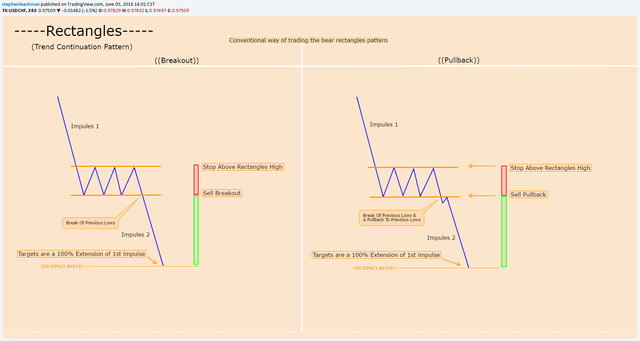

The rectangle pattern is a trend continuation pattern. It is formed in trending markets

where there is an impulse move followed by a range of price consolidation which makes

the rectangle . Once the range breaks back into the direction of the trend you would

look for a 100% extention of the first inpulse move.

-----Breakout-----

(1) Wait for a clear rectangle to form.

(2) Buy a break of previous high. (Top of rectangle )

(3) Stop below the rectangles Low.

(4) Target is a 100% extension of the first impulse move.

-----PullBack-----

(1) Wait for a clear rectangle to form.

(2) Wait for price to break and close above previous high.

(3) Buy pullback at previous high. (Usually happens 1 candle after the break)

(4) Stop below the rectangles Low.

(5) Target is a 100% extension of the first impulse move.

-----Breakout-----

(1) Wait for a clear Rectangle Pattern to form.

(2) Sell when price breaks the previous low. (Bottom of rectangle )

(3) Stop above the Rectangles high.

(4) Target is a 100% extension of the first impulse move.

-----PullBack-----

(1) Wait for a clear Rectangle Pattern to form.

(2) Wait for price to break and close below previous low.

(3) Sell pullback at previous low. (Usually happens 1 candle after the break)

(4) Stop below the rectangle Low.

(5) Target is a 100% extension of the first impulse move.

hope all of you enjoy this post and help upvote me. thank you.