«All breathe deeply and wait little bit more!»

Русскую версию смотрите здесь.

Unfortunately, we have to repeat the quote from the previous forecast.

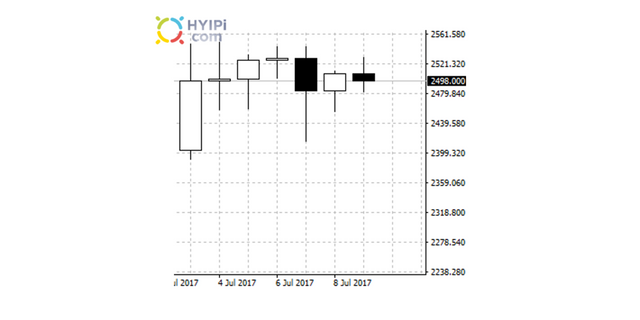

This week closes quite clear and as it was said in the forecast of 02.07.2017, the closing took place within 2'500 USD for one BTC.

Unfortunately, the expected rollback to 2'250 USD never happened. Instead, the price curve went sideways and after a rollback to the area of 2'500 USD all week long as it was left practically without movement.

In general, for a upward moving, in ideally, a pretty small falling would not hurt. For an example, look at the ETH USD chart, where the Ethereum receded by almost 50% from their peaks

However, the pair of BTC USD is not from a timid ten and it is not to give own positions so easy.

On the other hand, this indicates a fairly high potential of bulls and the presence of long money, and, the general lack of ideas on the market.

To be more precise, it's not even ideas, but an excuse. Bulls are clearly waiting for a reason for growth!

And I believe that next week will give them that!

Now, in London is starting London Fintech Week. This is a fairly large forum, where practically the whole week will discuss the future of IT-technology (check the review of the forum in the picture below)

Us for me on this forum the favorite two speakers, which will speak about the prospects of blocking and technologies related to it (if you find someone else, write in comments pls):

Brendan Blumer - CEO BLOCK.ONE (EOS) (speech from Monday to Wednesday)

Richard Crook - head of innovation engineering ROYAL BANK OF SCOTLAND (speech on Thursday)

These guys will talk for almost a week, so the next week can shoot any day and no fundamental analysis here will help.

As for the technic analyz, then on it everything is not so unambiguous. If to look week, it was closed by a white short candle after almost same short black candle, absorption certainly it can not be named, but it in any case, it is better, than doji or a black candle.

After such a candle, a window was opened for the bulls, which us we can see pretty weak also. Therefore, given the low trading volumes, I do not expect sharp movements.

As for our corridor, which was drawn on the last week,

Then yes, a conditional breakout took place, but it was not as clean as expected.

In the classics, a bullish signal recognizes the breaking of the wedge from the bottom to the up. We just walked it sideways, not showing the desire to make sudden movements.

However, now the market has driven itself into a very narrow corridor between 2'450 and 2'550 USD and I do not lose optimism about the upcoming week.

The reason for this is a whole bunch of levels of resistance, which they bears in their current state are not able to break through.

The first level is at 2'450 USD, which the market designated as the level of resistance for the last week.

The second level is at 2'400 USD, which forms from EMA 31 (the orange line on the chart)

The third level is the imposition of Fib 2015 and Fib 2017 at the level of 2'250 USD - very strong.

This breakdown is possible only in the case of some very apocalyptic moods.

Time to sum up:

- get patience and look forward to closing the day above 2'550 USD (This will be a strong bullish signal)

- In case of a fall, do not panic or sell. The bottom I see at 2'250 USD

- Movement up the market is limited by the current highs of 2'740 -2'890 USD. Above these levels within the week is unlikely to go.

Good luck and good profits for all!

Regards,

Mikhail Hyipov

If you liked the article, support the author, subscribe to @hyipov

Your support is very important to me!

Disclaimer: No information presented in this article is a guarantee of obtaining a certain return on investment as well as a guarantee of stability in the amount of possible costs associated with such investments. Materials should not be considered as informing about possible benefits. A certain profitability in the past is not a guarantee of profitability in the future. The responsibility for making an investment decision as well as the risks of losses each takes on itself.

* For the analysis, btc-e.com

** HYIPi.com is a registered domain name for my author's project. If you like my work, sign up and repost this article.

When the number of subscribers exceeds 1000, the project will be born:)

подписался))) на голосе такой же ник

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Many thanks :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @hyipov! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit