Utilising a Risk to Reward Ratio in Forex

How many of you obsess over an 80% profitability rate? You may feel the need to be right all the time and cannot accept a large amount of losing trades.

OR

You may think in order to become a profitable trader you need to win more than you lose.

Well it's time to put that aside.

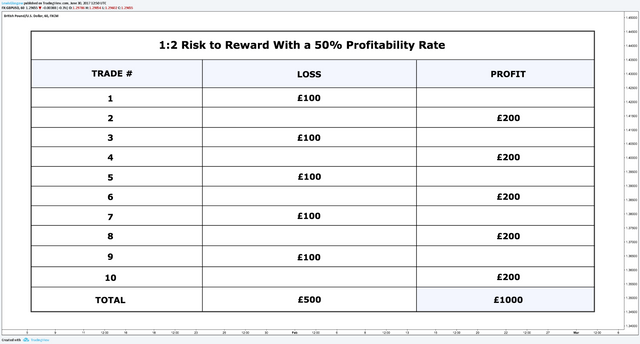

You do not need to have a high profit/loss ratio or profitability rate to become a profitable trader, you can be right just 50% of the time (as shown on the chart) and still make an excellent profit by utilising a strict risk to reward ratio when trading. You can actually have a profitability rate of 40% with a 1:2 risk to reward ratio and still be in profit!

The higher your risk to reward ratio the less you need to be right, many professionals use a minimum of 1:3 meaning they will risk 100 pips to make 300 pips.

I personally use a minimum risk to reward ratio of 1:2... But in order for you to do the same, it has to align with your trading strategy. Do not set unrealistic profit targets in which you will not achieve!

To round off this post I truly hope this explained the positive effects of applying a strict risk to reward ratio in your own trading.

Click here to view my original post on TradingView.

Don't forget to upvote, resteem and follow me for in-depth market analysis and investing education.

Thanks for the post, as usual great content!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're welcome! Thanks for the support, I hope you have a good weekend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post received a 0.8% upvote from @randowhale thanks to @lewisglasgow! For more information, click here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How about controling your risk before you enter your trade using option strategies?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post mainly applies to forex :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I prefer the 2:1 risk reward. But yeah you need to trade above 75%.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Everyone has a strategy that works best for them, may I ask why you prefer 2:1 risk to reward?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

well if you target is twice as close as your stop loss then basic probability is in your favour. you can then improve your profitability with 'runners'. happy to elaborate if that doesnt make sense.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So i guess its not really 2:1 .. its 2:1 on the first 66% of the trade. Once that target is met you can zero your stop loss and have 0:infinite on the remaining 33%..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Makes perfect sense! I use the same method with my positions, once target one has been achieved I'll move my stop loss into profit to bulletproof the trade.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks was looking forward to this! Just curious what is your view on btc now?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Want a boost? Click here to read more!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit