There used to be a time when trading was reserved for the select few with the resources and connections to access it.

Not anymore.

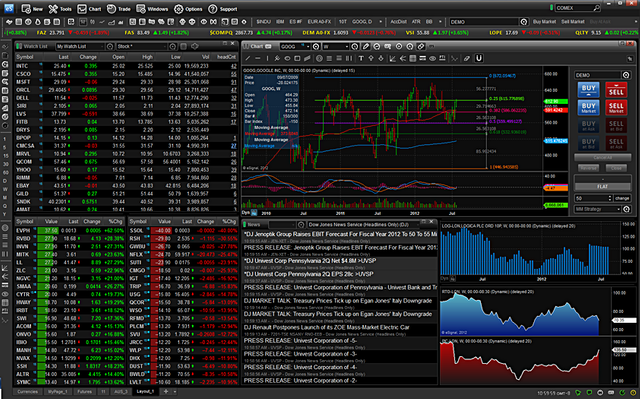

There are a lot of trading platforms out there, today, and each one with its own range of features, design functionality, and specific opportunities for users to make the best use of their capital investments.

Where many of them fall short, however, is in their users inability to learn from and improve on their mistakes while using them.

Join us, today, as we take a closer look at Spectre’s adaptive trading platform, and how it goes the extra mile to help you develop your trading prowess.

But let’s not waste any more time talking about it – it’s time to get down to brass tacks!

Change With The Times, With Spectre

Part of our two-pronged approach to doing trade platforms better is to offer users the opportunity to get better, themselves.

Our platform’s algorithm has been specially designed to learn from the work being done on it.

If traders make decisions that, in turn, make them money, the algorithm remembers what they did. Similarly, whenever a user does something “silly” and ends up paying more for it than they’d planned, the system’s ability to warn them against doing it again can prove to be invaluable.

Spectre actually offers a range of trader protection algorithms, for use in various situations.

Emotion control, for instance, has often proved to be the downfall of many traders. Part of Spectre’s design incorporates precautions against emotional trading, with a series of checks against spur-of-the-moment spending.

There are also built-in measures to aid in risk management and trade opportunity recognition. The trade industry has many inherent risks, and while most people understand that before getting involved, it helps to have someone looking out for you. With our targeted algorithms in your corner, you’ll know what the risk stats are on your next purchase or sale. Similarly, you’ll get updates and insights into trade opportunities, letting you in on potential profits, based on figures from previous and ongoing transactions.

But How Does It Work?

Taking a moment to get into the technicalities of these safety precautions, we’d like to address the question of how our trading platform safeguards against risky spending, bad trading, and the like.

Traders using the platform to open either long or short trades benefit from being monitored by our targeted, verifiable price feed. This live feed incorporates various audited financial sources into its algorithm, using these to compare your numbers to the best the industry has to offer.

Outcomes are determined when the trade expires, either way, with the 96% excess from a loss going straight into the Spectre liquidity pool. If they’re fortunate enough to make a win, instead, clients can expect a 75% ROI from that same liquidity pool.

With our tokenised balance sheet model, and the aforementioned liquidity pool serving to buffer the platform in times of good and bad investments, our projections map out a steady increase in trade sizes as the balance sheet inches towards sizes of between $30 and 50 million. All of which means a consistent and reliable trading platform with a longer shelf life for the people making use of it.

If You Have To Take Risks, Take Them Safely

With Spectre, the trade experience is our first priority.

With our robust liquidity pool, we’ve gone the extra mile to ensure that, not only can users rely on our platform for present and future trading, but they can count on increasingly better sales, as the platform grows.

Discover robust, tokenized trading, today, with Spectre.

@originalworks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The @OriginalWorks bot has determined this post by @lightningraven to be original material and upvoted(1.5%) it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit