While the stock and crypto market is going to be in full swing, gold is becoming more and more attractive to investors. Yesterday we already showed 4 graphs that show that you have to buy gold mine shares. Today we give 5 good reasons why investors should opt for gold in 2018.

Read here: 4 graphs that say you have to buy gold mine shares

After the resurrection in the first half of 2016, gold continued its recovery in 2017. For 2018 one can expect the continuation of 2016, especially since almost no one is looking at gold and gold mine stocks. That is the ideal breeding ground for achieving exceptional returns.

Reason 1: Bottom of the gold price

Gold looks pretty good technically. It did not really succeed in an outbreak, but the soil was firmly tamped. Before the outbreak, the yellow precious metal must finally leave $ 1,350 behind, but in the meantime a solid bottom was laid between $ 1,200 and $ 1,250. Since then, the gold price has set higher soils and higher buds.

Reason 2: Rotation under assets

With a stock market that is significantly overvalued and a crypto market that is red-hot, it is only a matter of time before investors begin to rotate their assets. In addition, there are not so many opportunities and gold seems to be one of the most attractive investments.

Reason 3: Strong global demand

Between October and March there is always a gold season in China and India. The import of gold in India rose by 67% last year and China also saw an increase of 40% in November.

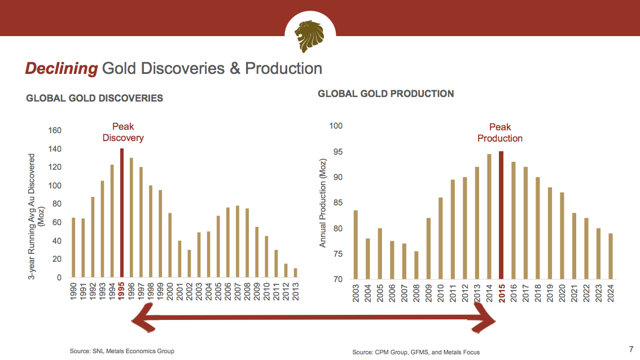

Reason 3: Lower production

For the first time in a long time, less gold will be mined. No new large mines have been discovered for many years, while the largest old mines are gradually becoming productive. The lower gold price and slump in the sector also resulted in fewer investments in recent years.

Reason 4: Weak US dollar

Gold has an inverse correlation with the US dollar. The US dollar experienced a weak year in 2017 and is now again at the lowest level in 3 months. According to Morgan Stanley, this dollar weakness can continue for several years.

Reason 5: Crypto coins

Crypto coins and especially Bitcoin undoubtedly held capital of the gold market. Many investors in Bitcoin look for alternatives because they lose confidence in fiat money. But the market for crypto coins still can not compete with gold. With a sharp correction on the crypto market, a lot of money can flow back to the gold market.

I would rather to buy physical silver instand of gold.

I got both, my portfolio is: 80% silver and 20% gold.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit