kills me makes others stronger.

Play your game. Play it well.

De-procust-ization as a one fits all in handling risk.

Kelly bets?

We do not need to understand the future probability of events, but we can figure out the fragility to these events.

Figure it out ---> profit.

That's really it folks. A quick rundown of my trading philosophy and style, based on an expert's insight into risk (Taleb).

Please let me know in the comments if this is something interesting to you and you think you got something from it to improve your trading.

🛢️Bunker Tanks - 🛢️Fuel for Thought 🛢️

Also, If you'd like to gently caress my Twitter profile this is where I post snippets of gold.

You have a minor misspelling in the following sentence:

It should be accommodate instead of accomodate.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! :D edited.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit