The importance of mark price

Mark price determines whether your position is liquidated or kept intact. If last trade price goes down, but mark price stays the same, your position is left untouched by the liquidation engine. However, if mark price crosses the threshold for margin call, you’re in for a nasty surprise.

Mark price definition

Short & sweet version:

Mark price = asset price (= how much the actual underlying asset costs)

Long & precise version:

Mark price is a reference price of a derivative that is calculated from underlying index, often calculated as a weighted index spot price of an asset across multiple exchanges (to protect from manipulation on a single exchange).

How to incorporate mark price into your trading strategy

You can use the difference between mark price & last trade price of derivative to make a trading decision.

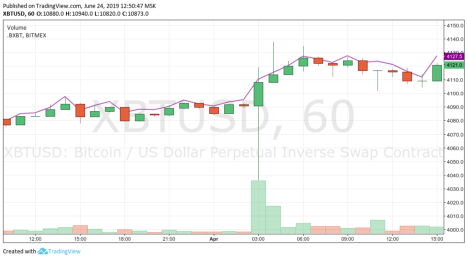

Take a look at the screenshot above. Around 03:00 the XBTUSD contract price wicked down to 4036.5, but the mark price didn’t move. The bots & intraday traders who noticed the difference bought the contracts & restored the balance.

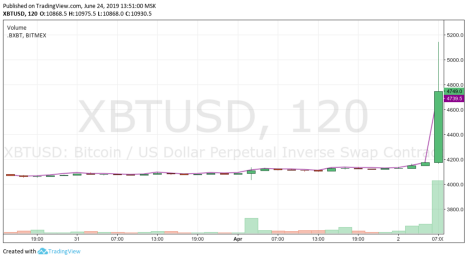

Meanwhile, the swing traders realized that if mark price didn’t move, that means spot markets were ready for a leg up. So they bought both the spot & the contracts. The result — a leg up to 5144.5:

You can do the same: notice the difference between mark price & last trade price, then make a trading decision based on that information.

Hint of the day: during accumulation, futures price is slightly lower than mark price, since uninformed traders believe that downtrend will continue, so they sell futures at discount compared to spot.

Different ways to calculate mark price

As index of spot prices: for example, BitMEX calculates mark price of XBTUSD contracts as index of Bitstamp, Coinbase Pro, and Kraken exchanges (equally) plus % Fair Basis (source).

As function of natural variables: for example, weather derivatives mark price is based on average temperature over a certain period. This allows farmers to hedge against frost damage.

As function of volatility: for example, mark price of Bitcoin Volatility Token depends on how fast Bitcoin price has changed over the last 24 hours (that is, how volatile it was).

An important property of mark price is that it can’t be controlled by derivatives exchange operator: only then the traders will believe that they won’t be liquidated on a whim.

Conclusion

If you’re trading derivatives, you should pay attention to mark price — it’ll help you make better trading decisions & avoid unnecessary liquidations.

If you’re still alive after “the chop of 2018”, you’ll benefit from other tips: https://twitter.com/MarkPriceSource