Arnaud Legoux Moving Average is a trend following indicator that uses the gauss normal distribution curve.

Being a trend following indicator, Arnaud Legoux Moving Average was created by Arnaud Legoux and Dimitris Kouzis Loukas with the main objective of removing the small price fluctuation thus enhancing the trend of the market.This is mostly achieved since ALMA indicator uses two moving average, one from the left to the right and another from the right to the left thus making the market trend movement to be more responsive and smoothness. Just like in others trend indicators, Arnaud Legoux Moving Average is also based on support and resistance thus enabling traders to know the entry points in the market. Arnaud Legoux Moving Average Indicator is further explained as follows;

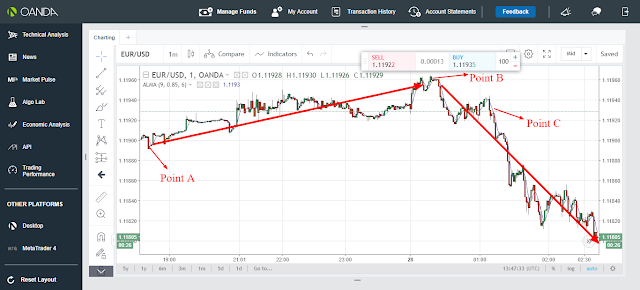

Since Arnaud Legoux Moving Average is a trend following indicator,it therefore follows that when the market is trending upwards, the Arnaud Legoux Moving Average will also be trending upwards while when the market is trending downwards, the Arnaud Legoux Moving Average will also be trading downwards.Based on support and resistance, when the price rises above the Arnaud Legoux Moving Average when the two are moving upwards,a reversal/breakout will take place and the two will now start moving downwards. On the other hand, when the price falls below the Arnaud Legoux Moving Average when the two are in a downwards trend,an upward reversal will again take place and the two will now start moving upwards.This is indicated as from the candle sticks chart below;

From the candle sticks chart above,there are 3 points, point A,B and C.Point A and B are support and resistance point while point C which is blue line is the Arnaud Legoux Moving Average.At point A, the market and the Arnaud Legoux Moving Average were initially moving downwards.The price in the market then falls below the Arnaud Legoux Moving Average thus resulting to an upward reversal movement.This will signal the trader to close any sell position and open a buy position.On the other hand,at point B, the market and the Arnaud Legoux Moving Average were initially moving upwards.The price in the market then rises above the Arnaud Legoux Moving Average thus resulting to a downward reversal movement.This will signal the trader to close any buy position and open a sell position since the two will now be moving downwards.

Recommendation:If you are a day trader just use 1 min, 5 min, 15 min and 30 min timeframe while if you are a swing trader just use 1 hour and above timeframe if you want Arnaud Legoux Moving Average indicator to work well for you.

You are always free to support our work from below;

skrill donation:[email protected]

Neteller donation:[email protected]

Bitcoin:3AFeiwUp6erj2iRBmdsnc7YhC7gcYVD6oj

Ethereum; 0x346570c491b76c7cd51699bdd272762111b743a9

Litecoin: LeEH7B82ccXJ6QoibCryGJNpDGNx2x77fL

Dogecoin: DLShs2vqhMc1ggqo8MPPMBTcPAZdqCZoWd

lightning network:tipping.me:https://tippin.me/@quintomudigo

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit