I don’t know what to to. Bills are coming in and I just can’t find enough work. I have to worry about buying food or keeping the lights on this month. I just don’t know what to do. If I could just something to make extra money, then everything would be ok.

The above caption is the absolute worst way to become a trader. It happens every day, however. Mom or Dad just can’t make ends meet but then they answer an advertisement online about trading and think they can fix all of their problems in a week. They unknowingly have false hope that all of their problems will be solved if they can just follow a trading signal.

Mr. Bill Payer

In 95% of circumstances, I would assume, this doesn’t work. I would assume, based upon pure speculation and backed by no research. that this is what happens in these types of circumstances… Mr. Bill Payer is so worried about his family that he can’t think straight. All he is focused on are his bills, his kids, and the desperation of life. His mental attitude sucks right now and he can not operate at his best. He is desperate.

When a person is desperate like this, how can they possibly be focused on learning to trade properly. They think they can learn this skill, which takes years to master, in a few days. They listen to all the fake hype in an attempt to better their family. They fail more often than not because they are unwilling to give the dedicated time to learn trading and want it NOW.

I am sorry but it’s not gonna work like this. You have to come into the world of trading just like you would any other profession such as a doctor or lawyer. You have to go to school…learn the basics… put those basics to work while learning more… practice… and so forth. Trading can not be mastered in a week or a month. Years of practice and dedication is what is needed, while you also have a proper mental attitude.

Fake Hype

Here is another reason why traders fail. They believe the fake hype. They think they can come into this arena with professionals and take their money. They actually believe that anyone can win in trading and that money is easy to make.

Look dear traders, do you actually think that you are going to easily pull money out of the pockets of very rich and extremely successful traders EASILY? I don’t think so. You have to understand what trading is first.

Trading is whats commonly called a zero sum game. This means that for every win, there has to be a loss. Every time YOU win… SOMEONE ELSE loses. Now think about it like this. You are up against the smartest guys on the planet. Banks have spent billions to keep you from winning. And you think it’s gonna be easy? You are fooled!

Trading is NOT easy. It can be simple but never easy.

It will NEVER be easy!

Sometimes you even think you are trading when you are not actually entering trades into the market. How absurd is it to think your broker wants you to win. They don’t. They know you have a huge disadvantage and they also know that you will keep coming back for more. Who is on the other side of your trade and can spike the market at the very last second?… Your sham broker.

Check your regulatory agency because not all brokers are real. Some are bucket shops. This means that your ‘orders’ or trades you place never go into the market. They go into the bucket… your brokers bucket and you will never win if you are trading with one of these bucket shops. Do your homework and keep a level head.

Watch Out!

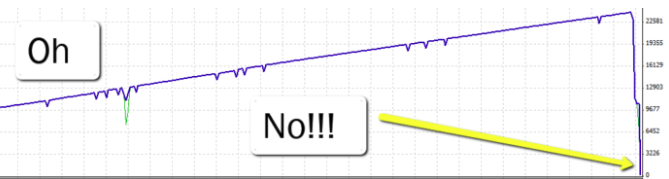

I showed this picture earlier in the course but look for a minute. In forex and futures trading, this is the one big account killer for experienced traders. This method of trading is called ‘averaging down’ or ‘dollar cost averaging’ and is the terrorist who has killed more trading accounts than anything.

Here is how you can kill your account:

- Place a long trade at 1.3000.

- If price drops to 1.2950, place more long positions.

- If price continues to drop to 1.2900, buy more.

- Continue to average your position as prices goes against you because it will eventually come back… right?

Take a look and you be the judge…

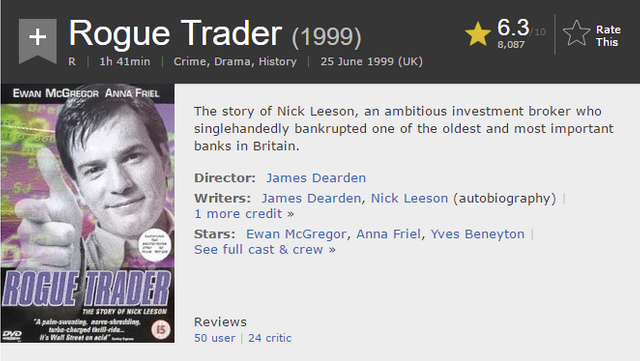

This method has it uses, if you know how to do it properly and limit your trades but done incorrectly will blow out your entire account in one day. If you want to get the inside scoop of a real person that lost a BILLION in just one day, watch the movie below. This is a true story and one of the most inspiring of what NOT to do.

http://www.imdb.com/title/tt0131566/

http://www.imdb.com/title/tt0131566/

If you Average Down, Be prepared:

- To lose it all

- To make a lot of money over an extended period of time, then lose it all

There is a way to martingale, average down or add to a losing position but you have to use strict discipline. We will cover that later.