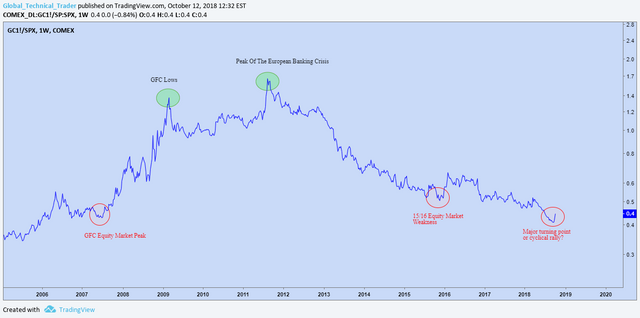

Whilst this is a far from perfect indicator, at major turning points, the ratio of Gold to the S&P 500 can give us clues to the future direction of Equity Markets.

On the above chart, I've highlighted some of the major turning points in the ratio and as can be seen, these all correspond with significant turning points in the equity market.

In 2007 the ratio began to turn higher in June, 4 months prior to the market peak in October. The resulting peak then corresponded with the GFC lows in March of 2009. The peak in 2011 lead the equity market lows by 2 months and then lastly we can see gold's strength in 2015 whilst the SPX was in a correction.

Given the recent performance in global equities and the outlook for gold, which I have analysed in detail here, the question we need to ask is have we seen a secular low in this indicator?

If so, we should be very concerned about the future direction of equity prices from here on in.

excellent indeed! Let's see what type of rally we get here..longer term..lots lower. (2019).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great analysis!

I have a suggestion for you! Analyse the spread between the 10 year yield and 2 year yield on the US government bonds. For the past century it has been a great indicator for financial disaster.

Keep up with the great analysis!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!! The yield spread tends to lead stocks by a significant time. Pre-GFC it first turned negative in early '06 I think. Always seemed to me one that doesn't offer enough info to be valuable from a trading perspective. Was mentioned on a podcast I listened to recently, will have another listen to it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What is the podcast episode?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Allstarcharts Podcast, guest was Ryan Detrick

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting information!

SPX is the same as S&P500 right?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit