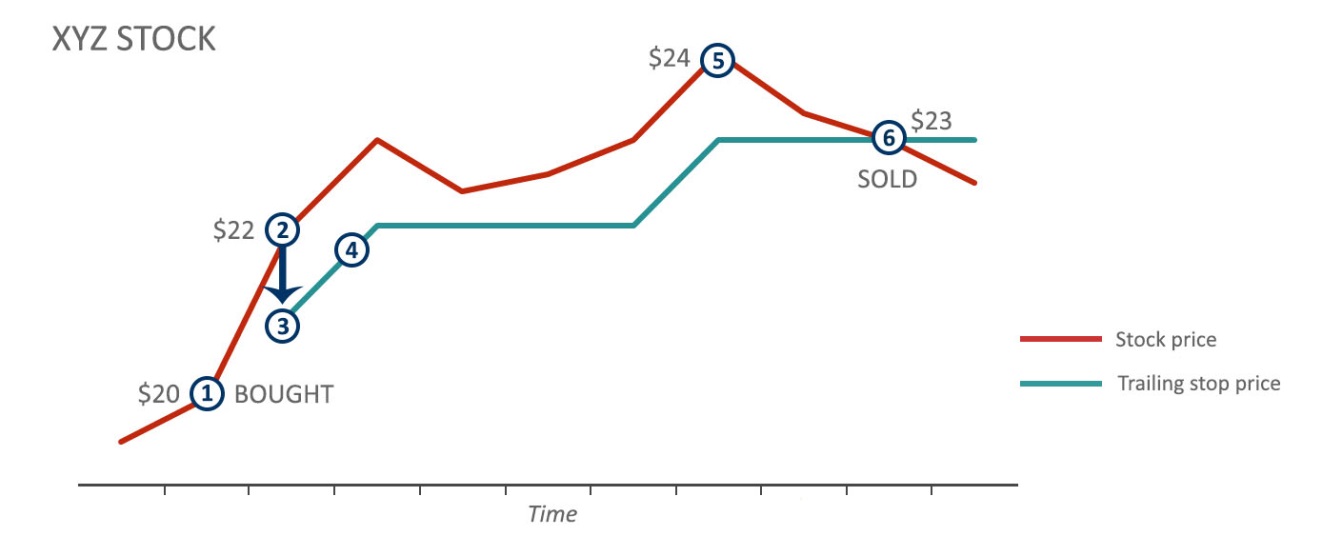

A trailing stop is an order to buy or sell a security if it moves in an unfavorable direction. Trailing stops automatically adjust to the current market price of a stock, providing the investor with greater flexibility to profit, or limit a loss. The stop level can be expressed as either a fixed dollar amount, or as a percentage of the stock’s current price. Trailing stops can also be used for short positions by establishing a trigger price above the current market price.

Lisa buys 100 shares of Joe's Ice Cream at $30 a share. For protection, Lisa decides to place a 10% trailing stop, which means the broker will try to execute a sale of Joe's Ice Cream shares if they fall 10% below their peak price after purchase.

Because Joe's Ice Cream is currently $30 per share, the trailing stop would be triggered if it fell to $27 per share. However, if the stock price reaches $60 per share, the brokerage would automatically adjust the trigger price to $54 (reflecting a 10% loss of a $60 share price).

One of the tricks to using trailing stops is choosing the appropriate level. If investors choose a cushion that’s too big, they’ll face greater losses. A trailing stop that’s too tight, on the other hand, may trigger a sale before the stock has a chance to correct itself.

Read more: How to Use Trailing Stops - Video | Investopedia https://www.investopedia.com/video/play/how-use-trailing-stops/#ixzz5EeDFPKyW

Source: https://www.investopedia.com/video/play/how-use-trailing-stops/

I normally use a stop of 2-3x Average True Range so it takes account of volatility, works pretty well and a lot of other traders use the same.

When volatility drops the ATR drops too and the stop tightens, it helps to lock in more profits when the market goes quiet and keeps you in the game when it's all a bit hectic.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit