So I want to discuss the old videos that im linking to this blog, and why its important to stick to my safe method. Im really not sure how many of these older videos I will upload to my new YouTube channel, because much of the subject matter is trading PennyStocks and I dont want to confuse or distract my followers with more than one strategy..

A two month 1hr candle chart is all you really need in cryptos, and its the safest method.

What moves price part 1

What moves price part 2

Thanks for watching and I hope you find these videos helpful in making safe profitable trades,

Luc

Hey man, just came across your post here. And I want to say thanks!! You are one of the first people I ever watched on YouTube about trading. "Look for the arguments" haha

It helped me out a ton and I've since done fairly well at trading. Still a novice though, and the last couple weeks has been a bit harder. But I keep plugging away.

Always enjoyed your videos though. Super informative. Easy to understand. I didn't realize it was you until I scrolled down your post and was like, "I know that guy"

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome, Im my videos helped.. This is only the begining, as more and more people enter this market, and more and more big coins get developed, its going to get even better trading here.. I am planning to leave the stock market eventually and trade only coins.. Its a little to quiet still, but soon.

Anyway, thanks for the vote and comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, Just thought i'd share a few of my trades on VOX.

Happy Trading!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

WOW, that is perfect.. it looks almost identical to my chart and buys and sells.. Brilliant!! good job!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Why the first buys at that level? Is it following the base strategy? I can only see the last one logic, with the third one being maybe the bottom of the dip.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am very new to this, so im by no means do i know exactly what i was doing in the first few trades.(or even now, there is still so much to learn!) I started watching Luc a few months ago. Its taken a while to get the emotion out of trading, FOMO and just trade by the charts . I was just showing that I actually made some decent trades and made a little $. I think I got lucky on first two buys that the bounce was so big.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent trading there! Some solid news came out today about VOX on Twitter. I'm sure that was the driving force for the sudden increase of buys coming in. Congrats!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have a question about orders being executed. I have tried setting orders over night just to have the bars run through them and stay in the queue when I wake up. Then this morning I wanted to buy something for $20 but they wanted BTC so I popped over to make a trade and it doesn't execute.

How do I ensure that my orders will execute regardless of size? Is there any sizing that I should be looking at?

PS - Really like your videos and posts, I'm learning a lot about reading charts that I haven't had any luck with in the past.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have to get familiar with level 2 and time and sales data .. its the tab over from trade on your coinigy platform.. if your in the bid and the price passed your bid you will get executed.. They dont skip prices, especially not Kraken exchange.. I would just review when you entered your order and what prices past through the time and sales since you entered your order.. But i have never seen any of my orders ever get skiped

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've been wondering about something since I read one of your comments, are your bases at the end of the long wicks or the candles themselves? It seems that it's around the lowest point of the wicks, but you mentioned once that the order book on the coin can be thin, so the base isn't really at the bottom of a long wick. Or is it coin dependent?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yeah it depends on the situation.. sometimes a drop might sit there for 15mins and then bounce back up.. so on a one hour candle you cant tell that it was a thin book or an actual base that took 15-20 mins to bounce.. So you have to look deeper than 1hour candles if you want to make the call.. but if its a really long tail, then I would think you mark your base a little closer to the body.. if its a short tail than you can just mark the bottom..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a very insightful post, thanks for the awesome content! I have been around Steemit since May, 2016 and was looking for solid trade related content before I came across your account. I definitely think that looking at 1hr candles is a great strategy for beginner traders.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the support.. Although I do trade the stockmarket, I am working hard to make plenty of video resources here for everyone to see how to trade coins safe and very profitably. Eventually Coinigy or some other platform will get a coin market scanner.. When that day comes, I may move right out of stocks for good. A scanner would increase my trades in crypto by a big factor. At that point I will likely do a daily video recap, explaining all my daily trades or figure out a way to alert them as they happen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sorry for the noob question but what's a scanner? And why is it such a game changer?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

if you look at the top of Coinigy in Apps you will see that there is a market scanner in the works, they say coming soon. No human can keep an eye on every coin all at once, but a scanner can.. you can set up your scanner to watch for exactly what your looking for, across the whole market.. then when the conditions you inputed are met, it alerts you.. as an example, i would tell my scanner to watch for coins that trade a min of $5,000 a day, and that dipped below a 3 day low.. then everytime that happens on any coin I would get an alert and could see if its in a panic dive and if the chart is good.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ah wow that sounds pretty damn cool and def sounds like a way to take your trading to a whole new level.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, if we get a scanner then I will start a chatroom, so that I can alert everyone as my trades are happening.. because with a scanner I would just move from the stockmarket to this market and trade here fulltime .. A scanner would give me trades all day long.. so everyone should request that scanner from Coinigy so they get working on it..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Luc, I know this is totally off this subject, but there is so much talk about the SegWit softfork. People are suggesting to pull your Bitcoin and wait for the smoke to clear. Any thoughts? Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have no idea whats gonna happen.. I cannot see them Hardforking bitcoin.. but as a precaution I will pull all btc off the exchanges and have it all safely in cold wallets.. so that if there was a fork I would get double coins.. as far as a soft fork, some exchanges might freeze trading for a few hours.. no biggie

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Luc, does this comment you made have any bearing on "Investment" coins that you're long on, that are tied to BTC? I have a descent investment portfolio - all tied to BTC and the talk of the fork concerns me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nope, im not going to liquidate anything.,. only going to hold my actual bitcoin off the exchanges for a few days around August 1st.. then put btc back on the exhanges afterwards.. You can make a case that everything is tied to BTC, if it dives the whole market dives... so there isnt really any point to mess around with all the coins prior to the forking... I just want to have double coins in the rare chance that they hard fork and some exchanges might only support one chain and since they hold your private keys your stuck with the chain they support..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My account should be funded and running on Kraken well before Aug 1st, as a new trader should I wait till after Aug 1st to start trading? Not sure what hard or soft forking even means, and if Bitcoin does take a dive the whole market will go with it for a while right?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really cannot imagine a hard fork.. while I will take precautions, I dont think it will happen.. and as long as its just the soft fork, everything will probably go up, because the fear in the market will be over.. everyone is just worried about this forking.. many traders will likely move there money off exchanges or into other coins.. its really hard to know whats the best plan.. but yeah after august 1st things could get really good

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sitting out is a good call if you are not familiar with the technical background. On the 1st of August there will be some nodes on the main net which will change their protocol, the general test the proposing team did a couple of days ago was a complete mess (the test net split in 2 chains). If you think this can happen, then for sure it's better to sit it out. As an example you can look into the origin of ETH/ETC, much of the reasoning that were done back then can be applied also now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So, where is a good place to park your BTC? I don't have a cold storage device.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi epic posting as always :) I can see you bought eth/usdt at 196 or something and the little base is about 5-6% higher 205 or something. Do you trade eth with 5-6% cracks or does it have something to do with recent gapup and coming back to support. Do you plan to sell most that crack at 205? I would like to trade eth more efficiently so I am asking. Do you trade other than eth with usdt? I would like to learn little but your stucture also. You said you have large usdt bankroll waiting for big crack. How much of you usdt bankroll you trade with that 5% crack and how many % at 10 % crack. Just estimation so I am not way off. How many % you always have just in case for super panic sells like eth at 120. Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah i can see that those green arrows are deceptive.. That 196 buy was just a nibble.. where as I would normally trade 10 ETH or more here an there per entry, and alot more if it panic dives below 170.. I satisfy my need to buy some under 200 by buying nibbles here and there of just 1 or 2 ETH at a time.. but yeah it messes up my charts.. but I have a hard time resisting buying some of every pullback.. Its because ive been a daytrader for so long, i get impulsive on those pullbacks, so i play with it, but it does not help keep a clean chart..

Sorry I wish i could erase insignificant buys and only keep the serious ones.. But it was a slow day, and i was getting impatient..

Right now i have atleast 40% of my capital free in USDT for a panic dive.... and there is no formula for layering.. i just play it by ear,, if it drops fast, i get in heavy fast.. if it takes hours to panic lower, then i get in little bits every few hours..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A question about those very sharp wicks and alerts. I set an alert for EOS/USD on Kraken for 1.55280, however there was a real sharp dive today and you can see the wick go all way down to hit the low of 1.5200000. So it cracked slightly lower than my alert for a brief period in time, however my alert never went off?!?

Do alerts go off if the price only drops below them for such a short amount of time? And if I had an actual buy order down there would the buy have been executed? Kinda weird.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I see some cracked bases in that EOS chart earlier in July that have still not bounced back to support. I feel like this chart is one to stay away from for the time being. Even though the most recent base bounced.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think your volume might be off or you messed up the alert somehow.. because they always work for me, everytime.. I havnt seen one not work, ever... very strange that yours didnt go off.. maybe set some up close, so you can witness them working..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Every other one has always worked for me too, that's why its odd that this one didn't, going to keep a close eye going forward.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it does happen... even if your odds of success are 95%, then 5% will give you trouble.. but its not over.. it may still bounce.. just dont add to the loser

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Definitely agreed with this on several points, but in the end. Time Frame analysis is key. You look at the bigger time frames and work your way down, looking for them to be congruent in trend/move.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's right the higher time frames usually reflect the real market bias and most of what is seen in lower time frames are market noise, wish newbies can make sense of that!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi luc !, thanks for the videos I am a beginner and I have a doubt: in the following chart, I draw two bases in blue, and then another in yellow.

According to I understand the ideal would be to buy in the blue circle but that time has passed, but which of the two options would be the best?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The most important part of that chart is that the price didnt bounce back to the previous base, on the earlier bases.. so that means there is extreme weakness showing on that chart, and so I wouldn't trade it. I would find another chart thats safer.. unless you really really want to own AMP and you dont care if it falls further.. .. but please watch my previous video on Support and Resistance to get a clear picture of where to draw your safety circles..

Btw.. I am stuck in AMP now because of those crappy no bounce bases.. But I wont sell ofcourse until i get my bounce.. but I also wont buy it either, now that the chart has gone bad..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

IM right there with you Luc, I made several buys on the downward trend and didn't bounce. I think I should have sold on the 93 bounce and would have broke even.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

disappointing, but it may still bounce.. atleast im not going to throw more money at it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey Luc! Once again thank you for spending so much of your time to share what you know and answering so many questions, everyone really appreciates it!

Quick question. What do you suggest we do on slow days like today? Should we double check that the alerts we have set are still relevant after the last couple of days?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yup.. i look over all my charts first thing in the morning and make sure that I have alerts set on all of them... For me even a slow day is quite busy, because of the stock market.. I just have so many things to trade.. but there were still a few highlights today in crypto land.. Vox got closed for a nice profit..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Luc for the reminder to keep it simple with the 1-hour charts. I find myself trying to over analyze the 5 minute and end up wasting a lot of my time that I should be working.

ETH/BTC looks to be setting up for a nice bounce around .08?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

sorry i dont play bounces off support.. i wait for a crack of support and then the panic dive.. thats my play

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the reply. Ok, Im getting a better understanding of how you play your strategy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Luc, going to rephrase that question. So if ETH/BTC cracks the big base around .08 then you would be ok to start layering buy orders into the panic sale? Would you consider the drawings of the two small bases on the right at .0836 and .0867 actual bases or are they too small?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I define bases by the bounce they get off of them.. if there is no decent bounce then they are not bases.. so the last two on the right are too small in my opinion.. and you need to have your chart streched out to include 1to 2 months of data to make it easier to recognize bases.. but yeah if it cracks the .08 and then you see a good panic happenin.. (a bunch of red bars) then you should be good to start buying.. just set your alarms and let Coinigy do the work for you..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Luc, your the man! I am dialing in what to consider a base or not. Thanks for pointing out that we need to look 1-2 months out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I fully understand the level of bounce to identify a base. What I'm having a little problem with, and it's almost making me paralyzed, is entry point if you miss the panic. In this chart, I've clearly missed the panic, and the nice bounce and now it's fluttering. Do you just stay away from this coin currently, because the drama to the story has already happened, and we're currently sitting through the setup for the next wave of drama - either way?

I find myself always going back to charts that seem to have produced a big panic dive and that haven't recovered from it. In short, this appears to be a "Not Today" chart - correct?

https://www.coinigy.com/s/i/5968bd306a75c/

Lastly, being that it's Friday - Do you ever stay in Crypto 'day trades' over the weekend? I know that's a NO-NO in the stock market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, i only buy the panic dives while they are happening.. Thats the safest set of conditions to enter.. after the bounce is done, why should bounce again? the reaction is over.. The reason a panic gets a bounce is price dicovery.. A base got cracked and as a reaction a group of novice traders paniced out of there position, usually due to stop losses getting hit and then leading to more panic as the price drops.. then when any big buyers step in and stop the drop, it bounces back to where the crack happened or even higher.. the panic is almost always novice players, and thats the best place to get coins, from inexperienced traders.... but if it bounces and then settles at a new price, then there is no telling where it will go next.. the odds are not stacked in your favor, like before when you were buying from panic sellers..

Oh and about the weekend thing, it doesnt apply to this market.. because its 24/7 .. everyday is the same for me..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you sir. You say it, and i hit my forehead with my palm - cuz it's so obvious. BUT - how do you uncover the panics in time? I find myself looking at chart after chart and trying to predict the future. I would be very grateful if you could answer this 1 question in detail please. When i get to my computer at 5am, what is my first step (and possibly several steps) to uncover a good dive about to happen? - OR - is there something i should do from the day before, such as identifying coins that rose abnormally high the previous day?

I am close to being able to trade daily. However, im the type of person, that unless i fully understand the strategy, I find it hard to apply the principles. I feel like a blind squirrel that stumbled upon a nut when i think i 'might' see a dive coming - then question my entire process. Sorry for the incredible lack of confidence post. The simple truth, is I'm a family man, and take that responsibility very seriously. I know there'll be mistakes made along the way, and that's ok, I just want to know that each mistake will lead me closer to more knowledge to the entire process. Thanks Again..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Here is my process:

I have a list of favorites, coins that I like the chart and some that I like the project that the coin represents.. (we dont have a merket scanner yet, so I cannot monitor the entire market, but I, just today, again requested that Coinigy work on the market scanner)

Ok so every morning I pull up my Coinigy platform and I go over all the alerts from the night before and make sure I place sell orders on anything I bought while I was sleeping.. Then I go through every chart in my favorites and set alerts or nibble buy orders, anywhere below a base that might get cracked.. then I go to trading my stockmarket, but i listen for any alert going off throughout the day.. after 430 pm when the stockmarket is closed, i raise the volume on my computer, so I can hear any alerts or orders that get triggered throughout the evening.. and thats basically it.. I let the market come to me. I only take trades that are in safe circles (below clear bases) easy peasy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Loving these older videos Luc....there's a lot to learn from them!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing! I am not a trader, but the latest days I could have done so much money with something simple as: "short everything" that I'd like to understand how it works (: What is the crypto you would suggest to start trading with? BTC?

Anyways, followed and upvoted! Crypto ON!!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

BTC is probably where everyone starts.. it was for me.. pls take some time to watch my videos so you can see how simple it is to trade.. Its also very addictive to watch your accounts grow

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great content once again Luc, thank you very much!

I have a question (actually quite a few questions but I'll save the rest for another time). Are there any pointers as to which coins we should avoid trading? I there a minimum market cap we should be looking for when trading, or min/max available supply?

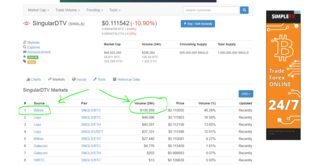

For example I am looking at SNGLS/ETH on Bittrex today, and I am concerned the trading volume won't be high enough to assure a high probability of getting 15% ROI or better if I start buying around 0.00053047 and lower.

Any guidance would be appreciated!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am totally a trader.. I cannot offer investing advice, because I spend all my time on the charts, not figuring out the fundamentals.. I am a firm believer that everything you need to make money, is right there on the chart.. Everything else is tea leaves.. Just consider the ICO craze, that people are buying up ICO coins way way before they even know how many there will be, or what they will be priced for .. well, buying coins already on an exchange, but basing your buys on the market cap and relative price is also tea leaves (speculation, fortune telling,and so on) Almost every coin, has such a huge supply that it could have a big sudden dump of selling pressure if sentiment changed for any reason..

Thats why I promote a method where you invest by safe trading.. and then investing your profits in the individual coins as you go.. then you are not bothered by the ups and downs, you can invest in any coin you are interested in for FREE.. it is possible...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Perhaps I miscommunicated my question. I am also a trader, not an investor. There are a few juicy trade opportunities I plan to take which might yield a significant ROI upon the bounce. The chart is ripe for the trade, but I'm concerned there may not be enough volume to make the trade worthwhile. Are there any key indicators you look for prior to your initial purchase to make sure there will be a buyer when your ready to sell? Lets use SNGLS/ETH on Bittrex for this example, I'm concerned there will not be a buyer when I sell after the bounce. Thnx in advance Luc!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh, ok.. I think I know what your asking about.. I always watch time and sales to see if the order Im placing might seem too big and stick out.. You always want to blend.. but another way to decide would be to visit Cryptocurency Market Capitalizations: https://coinmarketcap.com/assets/singulardtv/#markets

Here you can see the 24hour volume and then you will know how much buying and selling there is in compairison to what your planning to spend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, thats exactly what I was looking for!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Many thanks for taking the time to upload and share your old videos again, Luc!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice thanks again!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey Luc! In regards to the Baby coins, I am not 100% sure I know how to do this, I am a complete new trader so even after watching the first video and the last one where you touched the subject of low volume coins I am still lacking a bit of confidence. I wanted to show you my strategy for this coin, let me know if I got the correct idea. Thanks!!!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There are no comissions to worrie about so layer.. put a small order at your bottom line and then bigger and bigger orders below it.. and every so often you will get a spike down for 2 seconds and get instant profit.. but if you dont get a spike, well atleast youll pick a little up at your line and sell at your top line.. oh and layer out also incase you get a top spike..

BTW i just looked at this exact chart on my charting and i see some drop spikes to .0001 several times.. so make sure you layer a little orders down there.. and you will get 3 to 5 times your money when they happen

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great! I will do the layering , thanks a lot!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Also wanted to ask you, if the chart looks like the the one below (Wings), does it mean that it does not have good enough volume, should I avoid these or are they good? What are your thoughts on it? Thanks!!!

bb code image

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you again for this interesting set of trades. What sort of thing is happening with this coin? It's Avatar coin on Yobit. (AV)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

its just a thin market..there are almost no players yet, so the bid and ask spread are crazy wide apart..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ahhhhh, this is a really good tidbit of knowledge. I need to start looking at the spread to help determine the vitality of the market. Great tip! I hope you spend some time discussing the Data tab in Coinigy in an upcoming video - I'm kinda lost looking at market depth and price trends.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Luc: whats your thoughts about this ANT/ETH chart on Bittrex? The base is very linear with the exception of one blip, I assume this is a good thing - am I right? Do I just need to adjust my buys to snap up ANT when it hits the base, and not worry about layering my trades in?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

With ANT/ETH, you are trading a thin low volume coin pair, so the strategy is not the same.. here look at the same chart but ANT/BTC

its a perfect chart.. But ANT/ETH is not as supported so you have to trade very small and expect a sudden drop at anytime.. So yeah, I would buy at your line and have some lower orders way below incase of a spike down.. but another thing to consider is your %of profit availible vrs the risk.. .009 to .0095ish is not much profit.. for the huge downside possible.. not the best pick for a low colume coin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In one of your earliest posts, you said that you turned $300 to $50,000. Assuming you didn't even trade and just sat in BTC, you'd have at least doubled that and would be sitting on at least $100,000 worth of BTC.

Do you have trouble trading such a huge amount? Like do you encounter liquidity problems? Or do you just trade tiny amounts?

I'd assume for the larger trades, you'd be in large markets like BTC/USD(T) and ETH/USD(T), but even if you trade like 1/4 of your portfolio (is that too much?) on probably a really sure trade (e.g. a really beautiful dip, from cracking a base that had a gigantic bounce), you'd still encounter tons of slippage while trying to enter/exit your trades.

Also, with such a large amount, do you sit in mostly BTC or USD(T)? I'm just thinking since you'd probably find greater liquidity in BTC/USD(T) and ETH/USD(T), you'd have a huge portion in USD(T), just waiting for those cracked bases so you can always be prepared to buy them up. But then, you'd miss moves like when BTC went from $1200 to $2500 in April/May.

Or do you just keep everything as BTC? After all, it just started out as "free money" from your $300, so you could probably consider those as "free coins". Although when BTC just recently dived from $2500+ to $2200, that would be lots of "paper losses". And it didn't even bounce back up to base yet, it just bounced to $2300 and went sideways (trailing downwards?) from there.... what would you do in those situations?

Would you have been sitting in BTC ignoring the volatility and just trading altcoins, or would you have been sitting in USDT buying that dip?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There really isnt any right or wrong way to build your wealth.. Aslong as it keeps going up your doing good.. I made plenty of mistakes, where I would have made much more if I could fortell the future.. At one point I had so much ETH, and I sold most of it at $18 and though i won the lotery.. well all that ETH would be worth over half a million today.. I also sold a whole bunch of BTC at $1,600 and watched it climb to $2,400 without me.. luckily there was a dip in may so i got it all back before it went higher .. but those are examples of my not being able to hold because I am a trader and love to take profits.. Also i cannot predict the future past the next bounce..

So while I am an awesome trader, I suck pretty bad at investing.. thats why my strategy is to just hold a little of everything that interests me... I do what im good at and trade, then I always keep some for the long term..

As far as my portfolio of coins go.. Im not comfortable anouncing my holdings.. But I will always be happy to share my trading knowledge..

Oh, and about your question of sizing your trades.. I think someone can easily trade 300-500 ETH without any trouble, on most large exchanges.. and thats 60,000 to 100,000 .. so I dont think scaling is much of a problem.. I dont even trade near to that size in ETH

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In your defense about selling those ethers... there was the DAO last year and some pretty significant panic!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yeah, I made some awesome trades off the DAO thing .. but yeah, I never imagined it would run so hard so fast.. everyday something makes me shake my head

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very new to the cyptoworld and haven't begun trading yet. But thank you for the videos. I looked for you on Youtube so I could marathon-watch your videos on my phone and hopefully, pick up your streetsmarts on trading.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

sweet.. glad to have you on board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi everyone,

I'm about to purchase my first crypto coins and registered at coinbase.com. Now, if I do that, how do I link my ETH Wallet to coinigy?

I really don't know what to do....

Thanks for the advise in advance

Ben

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coinigy is just a trading platform.. You send your BTC to the exchange you like.. Example: Poloniex or Bittrex .. then you can trade on that exchange using the Poloniex website, or you can set up a personal A.P.I. and enter that into Coinigy, and from then on Coinigy and Poloniex are linked.. So think of Coinigy as your remote control for your account at Poloniex (or which ever exchange you choose)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the quick reply! Very much appreciated.

I do understand the concept of coinigy but what I don't quite get is, where to make the very first purchase of a coin (BTC or ETH) and then move it to.... and start trading.

Is Coinbase a good start or should I just purchase some place else?

(I have been watching your videos for almost 2 weeks straight and absolutely believe in your method, thats why I really want to get started)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I haven't made a trade yet and have had that same question. What I am doing right now is getting set up at Kraken because I can deposit USD there and then start trading off other coins. My plan from there is to then take the profit coins and then transfer them to other exchanges like Bittrex that don't take deposits of USD. You could I imagine do it the way you are saying but for me I don't own a single crypto coin yet so I need to deposit some USD and then go from there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its best to consider Coinbase an institutional bank rather than an exchange. Your pricing for USD to BTC, ETH, or LTC is pre-determined at a fixed rate that is periodically updated.

Rather than use Coinbase, you will get a better rate if instead you convert USD to BTC via GDAX (the sister exchange to Coinbase) or Kracken if you are a US citizen. In addition these three exchanges can be used within Coinigy.

PS: Coinbase does not have API integration with Coinigy. This is likely because Coinbase does not offer an exchange market, but it's sister site GDAX does.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Look into setting up the API connection from coinbase by generating a key and secret. Then go plug those into the coinigy accounts tab. I'm unsure if coinbase allows trading from coinigy like the other exchanges.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When I check the API from Coinigy, Coinbase is not included in the list. I guess that means that I should not buy my first coins on coinbase.

@Luc Which one would you recommend? Kraken?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So you just need a wallet.

If you have a wallet, you can store your coins there.

There are HOT wallets and COLD wallets. Wallets are where you keep your coins. Once in your wallet/wallets, you can send money from that wallet-address to anyone.

The cold wallets are more secure, as it is a PHYSICAL flash drive that holds your coins(it will have to be mailed to you), and can be disconnected from your PC.

The hot wallets, are online. The way it would typically work, is that when you need to transfer coins TO the exchange, you would take some coins from your COLD Wallet, transfer to your HOT Wallet, which you would then transfer to the exchange. Exchanges and HOT wallets can of course be hacked which has happened in the past. So typically, youd have the bulk of your money in your COLD Wallet offline, until you wanted to deploy it that is.

Obviously you can decide how you want to manage your coins, and where you want to keep them at any given time.

A simple idea, is that you trade small to start, and keep your coins in a free Hot Wallet. And get a COLD wallet by the time you've gotten good with trading, and ready to make larger bets.

The above paragraph is my plan as I'm in the process of setting up accounts and buying coins, and learning to trade. So any small money I start trading with I'm not too worried about. I'm trying to decide between trading with Bitfinex or Bittrex?

Your question about buying from CoinBase... You can buy from coinbase, you just would then transfer those coins you purchase INTO your Hot Wallet. Once in your HOT wallet, you can transfer to the exchange of your choice and trade.

The below is the advice I got from a Good Friend of mine, so I'll share it here.

Good Cold Wallet: https://www.ledgerwallet.com/products/1-ledger-nano

Hot Wallet: https://jaxx.io/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You can buy coins on coinbase then you need to transfer to an exchange like kraken or bittrix, from there you link the API of the exchange to Coinigy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am using coinigy + bittrex and work perfect!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If your in the US then as far as I know coinbase is the best place to purchase your coins. It's not the best place for trading as it has limited coins that you could trade. Id recommend accounts with the exchanges Bittrex, Poloniex, Kraken and maybe HitBTC (for small trade coins). Or just pick one to keep it simple. Then send your coins from coinbase over to your exchange account. Then set up the API connections on coinigy with your exchanges.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

right now I'm using coinbase to transfer fiat money to crypto and then transferring it out of coinbase to an exchange with more coins available for trading. The issue with coinbase is their fees are pretty high so I only buy in bulk when theres a huge drop . Doing that until I get tier 3 on kraken and can start depositing money straight from my bank without all the fees.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey Luc ,

I'm really a big fan of you and ur videos , you've helped me a lot .

I have a few questions ,

1st I'm really also interested in Penny stocks trading, in your freetime ,will you consider making few videos for us newbies also in the pennystocks?

the second question/fear , your strategy is the best and I believe in it , but are there any worries if everyone took your advice and started doing the same as ur strategies, that we'll make less money or they'll stop working ?

I suggest you making a video club or something with payments ( i personally do not mind paying a monthly fee to your videos )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

here are my thoughts.. (1) theres soo much opportunity in cryptos right now, i would like to keep this blog about trading cryptos (2) I have trained many people to trade pennystocks over the years, an have never found one to end up successful.. its very very dangerous in pennystocks, and I dont know anyone who makes a living at it, except me.. (3) one of the major issues with pennystocks is the commissions.. I easily spend $10,000 a year in comissions.. some days I give back $250 in commissions per day, when im busy.. So not only do you have to make sound decisions/good trades and never make a mistake that might cost you thousands, you also have to overcome these hefty commissions.. It's very hard for the new trader to do what I do..

But here in cryptos the commissions are soo small that you can trade anything any size.. and the trades are soo easy that almost everyone works.. and the percentages are awesome.. I get double money trades almost every week..

So I really dont want to promote penny stock trading here, because I would be leading others to a market that I have never been able to teach anyone to trade in.. And it frustrates me to watch my friends lose money, because I cannot press the buttons for them..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Luc, just checking with you if I caught the panic drop right?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sorry no.. you need to zoom out to see more data to decide on your bases.. a base is defined by the bounce it had off of it.. so I will draw some x x x to show you the bounces that are missing, to define your bases.. notice my arrows show you too locations that look the same and dont create a bounce.. .. now i will draw in yellow the real bases and the safe circles to buy in..

hope this helps.. pls dont forget to zoom out and look at a 1 to 2 month picture of the stock to see the bases easier..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Assuming the rest of the chart looks good, going back 1-2 months. Would you say this chart is a buying chart, or are you waiting for that further base to break, which would be the second base?

https://prnt.sc/fvqf9f

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

that base seems to weak.. especially since its been consolidating there for a while.. Btw the rest of the chart is not nice.. you have to look at a bigger picture..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much ~

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi there Luc,

First of all I'm new here and I would like to thank you for sharing so much valuable information about trading cryptocurrencies. Especially for new traders like me.

Just a quick question if I may:

I was wondering on what point are you trading your bitcoins/altcoins back to dollars? Is it on a daily basis, weekly, or? Because every altcoin is connected to the value of the bitcoin, or ethereum, whats the best moment to take your profit into dollars? The next day your profit could be vanished because of a dump of the bitcoin value, right?

I hope my question makes sense, and would love to hear about your methods! Thanks mate!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I always hold ETH and BTC as base currencies because most other coins pair off them.. And I dont ever trade back to dollars, but I do use the tether coin (USDT) which mirrors the US dollar ..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmm okay! But what's the purpose of trading coins and not trading back to dollars? Is it a long term plan?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I trade into coins because they can be moved around fast from one exchange to another.. I often do arbitrage, because the market is so new that there can be a big difference from one exchange to the next.. If your money was in regular old USD, you cannot move it in minutes to another exhange.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

IIRC, Luc said in one of his videos he's never taken a withdrawal from his crypto exchange accounts. So he's not using this stuff to pay the bills. Presumably that comes from his stock market trades.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yup, this is true.. I havnt sent anything back to me yet.. Im a true investor, I bought $300 worth of BTC in 2015, its all up up up since..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Or are you always changing your ETH and BTC to USDT each day? So you can secure the value of your coins before bitcoins' value will drop?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

no.. im not trying to make currency trades over my regular trades.. If you believe in ETH and BTC longterm, then there is no harm to just hold a little of each to trade other coins with.. .. and then if you want to trade ETH/USDT or BTC/USDT then set aside some money for those trades.. but i dont want to over complicate it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Luc! I just want to say THANK YOU! I now understand that I have been "playing" in trading for the past 2 months, I was too emotional, panic owned me a lot, i lost a lot. I have improved so much since I start watching your videos, how to draw bases, safe zone, study the chart, analyze history, watching for volumen, and so many other things that I have learned with you. Now I see my balance growing everyday, I have some bad trades, of course, but it generally a good day. So again, THANK YOU SO MUCH!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your welcome.. Thanks for letting me know that you have gotten some good training from my videos.. I love to hear traders who are trading like me.. feel free to post some trades here now and again, id like to see those bases your drawing..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Luc, do you think it is possible to take advantage of these peaks?.

https://www.coinigy.com/s/i/596a8b0f8dd2b/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yup for sure.. just with small money.. maybe 2,000 coins on a trade = $300ish.. you cant get in too much higher than that.. but is a good small account builder

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Something curious, there are exactly 5 days between each rise in price, today is the fifth day ...

Https://www.coinigy.com/s/i/596aa974480c7/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, that is an interesting chart. very good percentages on those spikes.. I would say this chart qualifies as a small account builder..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha, I noticed that too. Will be watching to see what happens the next couple days...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've been working off a few low volume ETH paired trades similar in volume to PDC/BTC. I'v come to realize that the time frame required to execute these trades may be longer than I am comfortable with due to low volume. But the tradeoff is rather large increases - provided that I'm willing to sit and wait for the market. On the bright side its really easy to see where the right spot will be for a positive trade because there are so few trades occurring in the data list.

@Gustavo-ar was right about the 5 day period, looks like a pump and dump group has been active every week until yesterday - then it suddenly stopped. Interesting... also interesting to note that the volume has decreased to 1.72 BTC - is this a potential trap?

https://www.coinigy.com/s/i/596ce46db3c00/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi,

Could you make a video or release old one where you focus that first pullback like in video 1 where you go trough stock market chart. I can see those crazy moves in crypto world almost every day. There is that first big bounce eevery time and I see an opportunity there to profit. I would like to learn more of that. Is there any material you know which would teach this or do you see that too hard to implement alltogether. Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey man, first off, thanks a whole bunch for sharing your experience and techniques with us. I've started looking at these charts in a completely different way now, all credit to you. I'm still in the midst of reading charts and figuring things out, but I'd like to think I'm getting a very slight hang of it now. Lots of chart reading to do still though. Would you have any suggestions for charts/coins to check out? (I only have around 0.35 BTC to start with)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

oh man, thats exciting :) I sometimes wish I could start over and grow a large account from a small one.. Really you should just keep track of the coins I disscuss in my blog, the ones I am trading are a great start. But most coins will work, this market is very easy on traders..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Perfect, noted. Yeah, I am beginning to see what you mean when you say that Ethereum is THE safest chart here to trade on. So it's better that I get the hang of things there. Thanks a bunch again man.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Still absorbing the amount of information in all of these videos and getting the strategy down. Quick Question:

When the coin is in say a downward swing and the base is set, you have your safe zone and you execute the trade. The trick here I see is to watch the bounce very closely right after your trade has been executed. Many times I see a pattern of solid identical bases trending downward, you set your buy when there is an indication of volume coming in as well on the buy back and you move with it. Makes sense. But, lets say the base has a tiny bounce up and then reverses on you? Meaning you had to be watching that bounce for at least a few minutes to make sure it does not and continues up.

With that you really need to watch after every buy, for at least the first couple of minutes to make sure it does not go the wrong way while you wait. If you walk away and hope based on prior movement from the past hour or more you could set yourself up for a reverse movement that goes against you.

I suppose you could set (2) alerts after every trade. One for any movement below your price trade, one for how high its going. To me that would make sense on safely monitoring the directions.

Does that make sense? I am still new but hopefully starting to grab the idea here. Thanks guys!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

if you are buying in the safe circle you are expecting a bounce atleast to the prior base and maybe even past it.. but yeah, I always take a gift (if a few minutes after my entry there is a quick bounce and Im in solid profit, I will take profit) Those quick bounces are gifts..

However I prefer it when after my first buy there is still more panic and I get to buy again, more, lower.. Because I like to have big positions when its possible.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, makes sense. There are some trades like BCC that after the big bounce and the downward trend the coin just kept going down past the last bounce and kept going. That coin got bad news that day and it was logical that it would keep going down. Now its getting back up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What do you mean in the first video about First pullback safest place to buy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Solid post. Same thoughts here. I strongly advice people to only buy in to cryptos that have a solid background: A solid team, product, advisors, preferably VC investors, etc. Sell all cryptos that don't have this solid background. It's a waiste of money. Does anyone know about: https://www.coincheckup.com Amazing opportunities came to light when I started using this coins to analyze cryptos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit