Every situation is different, but trading is always the same, because you are dealing with humans.. SO daytrading is alot like the position trading that you are getting use to.. with bases and surprise panics, the only big differences is timing and risk.. Daytrading is risky (not safe like the position trading) Panics dont always bounce like they should, but the chart always tells you the story...

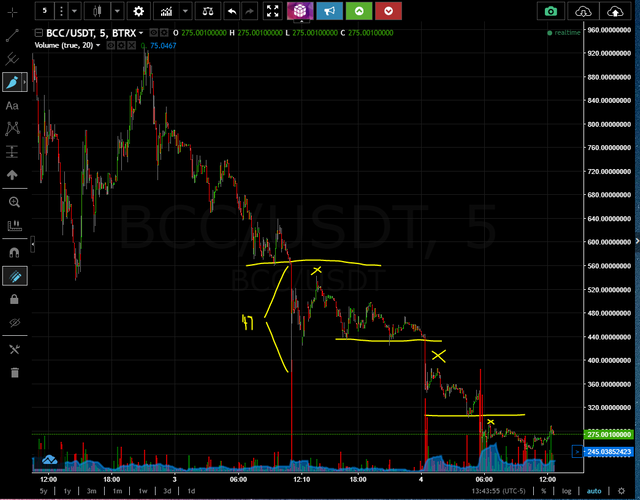

1st thing is your daytrading, so you have to be on a 5min candle chart.. then you have to read the chart so you know when panics are getting rediculous.. heres the current 5 min chart of BCC

can you see that every few hours we get a big sell off? thats when a block happens and finally some people have there BCC moved to bttrex.. then they dump the price and then it has a chance to settle for a few hours while we wait for the next block.. but the chart is showing this, even without knowing the back story... it tells you that there is way way more sellers than buyers, and they show up every few hours.. Notice the one 47% 5 minute drop ... it was so rediculous that it almost bounced back to the base.. thats a true panic... then every other smaller drop didnt make it back to there bases because there are way way too many sellers, this chart shows extreeme weakness... the next drop was 27% and the last drop was only 13% but i drew in Xs to show you where they didnt return to there 5 min bases..

So you can see how this is very unpredictable, and you could easily get stuck in a trade that leaves you bought in too high while the price slowly disappears on you.. You have to respect the risk.. you have to act fast.. You have to be willing to take a loss quick too if your wrong.. Its not an easy game..

Thats why I avoid trying to teach people how to daytrade, because so many will lose there money trying to time fast moving panics that dont bounce like they should...

Anyway, in regards BCC.. if there is a quick 5-10 minute drop of 30-50% or more I would be loading for a good bounce... so here at 273 i would consider buying around 160 and under, only if it happened in a fast drop, then if it paints a 2nd red bar to under 100, oh man i would get monkey long/buy big... and make huge percentages on the bounce..

I hate to say any of this on my blog, because its soo unsafe, and could get people hurt, and please remember I have been day trading for many many years, so I have an unfair advantage... (so if you feel nervous you are in too big, keep it small when your new)

If you start posting tutorials on daytrading like you have been on position trading, then It might be wise to add a disclaimer image at the start of the video which states something about how by daytrading a person will likely lose money if they don't know what they're doing. Then you can share whatever risky information knowing fully that every person who watches the video is responsible for their own decisions to take risks and you did your best to warn them.

I'm saying this to let you know that I'm one person (probably among others) who wants to get into daytrading cryptos but I'd like to do it right, and I trust your experience and value the information you put forward. I hope that when you post daytrading videos, you won't hold back.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have noticed that the people who are attempting to daytrade in the Slack group (see above) are almost always (1) brand new traders (2) do not have the fundamentals of position trading down yet (3) haven't payed attention to Luc's content or might have poor comprehension skills. They tend to be here for the gamble, the thrill of the experience, but they are taking great risks without the firm logic to back it up. I know this won't be popular, but perhaps Luc would be best to not discuss his day trading philosophies until his community has caught up with the basics of position trading. Personally this suggestion hurts me because I have the fundamentals of position trading down pat, but I know that the needs of the community outweighs my own needs. With that said, we cannot stop someone from taking risks, it's their life and they have the power of choice - so maybe my suggestion to tone down the more risky day trading content is pointless. I see both sides of this coin so to speak.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@tizzle - thanks, i think you just helped me a lot. Position trading it is until i get the fundamentals down and then some.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

People will always complain about losing money, but they can only blame themselves. I don't mind taking risks and even if I got wiped out I wouldn't complain. I like your in-depth chart analysis, it helps understand more chart types and how you can trade other coins in different ways.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit