Relative Volatility Index is a kind of volatility oscillator indicator

Being a volatility oscillator indicator, Relative volatility index was created by Donald Dorsey with the main objective of helping the traders to know whether the market is in volatility condition thus enabling them whether to trade in a downward or an upward market direction. This is achieved by measuring the standard deviation of price change over a given period of time.

Since the relative volatility index is an oscillator indicator, it, therefore, oscillates from 0 all the way to 100. It follows the concept of other oscillator indicators, that is, the concept of overbought and oversold as well as divergence. Relative volatility index is further considered to be similar to RSI. The only difference between the two is that to get the values of the relative volatility index, the standard deviation of price change is used while to get the values of the Relative strength index, price change is used. Using these two concepts Relative volatility index is further explained as follows:

Concept of overbought and oversold

According to RVI, the trader should be trading in an upward market direction when the RVI rises above 50 and in a downward market direction when the RVI falls below 50.

Using the concept of overbought and oversold, if the Relative volatility index falls below 30, this will be an indication of an oversold market condition thus signaling the trader to close any sell position and open a buy position since the market will reverse and start moving upwards. On the other hand, if the Relative volatility index rises above 70, that will be an indication of an overbought market condition thus signaling the trader to close any buy position and open a sell position since the market will reverse and start moving downwards. This is indicated as from the candlesticks chart below;

From the candlesticks charts above, there are 3 points, point A, B, and C. Point A represents the relative volatility index curve while point B and C represent point above 70(overbought) and point below 30(oversold) respectively.

At point C the relative volatility index has fallen below 30 thus an indication of an oversold market thus signaling the trader to close any sell position at that point and enter a buy position since the market is starting an uptrend while at point B, the relative volatility index has risen above 70 thus an indication of an overbought market thus signaling the trader to close any buy position and enter a sell position since the market is starting a downtrend.

Concept of divergence

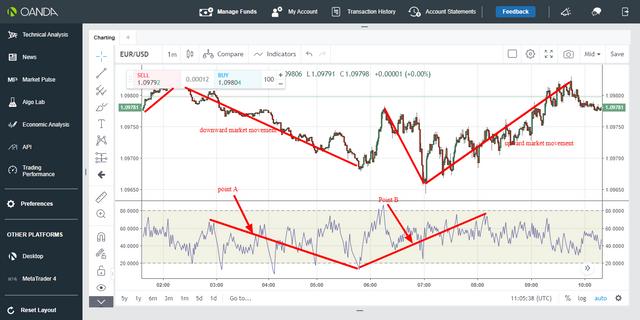

Using the concept of divergence, when the market is moving upwards while the Relative volatility index is moving downwards, the market will reverse and start moving downwards in the same direction as the relative volatility index.On the other hand, when the market is moving downwards while the relative volatility index is moving upwards, the market will reverse and start moving upwards in the same direction as the relative volatility index. This is indicated as from the candlesticks chart below;

From the candlesticks chart above, there are two points, point A and point B. At point A, the market was moving upwards while the relative volatility index was moving downwards. The market then reverse and start moving in the same direction downwards as the relative volatility index thus signaling the trader to be trading in a downwards market direction at that point. On the other hand, at point B, the market was moving downwards while the relative volatility index was moving upwards. The market then reverse and start moving upwards in the same direction as the relative volatility index thus signaling the traders to be trading in an upward market direction at that point.

Recommendation:If you are a day trader just use 1 min,5 min,15 min and 30 min time frame while if you are a swing trader just use 1 hour and above time frame if you want relative volatility index indicator to work well for you.

If you would like to support our work, here is our tipping details;

skrill donation:[email protected]

Neteller donation:[email protected]

Bitcoin:1Fp5aLgRB6WJnC7nxGw57M3JbbexaAWHG2

Ethereum; 0x346570c491b76c7cd51699bdd272762111b743a9

Litecoin: LeEH7B82ccXJ6QoibCryGJNpDGNx2x77fL

Dogecoin: DLShs2vqhMc1ggqo8MPPMBTcPAZdqCZoWd

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Never heard of the Relative Volatility Index, interesting indicator.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@rollanthomas. Indeed it is a good indicator for traders just like others

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit