Martingale or averaging down is normally the most destructive strategy in trading. There is a way, however, to do it with minimal risk. This method is quite productive.

Disclaimer Blamer!

I blew out 9 account by averaging down! - Ryan Herron

Yep! You read that right. In my early days of trading, I lost all my money on 9 separate occasions by averaging down. This method can and does kill accounts every day.

I know traders do it so I am trying to give them a way to do it with minimal risk.

What is Averaging Down?

It is the process of buying additional additional lots at lower prices than you purchased on your initial trade. This brings the average price you’ve paid for all your lots down.

Let’s pretend that Jimmy John buys the EURUSD at 1.2000 and price moves against him. He also buys an additional lot at 1.19000. This makes the ‘average’ entry price 1.1950, instead of 1.2000. This is 50 pips closer so that if price bounces back, he can realize a profit faster.

Averaging down reduces the amount a trading asset must raise (or fall if you are short) in order to realize a profit.

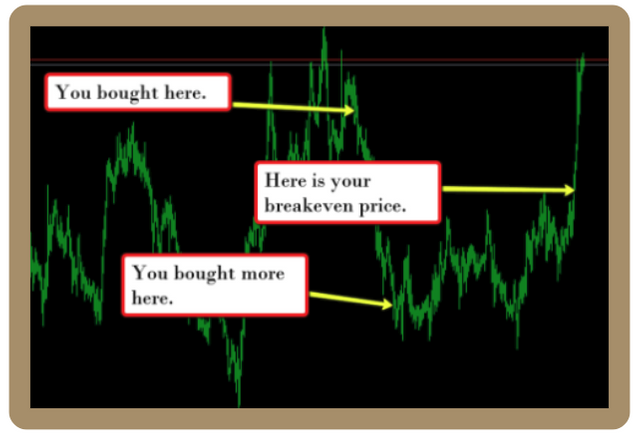

Here is a visualization of what it looks like.

Now notice, as price pulled back and you bought more, the price only had to move halfway up before you broke even.

This is why martingale or averaging down is so attractive...

After price moved halfway up, you were then making a profit on every tick twice as much as you would have made on your initial investment.

It doesn’t even have to climb all the way to break even on your initial trade for you to realize a profit. For instance. you could lose 50 pips on your first trade, win 100 pips on your second, and profit overall, even though your first trade lost.

ROCK HARD RULES!!!

This type of strategy has rules that must be adhered by, in order to make it work. If you deviate from these rules, you WILL lose in the end. This strategy is for those who have been trading for a while and know the impact of emotional trading and what it feels like. If you are a newbie, don’t even attempt this.Wait a while until you know what a losing trade feels like becasue when you lose one of these, it is often 2 to 3 times as bad as a normal losing trade. This is because when you lose, you will lose 2 to 3 times as much.

Only allow for 3 averaging entries. Do not risk any more than 3 because if you risk 3 entries and are still wrong, you are just dead wrong and should close your trade so that you live to trade another day.

Before you begin buying, make sure price is in a strong uptrend. Make sure that you have rock solid support to put your stops under. (Vice versa for a downtrend)

If price is in an uptrend, wait on a pullback near support before entering and make sure that all 3 entries are above support.

If price breaks support, get the hell out!!!!

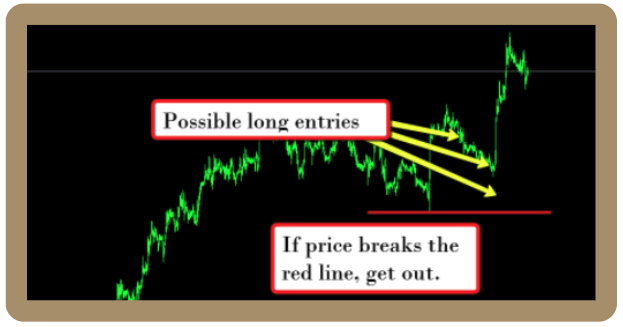

Here is a visualization of what I am talking about.

Do you see the red line? This is support.

If price drops below there, you are WRONG so close your trade down, cry, run to mommy, pray to Jesus, and stop trading. Can you spot the next support line?

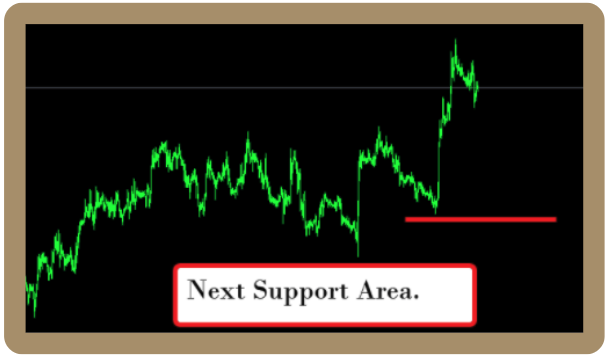

Look at the chart below and see if you can spot the support line. Here is a hint. It’s red and a line. As long as price doesn’t break support, you can enter just about anywhere you darn well please but rest assured, it it breaks support, what are you going to do?

Why can’t I average down more than 3 times?

The answer… LTCM.

I don’t care how smart you think you are. There was a company back in the 90’s that was ran by Nobel prize winning economists and Wall Street traders who thought they knew it all as well. They were called Long Term Capital Management and they ran that company into the ground in 3 months.

They lost billions of dollars because they would not shut off their averaging down strategy. They kept hanging on to it because they’ KNEW THEY WERE RIGHT’. They had to over-leverage their trades due to the tight spread they were trying to make money with as well, which is a bad bad bad thing to do.

Here is Their Story

What about Nick Leeson?

There also was once a guy named Nick who lost 1.4 Billion dollars and shut down the oldest bank in England, IN A SINGLE DAY, by not knowing when to cut off a losing trade.

Not knowing when to call it quits and get out of the market is the number one reason why accounts blow up. This is the cause of probably 99% of all failed traders out there.

If you employ this strategy properly, it can work just fine. You just need to know when to cut off a losing trade. We employ a small way to average down within the trading rules at TraderBot Marketplace and they work fine. From time to time, we have a big loser but we know these will happen in advance.

How to know if it is OK to average down…

- Do you have to be out of your trade by the end of the day? If yes, then don’t average down.

- Are you over leveraged? If yes then don’t average down.

- Have you been trading for less that a year? If yes, then don’t average down.

- Are you trading an ITM options or binary options contract? If yes, then don’t average down.

- Are you trading against the overall trend? If yes, then don’t average down.

- Are you trading a highly volatile asset that moves 40% in a day? If yes, then don't average down.

If in doubt, it is better to stay out of this trading method. Why do I talk about it if all I have to say are negatives?… Because if done properly, you can make a boat load of money with this method.

Happy Trading!