Hi whales, dolphins and minnows! For my first post I decided not to do an “introduceyourself” (I’ll do it later) but a guide about the best way to make great profits trading with cryptocurrencies.

You may know the classic indicators for technical analysis such as MACD, ADX, Bollinger bands and some others useful, but the King of all them is the Volume. The volume is a good teller, is the market talking directly to you and if you know exactly how to listen it, you will NEVER lose your money.

When exactly take position on a dumped cryptocurrency:

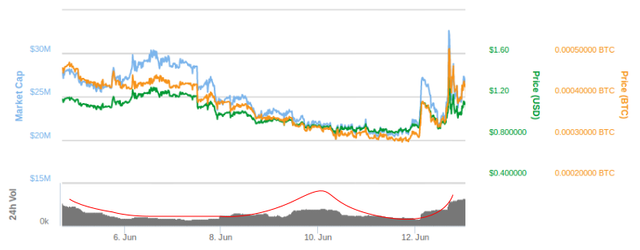

For this example let’s take a look at price of TKN in the next picture:

Source: Coinmarketcap.com

As you can see in 4th June the price started to fall and volume too but then something happened 7th June, the volume started to increase for three days although the price kept falling. Then again, the volume decreased until 12th June when the price suddenly took off. Fortunately for me, I bought some TKN 11th June. I called all this a W volume pattern (see the red curve); But why is this? And why does this pattern predict a take off? The interpretation of this pattern volume is next:

- 4th - 7th June: A decrease in the price occurs due to less transactions (volume), and the few ones were only selling.

- 7th -10th June: the price keeps decreasing and even stronger while a significantly increase of volume occurs because the criptocurrency was being oversold for panic or something else.

- 10th-12th June: the price keeps falling and the volume does the same. This is a BUY signal because means the most of TKN were sold between 4th-10th and soon people will need/want them.

- 12th- 13th June: a suddenly increase in price occurred due to an increase in the demand of TKN

This W pattern repeats in most of markets where the price is falling. Look at the next pictures of two more cryptocurrencies:

XRP - Source: Poloniex.com

STRAT - Source: Poloniex.com

If you enjoyed reading my first post and want a second part focused on Volume, I would appreciate vote/follow me, thanks.

This post received a 46% upvote from @randowhale thanks to @yamuz0! For more information, click here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice job @yamuz0, this information is important for beginners, i need the others Parts... :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You'll have them. There will be a total of 3 posts about volume.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for taking the time to put this post together, I am just trying to learn about crypto too!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for reading!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post learning more everyday.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good info to add to my moving averages

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the post. I too have noticed the patterns involving volume just before a price explosion. It is great to see someone writing about it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, and there are some other patterns in volume I'll be writing about

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Enjoyed your indepth tech analysis. Good overall discussion of chart volume for any investment. Good signals usually occur whenever you get divergence... (price down/volume up). Also thanks for the Poloniex source tip. Have it bookmarked now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm new to trading on poloniex. Thanks for sharing your W volume tip. Cheers!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, It's great seeing good reputation steemian commenting here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amazing for a first post! Keep it up, I'm looking forward to your new posts!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit