Bringing Order to the Chaotic World of Leveraged Trading

Margin Trading

Margin is to investing, as the Formula 1 is to the average mini-van. Leveraged trading is a high-octane marketplace with higher risk and higher reward plus a crippling penalty for failure. This topic is for intermediate level traders and should be undertaken with extreme care and risk management.

Please Note: This is the first in a two-part series entitled Art of Trading: Leveraged Trading. For more information and a deeper coverage of the technical and limitations of margin, please check back later.

What is Margin?

To properly understand the concept of margin (often referred to as leverage trading) we must first define our topic.

- Margin: The act of purchasing assets using borrowed money or securities.

When using margin, an investor uses a loan of either fiat money or the asset itself in order to increase the size of an order with the purpose of increasing the potential for profit. Normally, the borrowed money is used with a payment of interest to the lender. These can either be taken over time or as a lump sum, depending on your broker or exchange platform.

The concept of “leverage” comes from businesses who use debt to build their business and gain an advantage or “leverage” over the competition in the market. In the same way, an investor is able to utilize debt to gain an advantage over the market.

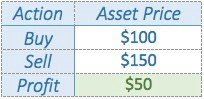

For a basic example, think of a traditional marketplace. Pay close attention as this does get a little tricky.

Let’s say you take five thousand dollars ($5,000) of your personal money and a loan from a bank for five thousand dollars ($5,000) at one percent (1%) interest.

With your ten thousand ($10,000) you buy five (5) motorbikes for two thousand dollars ($2,000) each a total of ten thousand dollars ($10,000).

Later you sold these motorbikes for three thousand dollars ($3,000) each, for a total of fifteen thousand dollars ($15,000). This gives you a gross profit of five thousand dollars ($5,000) total.

With the fifteen thousand dollars ($15,000) you can pay off the loan to the bank for five thousand ($5,000) as well as the interest payment of fifty dollars ($50) and your original capital of five thousand is returned to you and your total net profit is four thousand, nine hundred and fifty dollars ($4,950).

Why is this appealing? Well, if you had only used your personal five thousand dollars, your profit would have only been $2,500 at most. However, by leveraging debt from your local bank and paying them a small fee you are able to magnify your profit by an additional ninety-eight percent (98%).

This is the power of margin and leverage. By utilizing debt, you can increase buying power and increase the potential for profit. However, it also increases the potential for great loss. In our previous scenario, if you had not been able to sell the bikes you would have still owed the loan to the bank with 5 bikes in your hand and a new pile of debt.

How is Margin Used?

There are two different methods of using margin known as a “Long” and a “Short”.

Long: This method borrows fiat to buy and sell later at a higher price for profit.

Short: This method borrows assets to sell and buy back at a lower price for profit.

Longs are normally used to profit in uptrend movements in the market, while shorts are designed to be profitable in downward movements of the market.

In a long, the trader borrows fiat and buys into the market in the belief that the price will rise in the future. If the price rises and the trader sells, the trader walks away with the net profit of the trade.

In a short, the trader borrows the asset from the lender and sells it in the market for fiat in the belief that the price will fall. If the price falls and the trader buys back the assets, the leftover fiat minus fees is considered net profit for the investor

Trading Margin with Cryptos

When trading margin in cryptocurrencies, the common method of leveraged trading is via a multiplier. This multiplier can range from 2 to 200 times the order amount. In the previously given example, the loan would have amounted to a multiplier of 2x.

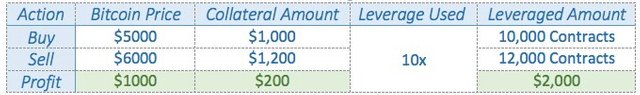

The way this works is fairly simple. Let’s say you wished to place an order for ten thousand dollars ($10,000) worth of bitcoin, however your wallet balance is only ten thousand dollars ($10,000). Instead of risking your whole wallet balance, you can elect to use only a thousand dollars ($1,000)

This thousand dollars ($1,000) acts as collateral against the margin you are about to use. You can select a multiplier of any range. For this scenario, we will assume a multiplier of ten (10x).

On the Bitmex.com exchange, the primary method of placing orders is through “contracts”. These contracts are essentially a contract of ownership for your right to the equivalent dollar amount of the underlying asset. The underlying asset in this scenario is bitcoin.

Using the Bitmex.com platform you place can an order for ten thousand contracts.

Long

In this scenario, by leveraging your one thousand dollars ($1,000) by a multiple of ten times (10x), instead of only buying 0.2 bitcoin and profiting by two hundred dollars ($200) you are able to buy two (2) bitcoin and profit by two thousand dollars ($2,000).

Short

In this scenario, by leveraging your twelve hundred dollars ($1,200) by a multiple of ten (10) times, instead of only selling 0.2 bitcoin and profiting by two hundred dollars ($200) you are able to sell two (2) bitcoin and profit by two thousand dollars ($2,000).

Remember: In a short, the leftover fiat from your opening sell and your closing buy is your profit.

Conclusion

From these examples you can see that, when used wisely, margin can be a valuable tool for trading. The ability to take increased positions, while maintaining only a small level of involvement allows a trader to dramatically increase

profit potential. However, this is merely a high overview of margin. For more information please check back soon for a follow up on the on the technical side

and margin’s limitations.

“Riches do not consist in the possession of treasures, but in the use made of them.“ — Napoleon Bonaparte

Jack Donaghy

If you are interested in signing up to trade margin, please utilize my referral link for a fee discount. https://www.bitmex.com/register/oW4uU7

Alternately, if this has been of assistance to you, please consider a tip. Thank you for your consideration.

BTC: 3BMEXBAxgLtMMzq89tDC3Gzi2MbwAjoEvQ

ETH: 0xa27eaa97713d776994cb3969c3ba8f8f5a1ff9d3

LTC: LYq7m98VQfxNQ2qMMKKWeaBW7WsCUH6NGm

Disclosure

The opinions and investment strategies of the author are their own and not to be construed as investment advice. With any type of investment, the potential exists to lose some, all, or more than your investment. The author makes no guarantees of gain or increased profit and cannot be held responsible for losses incurred.

Cross Posted at Medium.com.

Credit to Pexels.com and UnSplash.com for photos.