#PayPal Stock Fundamental Analysis: A Strong Track Record

PayPal boasts a consistent track record of earnings and sales growth, stretching back to at least 2010. In that year, it earned a mere 29 cents per share. In 2019, the company reported EPS of $2.96 per share. For 2020, the firm's earnings grew 31% to $3.88 a share. In 2021, the company's EPS grew 18% to $4.60. Analysts expect the company's EPS to grow 1% in 2022 and 25% in 2023.

As a result of the company's fundamental strength, PayPal's EPS Rating is an 84 out of the highest-possible 99. The EPS Rating measures a company's ability to grow profits year over year, using the most recent two quarters and the past three to five years of earnings growth.

PayPal continues to battle with Block (SQ) in the cryptocurrency space. The two payment companies are marketing apps that let shoppers get discounts, make installments and buy cryptocurrencies.

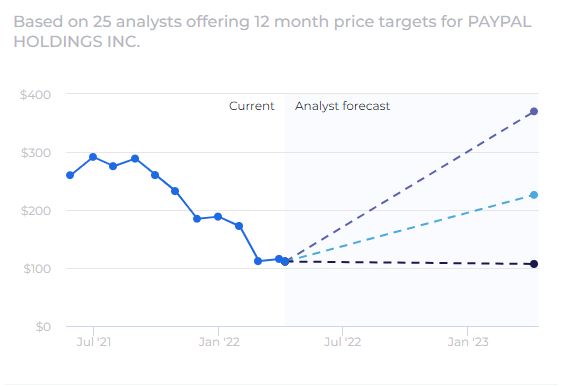

#Based on 25 analysts offering 12-month price targets for PAYPAL HOLDINGS INC.

Min Forecast $107.00-3.79%

Avg Forecast $226.08+103.29%

Max Forecast $370.00+232.7%

#Is PayPal Stock A Good Long-Term Investment? Why I Finally Bought The Stock

##PayPal traded above $300 per share just half a year ago.

##The stock recently sold for $109 per share.

##2022 is expected to be a year of muted growth, but growth should accelerate heading into 2023 and beyond.

##PayPal is likely to increase its share repurchase program.

##I have finally bought the stock for my portfolio and expect strong returns over the long term.

Do you wish to make a consistent profit in the stock market? -- tinyurl dot com/2f3f3wvr (Copt and paste this in a new tab and remove dot with actual . )