Trading is science deeply tied to psychology of one executing the trades, which makes anything that is performed or formed by human itself impacted by how processes are formed, often leading secondary variables impacting the process even more than trader realizes.

Best habits / rules of trader

In my several years of trading this has been trial and error process. Executing process, writting down positives and negatives of execution, revieving historical trades, and focusing especially on psychological variables that impact the trade, to exclude the noise of other variables that were present in trade. In each action that trader takes there are many factors having input on trade, and it takes years and very detailed reports/ researching /journaling to really get down to point where the errors are.

After one trades several years, its very interesting and yet logical to see that majority of successful and profitable traders actually share the same habits and rules as those were discovered trough similar process of journal or research process.

Here are the main habits that every trader should follow, no matter of experiance. A beginner trader that will follow those steps will by default have larger chance of success than one that does not follow them.

1.Discipline

Without discipline and following the rules that trader has found to work the best trough historical research of his/her system, it is IMPOSSIBLE to become profitable over long term without having DISCIPLINE, unless you are one of those very few lucky ones that just traded for short while in heavy bull market. If you want to stay in game for decade, strong shaped rules that work over long period of historical examples are needed. And most importantly, those rules have to be executed on every trade with iron discipline.

For me personally this was by far the hardest obstracle to pass, since discipline is one of weakest points in general not just in trading, which means i had to took it very seriously and adapt. For me that meant buying flat white board, place it right next to my monitor and write down with red bold letters all the rules i follow in strategy. And if that means hanging extra paper next to it with extended rules so be it, i dont mind damaging wall by tapping paper on it, its big picture that matters.

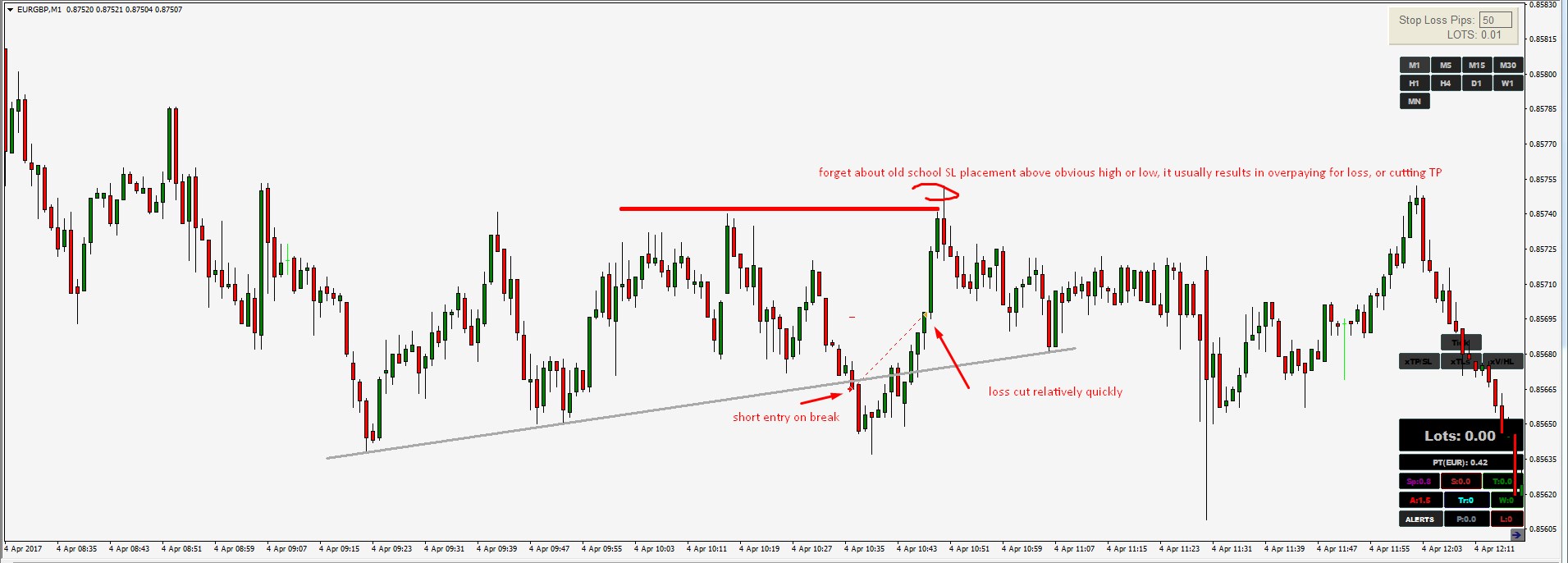

2.Cut the losses fast and aggressively

Dont let the loosing position keep running against you more and more, learn to cut the loss quickly, this will free up your capital to enter new play as soon as possible. Always remember, investing and trading is never about single play and being "100% sure" that this play will work out for you, one can never be sure, thus having ability to be in many plays is the key to success. In my statistical research over thousands and thousands of trades i placed over years is that every research comes with same conclusion: cutting loses quicker is what makes you more profitable. Sticking to one long loss for long time can wipe out easily 10 or 30 winners if one is stubborn.

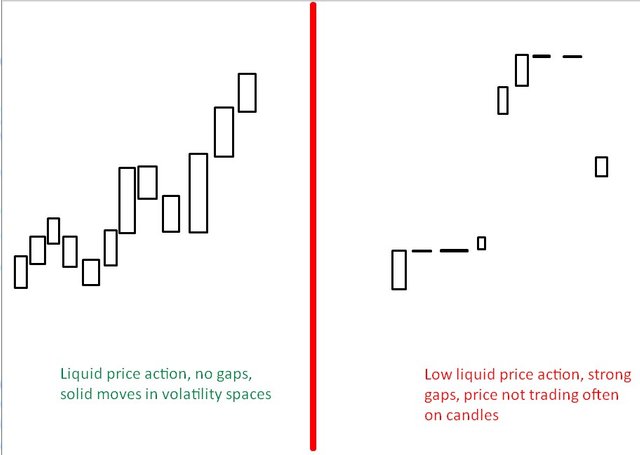

3.Trade liquid instruments, based on the time frame

Liquid instruments are simply identified by candle structures. If candles are opening and closing on the same price and having huge gaps into next candle that follows, and the volume per each candle traded is very low then that is simple pointer that you are looking at low liquid instrument, and low liquidity brings trouble, unless one is trading it on high time frame like H4.

Stick to liquid price action, clean structures with candles opening and closing withing proper structures.

4.Stick to trade in time that you perform the best

Often traders have specific few hours where they perform good, find that time from your journaling and stick to it.

5.Only trade clean symmetrical technical setups

Follow only symmetrical patterns, if you can connect highs or lows in clean line either flat or trendline without much gaps in btween of line and high/low then you have symmetry. Focous on those patterns, simply animals are made to focus first on clean obvious symmetry rather than asymmetry, meaning if something is heavily asymmetric its unlikely many will follow it, thus youll be trading structural point by yourself, which is not what trading is about. Trading is about following the key structural points that crowd and capital buildup is watching besides yourself.

6.Use objective technical information to base entry and exit on

Objective information is something that you cannot use very rough random value for entry, its quite precise and specific, this helps you to hold yourself accountable on entry and exit, if you dont use anything objective and only use random price, its very likely that you will not follow your own rules and break the discipline, very common thing in trades, make sure there is something very objective in terms of information on chart and the rules you have to follow and tie together.

Interesting, however, this seems to be from a technical analysis stand point. If you are a business investor, some of the tips should actually be avoided. For example, cut your losses, would in some cases actually cut your winnings. Also technical information is highly speculative, but in cryptocurrency it seems to work. My own insight is that it works because so many are using it, so it becomes some what of a efficient market instrument, if you believe in efficient markets, that is to say. I personally don't fully.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit