This last week has been one of the most volatile weeks in the market we’ve seen for some time. We’ve seen the biggest weekly decline in stocks since 2016. https://goo.gl/kG1QZk

With fear in the equities markets, investors sought safe haven assets such as Gold and Japanese Yen. Gold rallied to $1350/oz and USDJPY dropped under 105. Which offers potentially interesting trade options. While short-term traders will look to take advantage of the bullish sentiment on gold, more patient traders will be looking for entry points to sell. When everybody is buying, at some point, there’s no one left to buy, then people start selling. The Martingale trading strategy can prove rewarding for patient traders and while it’s uncertain if there will be a trade war, traders could start to look at a potential set-up for Gold.

The example below is just an example and careful consideration needs to put into place on whether there is potential for escalation between China and the US.

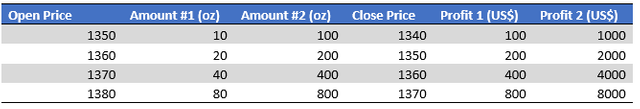

If a trader places a sell at $1350/oz and closes at $1340/oz a profit of $10/oz was made. If the price continues to rise, a second sell trade would be opened at $1360/oz which is twice the size of the previous trade with a take profit at $1350/oz. If the trader has both trades open and closes all at $1350. He or she would have broken even on the first trade and made a profit of $10/oz on the second trade. If the trader opens a sell at each of blue lines on the chart and has not been able to take profit on any, the trader could be down $1,100 if they started with 10oz of gold or $11,000 if they started with 100oz (with increasing trade sizes at each entry point). However if gold does at this point retrace down to $1370/oz, the trader could close the most recently opened trade with a profit of $10/oz, which would be $800 in scenario 1 or $8000 in scenario 2. Recent history shows this strategy would return profits with entry points every $10/oz from $1310/oz to $1360/oz.

This is just a scenario and a number of other factors are at play, such as rollover fees, emotions of the trader, equity size and political factors. Trades like this can be placed with entry orders and take profits which activate automatically, so once set-up they require minimal time investment from the trader. The martingale strategy is for instruments that tend to fluctuate not solely move in one direction and for clients with large equity and patience. I must stress this is a general trading strategy and does not take into account your personal financial situation.