Introduction

Let this new entry serve to socialize with all of you some ideas on how we can use Volume and price action evolution as an entry strategy in our trading operations.

Obviously, volume is a reflection of the buy/sell actions that are executed in a given market, therefore, it is intuitive that volume provides us with a very advantageous reading of market sentiment.

As I have already mentioned, volume indicates whether there is selling pressure or buying pressure, elements that help us to anticipate what the price will do.

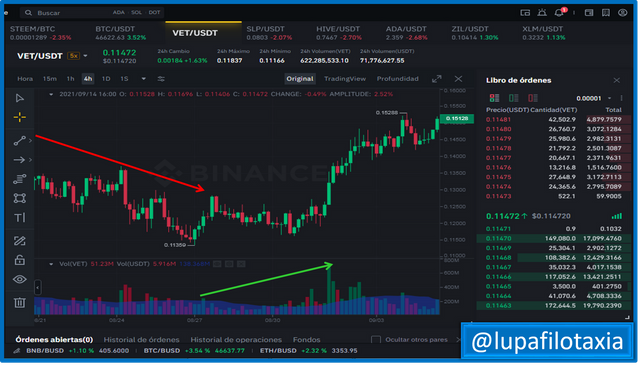

Falling prices in correction zone and increasing volume

When a certain asset or financial instrument is in an uptrend in certain areas, there are usually pullbacks, i.e. the price enters a correction zone.

Now, if in these pullbacks the direction of the volume follows the uptrend, it is a typical case of when the volume anticipates the price as it starts to draw larger columns before the price starts to take new impulses to the upside.

SOURCES CONSULTED

➊ Steven N Using Trading Volume to Understand Investment Activity. Link

OBSERVATION:

The cover image was designed by the author: @lupafilotaxia, incorporating image: Source: Binance